Ethereum (ETH) Price Prediction 2025: Bulls Charge Toward $10K as Daily Inflows Shatter Records

Ethereum's rally isn't just back—it's rewriting the playbook. With daily inflows hitting unprecedented levels, ETH's path to five figures looks less like speculation and more like inevitability.

The Bull Stampede

Market momentum has flipped violently in favor of buyers, with institutional wallets accumulating ETH at their fastest pace since the last cycle's peak. The $10K price target—once dismissed as hopium—now sits squarely in the crosshairs of derivatives traders.

Liquidity Tsunami

On-chain data reveals a startling trend: smart money isn't just dipping toes, but diving headfirst into Ethereum's liquidity pool. The network's daily inflow metrics have blown past previous all-time highs, suggesting a structural shift in capital allocation.

Wall Street's Late Arrival

Traditional finance giants—always fashionably late to crypto parties—are now scrambling to build ETH positions before retail FOMO kicks in. Their typical playbook? Throw money at the problem until quarterly reports look acceptable to shareholders.

This isn't 2021's meme-fueled mania. The current surge rides on tangible protocol upgrades and real-world adoption metrics. Whether ETH punches through $10K or faces resistance, one thing's certain: the smart contracts revolution won't be stopping for stragglers.

As ethereum breaks key resistance levels and trading volumes surge, analysts are becoming increasingly confident that ETH could reach $10,000 within the next several months.

ETH Price Today: Bulls Take the Lead

Ethereum (ETH) has continued its impressive uptrend, crossing $3,660 and gaining over 45% in the past month alone. After a prolonged consolidation period, ETH broke through key resistance levels, sparking Optimism across the crypto space. Analysts attribute this rally to a combination of strong institutional demand and record-setting inflows into Ethereum-based ETFs.

Ethereum’s long consolidation is building momentum for a breakout, with $10,000 in sight as key upgrades and institutional interest rise. Source: TradingMula on TradingView

The recent surge in inflows supports this view. On July 16, ETH ETFs recorded $726 million in net inflows—a historic high—while another $602 million followed just a day later. According to CoinShares, Ethereum funds have absorbed nearly $1 billion in the last seven days alone.

Market Overview: Ethereum Technical Analysis

Looking at the charts, Ethereum is navigating a strong bullish trend. On the daily (D1) chart, ETH has reached a short-term target of $3,675, with the next critical resistance zone set at $3,980 to $4,100. Clearing this range could open the door to retesting the all-time high (ATH) of $4,868 and beyond.

Ethereum eyes $3,980 — a breakout above this key level could trigger the next major bull rally! Source: Ali via X

Ali Martinez, a leading on-chain analyst, stated that “If Ethereum closes decisively above $3,980, we may see a run toward $4,500, possibly setting the stage for a $10,000 scenario later in the year.” On lower timeframes, the H1 trend also reflects strength, with Ethereum respecting Overbalance patterns—indicating a likely continuation of the current uptrend. Even if a short-term correction occurs, the $3,400 zone, previously a resistance level, is now acting as a solid support.

Ethereum ETF News: Institutional Interest Surges

Much of Ethereum’s current bullish momentum is fueled by ETF-related developments. BlackRock and Fidelity have both filed to include staking in their Ethereum ETFs, signaling a long-term investment approach. The MOVE implies that institutions aren’t just buying ETH—they intend to hold and earn yield via Ethereum staking.

BlackRock and iShares move to add staking to ETH ETFs — 3% yield could soon boost Ethereum holdings for ETF investors. Source: Eric Conner via X

iShares, a subsidiary of BlackRock, also submitted a similar proposal, reinforcing the narrative that Ethereum is becoming a Core asset for institutional portfolios.

Market watchers believe these developments could mimic Bitcoin’s ETF-led growth in early 2024, especially as Ethereum still trades 26% below its ATH, providing room for further appreciation.

Ethereum Layer 2 and Network Strength

Beneath the price action lies a robust ecosystem. Ethereum’s Layer 2 scaling networks like Arbitrum, Optimism, and zksync are processing millions of transactions weekly. These solutions are helping reduce gas fees and expand Ethereum’s use case across DeFi, NFTs, and gaming.

On-chain activity continues to rise. According to data from L2Beat, total value locked (TVL) on Ethereum LAYER 2 platforms has exceeded $40 billion, showing the network’s growing utility and developer adoption.

Moreover, Ethereum validators are reaping increased staking rewards, driven by higher transaction volumes and gas usage. This incentivizes long-term holding and reduces selling pressure.

Will Ethereum Hit $10K?

The idea of Ethereum reaching $10,000 is gaining momentum among both retail and institutional investors. From a technical perspective, a break above $4,100 could pave the way toward higher targets, including $5,000 and the long-anticipated $10,000 mark.

Ethereum is gaining bullish momentum—breaking above $4,100 could open the path to $5K and eventually the long-awaited $10K target. Source: technicalanalysis_zone on TradingView

However, caution remains. Ethereum’s RSI is currently NEAR 80—overbought territory—and traders may look to lock in profits. That said, momentum remains strong, and dips are likely to be bought quickly by institutions accumulating for long-term staking rewards.

Ethereum Prediction: What’s Next?

Ethereum has firmly cemented itself as the altcoin heavyweight. With all-time high daily ETF inflows and corporate treasuries increasing their exposure, the path to $10K by 2025 is no longer conjecture—it’s backed by data, demand, and growing infrastructure.

Short term, expect a battle near the $4,000 level of resistance. But if that gives way, the next stop could very well be to higher highs—and beyond.

Final Thoughts

Ethereum’s recent price increase is not yet another crypto rally—it is reflective of deep structural changes in the worldview of ETH. From a smart contract platform to an institutional yield-generating instrument, Ethereum is evolving.

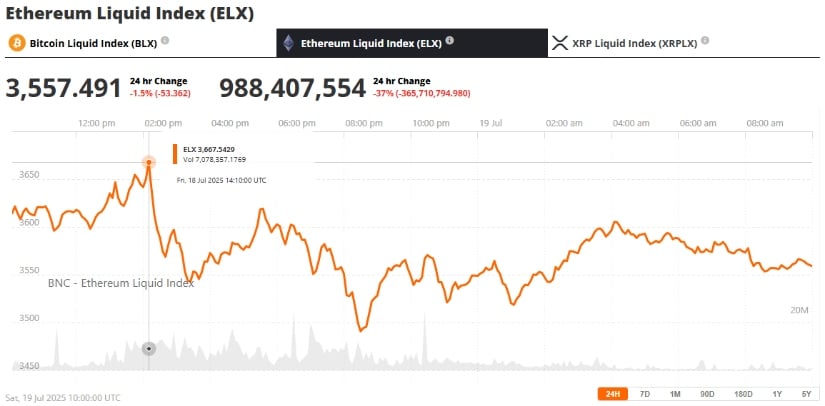

Ethereum (ETH) was trading at around $3,557, down 1.5% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Regardless of whether you’re an investor seeking long-term gains or a speculator seeking short-term gains, Ethereum remains one of the most lively prospects in crypto today.