ChainLink Surges 3% – Defies Gravity as Breakout Momentum Builds

ChainLink isn't just holding support—it's kicking bears in the teeth. A crisp 3% gain today proves the oracle giant's breakout isn't some dead-cat bounce.

Technical resilience meets bullish momentum

While traditional finance still debates 'blockchain use cases,' LINK's price action screams 'wake up call.' No fancy derivatives, no synthetic exposure—just pure, unfiltered alpha generation.

Watch that resistance level like a hawk. Because when this thing flips, even the Wall Street quant bros will suddenly remember they 'always believed in DeFi.'

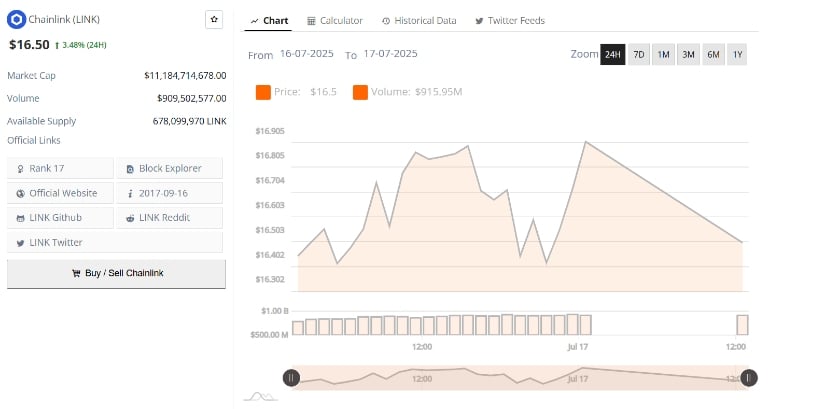

LINK Price ROSE 3.48% in the past 24 hours, trading at $16.50 with support holding above $16.30 despite minor retracements. Trading volume reached $909 million, reinforcing bullish momentum as LINK targets $16.90 and possibly $17.20 next. With a market cap of over $11.18 billion, Chainlink’s expanding role in blockchain infrastructure continues to support its bullish technical outlook.

ChainLink Gains 3% and Holds Support With Breakout Still Active

Chainlink (LINK) Price recorded a 3.48% gain over the last 24 hours, closing the session NEAR $16.50 after peaking at $16.90. Despite a brief pullback, the token maintained support above the $16.30 level, reinforcing buyer control throughout the day. The intraday chart showed a pattern of higher highs and shallow dips, suggesting steady buying demand and profit-taking balance.

Source: BraveNewCoin

Trading volume reached approximately $909 million, indicating strong participation throughout the session. The stable volume profile points to a market MOVE backed by consistent interest rather than low-liquidity volatility.

With a market capitalization exceeding $11.18 billion and a circulating supply of more than 678 million LINK tokens, the technical structure remains aligned with an active bullish setup. If bulls push beyond $16.90, the next target may emerge near $17.20.

Symmetrical Triangle on Weekly Chart Approaches Apex

Analyst LINK Collector presented a long-term view of LINK using a weekly chart, which shows a multi-year symmetrical triangle pattern developing since 2021. This formation, created by converging trendlines of ascending support and descending resistance, reflects prolonged consolidation. LINK is currently trading near the triangle’s apex at $16.77, a zone where price often compresses before a high-volatility move.

Source:X

The analyst noted $100 as a major magnet level should a breakout occur from the structure. The chart aligns this expectation with LINK’s broader narrative as an infrastructure LAYER for decentralized finance and data oracles.

On the momentum side, the Relative Strength Index (RSI) is flattening near the midpoint, a signal that price may be resetting for future expansion. According to the analysis, if macro trends and protocol adoption persist, long-term projections could reach higher valuations, though those remain speculative.

Confirmed Daily Breakout Suggests Target Toward $27

Analyst ZAYK Charts confirmed a breakout on the daily chart, showing LINK moving above the descending triangle resistance near $16.80. This structure had contained the price since late 2023, and its invalidation marked a clear shift in the trend. At the time of the post, LINK traded around $17.00, with the breakout setup pointing to a 63.33% measured move toward the $27.00 level.

Source:X

The setup has attracted interest due to its textbook pattern and favorable positioning within broader market sentiment. The rally came after a period of lower volatility and a tightened range, typical for breakout conditions.

With market structure flipping to bullish and overhead resistance clearing, traders may continue positioning for the higher target. The key level for invalidation remains the former triangle resistance, now expected to act as support.

Structure and Participation Support Breakout Continuation

The current chainlink price action reflects sustained control by buyers, supported by technical confirmation and strong market engagement. Volume held steady as LINK climbed, offering a foundation for continuation if price closes consistently above the short-term resistance band.

Should LINK price reclaim the $16.90–$17.00 range with consistent volume, the next resistance levels are expected above $17.20, leading into the projected breakout zone. With both short- and long-term patterns aligned toward the upside, the active breakout remains valid. Price action in the coming days will determine if the momentum can sustain and push toward the upper technical targets.