Pudgy Penguins (PENGU) Primed for 30% Surge: Triangle Breakout Targets $0.041

Pudgy Penguins (PENGU) is flapping its way toward a potential breakout—and traders are eyeing a 30% rally if the pattern holds.

The Technical Setup:

A symmetrical triangle formation on the charts suggests consolidation is ending. When these patterns resolve, they often trigger explosive moves. For PENGU, that could mean a sprint to $0.041.

Why It Matters:

Memecoins live and die by momentum. A clean breakout here could lure sidelined capital back into the game—just in time for the next 'number go up' narrative.

The Cynical Take:

Because nothing says 'sound investment' like cartoon aquatic birds dictating your portfolio's fate. Welcome to crypto.

After weeks of steady consolidation, PENGU Pudgy Penguins is now flashing a textbook breakout pattern, with price trading into a symmetrical triangle just above key demand. With liquidity rebuilding underneath and open interest cooling off, the stage looks set for a clean breakout toward the $0.038 to $0.041 range.

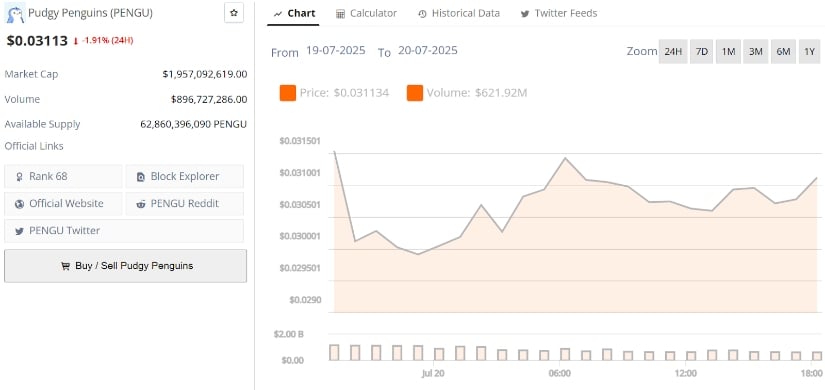

Pudgy Penguins’ current price is $0.03110, down -1.91% in the last 24 hours. Source: Brave New Coin

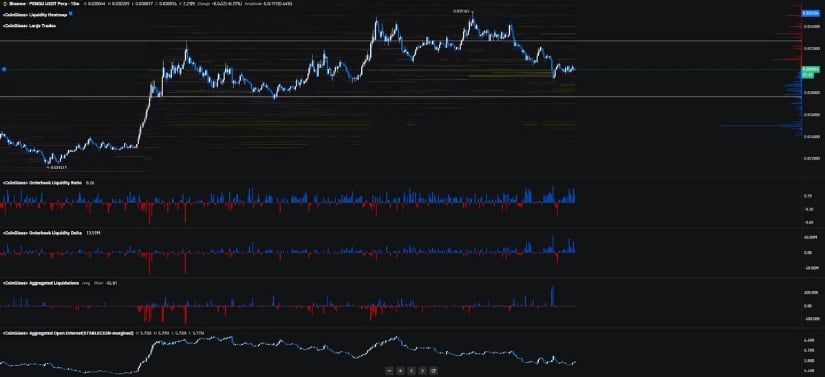

PENGU Chart Coils Tightly as Breakout Structure Takes Shape

PENGU is showing signs of a classic breakout setup, with price consolidating within a symmetrical triangle on the 4-hour chart shared by CROW. The pattern is defined by a series of lower highs and higher lows, compressing price into a tighter range just above a key horizontal demand zone around $0.026. The structure remains valid as long as the price holds above this region, with the lower trendline acting as dynamic support.

PENGU consolidates within a tightening triangle, hinting at a breakout with $0.041 as the next major target. Source: CROW via X

Multiple taps on the upper diagonal suggest weakening resistance, and if bulls can push past the $0.0315 to $0.032 range with strength, it WOULD confirm the breakout. The measured move from the triangle pattern projects a potential targets in the $0.038 to $0.041 area, with the broader market momentum likely influencing the pace.

Pudgy Penguins Builds a Base as Liquidity Flows Reset

As Pudgy Penguins consolidates just below the $0.031 level, the latest CoinGlass liquidity heatmap shard by TimelessBeing shows bid-side density building right under the current price, particularly around the $0.027 to $0.0285 range. This clustering suggests a potential absorption zone where demand could step in on any dip.

The order book data supports this, with the bid-ask liquidity ratio skewed firmly toward buyers, and the liquidity delta remaining net positive, indicating controlled, strategic positioning rather than panic buying.

PENGU’s liquidity heatmap shows strong bid-side interest NEAR $0.028, signaling a potential demand zone on dips. Source: TimelessBeing via X

What’s especially constructive here is the reset in open interest alongside liquidation washouts on both sides. Late longs have been flushed without triggering a full breakdown, suggesting that leverage has been cleared and the market is setting up for a more stable move.

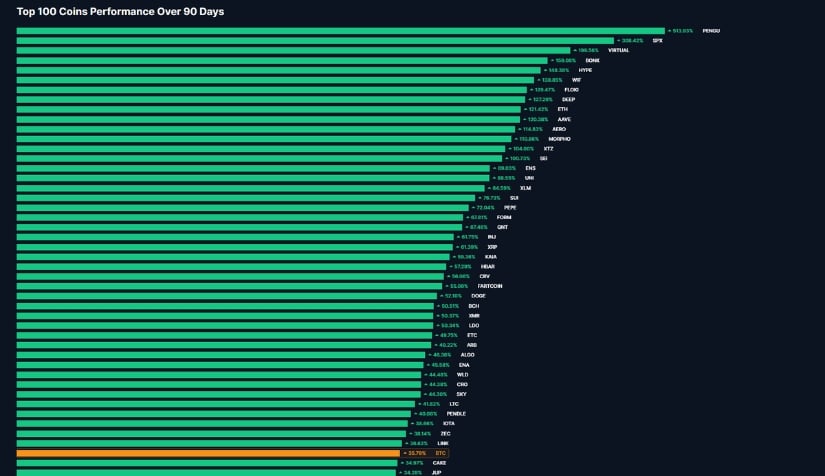

PENGU Stays Firm Among Top Performers

While the chart structure continues to coil and liquidity flows reset, PENGU’s broader momentum remains intact, and it’s showing up in the stats. According to Sweep’s latest leaderboard, PENGU currently ranks among the top-performing assets in the entire top 100 coin set over the past 90 days.

This isn’t just a short-term rally; it’s part of a larger structural outperformance that has quietly unfolded over multiple weeks.

PENGU ranks among the top 100 performers over the past 90 days. Source: Sweep via X

This kind of sustained strength often points to underlying demand that isn’t fully reflected on the lower timeframes. Even as PENGU consolidates just below local resistance, the longer-term trend remains intact.

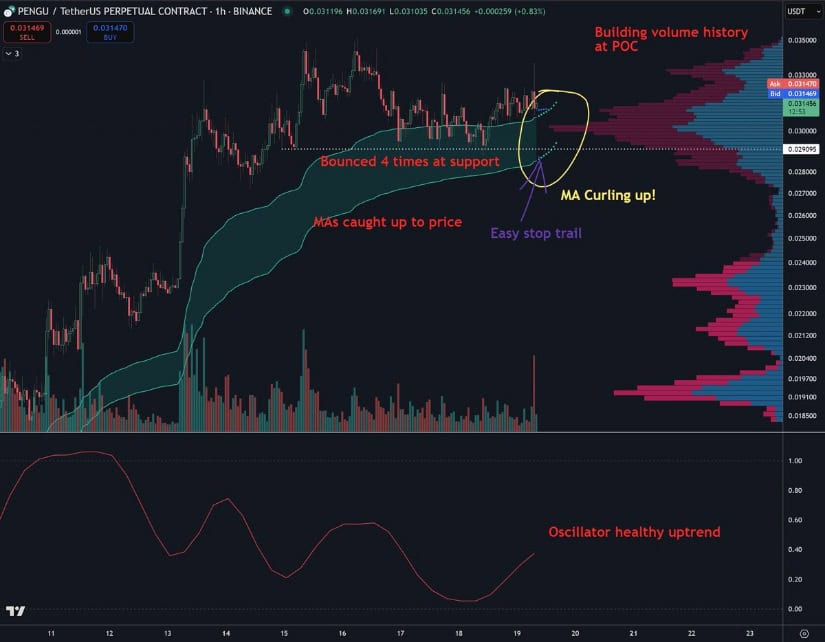

PENGU Technical Outlook: Key Support Holds as MAs Curl Higher

As PENGU grinds sideways just above the $0.030 to $0.0305 zone, the latest technical layout from NumberOnePengu offers a clearer look into the structure. Price has now tested the $0.0303 to $0.0305 support area four times without breaking down, which aligns closely with the visible range Point of Control. This zone, where the most volume has been transacted, has now solidified into a strong demand base. If price dips further, look for secondary support near $0.0288, where another local volume cluster begins to form. Resistance remains capped around $0.0324, which marked the recent high before this consolidation began.

PENGU holds firm above key support as moving averages curl higher, with eyes on a breakout above $0.0324. Source: NumberOnePengu via X

From an indicator perspective, the green moving average has caught up to price and is beginning to curl upward. The oscillator remains in a balanced zone. If Pudgy Penguins clears the $0.0324 short-term resistance with volume, the next upside targets fall into the $0.0352 to $0.0365 range, aligning with prior impulse highs from mid-July.

Final Thoughts: Continuation Ahead for PENGU?

PENGU is sitting at a critical crossroads; one push above $0.0324 could open the floodgates for a rally towards $0.038 and beyond. The technicals are aligning: support is holding, volume is clustering at key levels, and momentum indicators are curling upward. With fresh liquidity building underneath and open interest reset, the stage looks primed for a breakout.

But on the flip side, if price fails to hold the $0.0303 to $0.0305 demand shelf, it could drag back toward the $0.0288 support cluster, where buyers will need to prove themselves again.