🚀 Bitcoin (BTC) Price Prediction: Davinci Jeremie’s Bullish Call—$500K by 2030?

Bitcoin isn’t just climbing—it’s moon-bound. Crypto oracle Davinci Jeremie just dropped a bombshell: BTC could hit the half-million-dollar mark by 2030. Forget dipping toes—this is a cannonball into the deep end of bullish.

### The Case for a Half-Million Bitcoin

Jeremie’s prediction isn’t plucked from thin air. Scarcity, institutional adoption, and that halving magic keep fueling the fire. Meanwhile, Wall Street’s still trying to explain what a blockchain is over $200 coffees.

### The Fine Print: Volatility Ahead

Sure, the road to $500K won’t be a straight line. Expect dips, FUD, and at least three ‘Bitcoin is dead’ headlines before 2030. But for hodlers? This is the ultimate ‘told-you-so’ in the making.

---

Prediction or prophecy? Either way, the crypto crowd’s betting big—while traditional finance plays catch-up. Again.

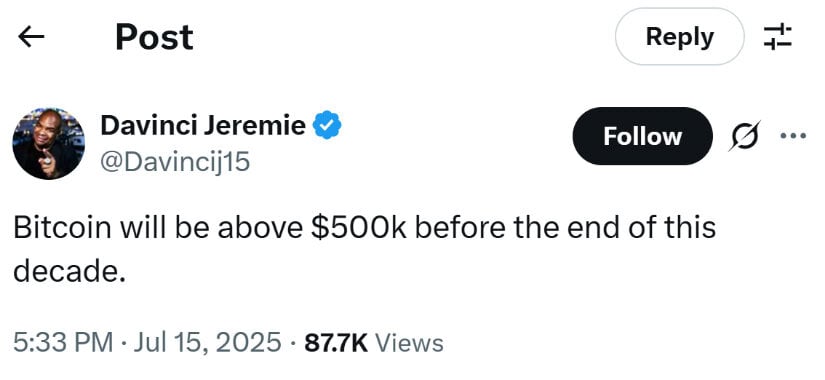

Early crypto advocate Davinci Jeremie has doubled down on his bold prediction, suggesting Bitcoin could soar to $500,000 by 2030—adding to growing institutional confidence and investor enthusiasm.

Bitcoin Price Today Surges as ETF Flows Strengthen Long-term Bullish Outlook

Bitcoin continues to make waves in the crypto market as bulls regain momentum following its all-time high of $123,000. Among those amplifying the long-term outlook is Davinci Jeremie, a well-known early Bitcoin advocate, who now projects that Bitcoin could hit $500,000 per coin by 2030 — a bold prediction that reflects rising institutional confidence, historical price behavior, and growing macroeconomic uncertainty.

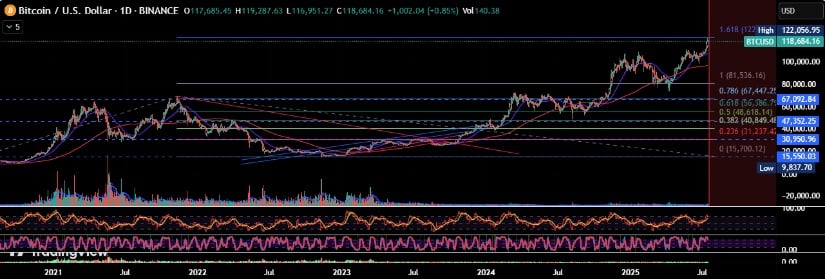

Bitcoin approaches the key 1.618 Fibonacci extension zone, signaling strong momentum as traders eye the next breakout level. Source: darwas121 Via TradingView

The Bitcoin price today is hovering near $117,700, marking a monthly gain of over 12%, with sentiment boosted by consistent ETF inflows and bullish technical signals.

Market Overview: Bitcoin Technical Analysis Shows Continued Strength

Bitcoin’s recent high of $123,091 was accompanied by strong momentum across technical indicators. The Moving Average Convergence Divergence (MACD) remains bullish, and Relative Strength Index (RSI) is a neutral-bullish region around 62, leaving it open to more upside.

Bitcoin breaks out into its projected target zone and is now consolidating, with bullish momentum still pointing toward higher levels. Source: Urkel via X

Whereas miner activity triggered mild concerns when the Miners’ Position Index (MPI) briefly crossed 2 — a very unusual signal of profit-taking in the past — follow-up MPI declines signaled controlled selling. This controlled behavior is a sign that most miners are not in trouble and remain positive on the long-term outlook for Bitcoin.

Analysts continue to note significant resistance at $130,000, with backing strong above $115,000.

Bitcoin Halving 2025 and Whale Activity Fuel Bullish Trend

Bitcoin whales have been quietly accumulating as anticipation builds ahead of the 2025 halving event. Historically, such halvings — which reduce miner rewards — have sparked multi-year bull cycles. The upcoming halving, expected in early 2025, could reduce bitcoin supply issuance even further, tightening market liquidity.

Meanwhile, social sentiment around Bitcoin has reached euphoric levels. According to Santiment, over 43% of all crypto-related discussions have focused on BTC, reflecting peak retail interest. Even high-profile celebrity investments, such as Ella Langley’s $3 million retreat purchase, are being viewed as reflections of growing confidence in digital assets.

Expert Insights: Davinci Jeremie and Max Keiser Sound the Bullhorn

Davinci Jeremie, famous for his 2013 video encouraging viewers to buy $1 of Bitcoin, has doubled down on his belief in BTC. He now forecasts a potential rally to $500,000 by 2030 — a 327% increase from current levels. “Just buy one freaking dollar… If it goes to zero, who cares?” he once said. His early conviction has paid off, with BTC rising over 90,000% since that call.

Bitcoin could reach $500K by 2030 as institutional adoption and macro trends. Source: Davinci Jeremie via X

Max Keiser, another prominent Bitcoin advocate, echoes this optimism, citing rising global bond yields and weakening fiat currencies as signs that Bitcoin could soon emerge as the ultimate inflation hedge. “We’re witnessing the beginning of a paradigm shift in how value is stored and transferred,” he noted recently.

Standard Chartered’s Geoff Kendrick adds a more near-term view, predicting BTC to hit $200,000 by Q4 2025.

Bitcoin Long-Term Outlook: What’s Next for BTC?

With Bitcoin ETFs like BlackRock’s iShares fund drawing net inflows of $50 million in just one week, and whale activity on the rise, the outlook remains bullish. If momentum continues, analysts suggest BTC could push beyond $130,000 in the coming weeks and possibly test $150,000 by early 2026.

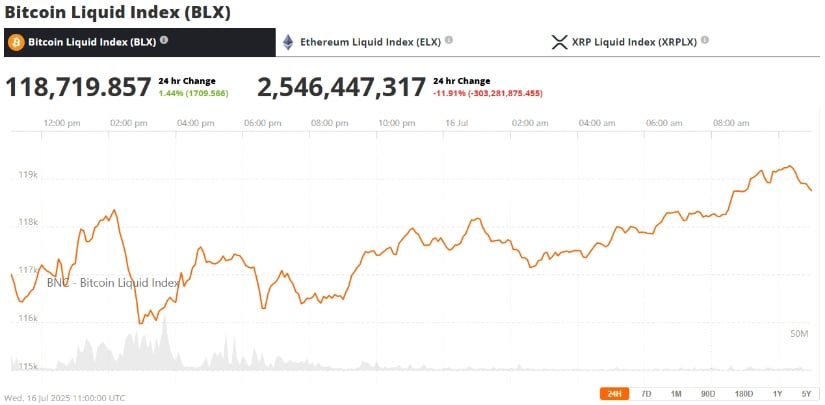

BTC was trading at around $118,719, up 1.44% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

Long-term projections like Davinci’s half-million-dollar call may seem ambitious, but with institutional adoption accelerating and macroeconomic tailwinds favoring decentralized assets, such milestones are no longer implausible.

Key Takeaways:

- Bitcoin price today: $117,705

- All-time high: $123,091

- ETF net inflows (7D): $1.31B

- Next major resistance: $130K

- Long-term prediction: $500K by 2030

- RSI: Neutral-bullish

- MACD: Uptrend intact

Final Thoughts: Bitcoin’s Bull Run Still Has Legs

Despite short-term adjustments, the structural basis of Bitcoin remains solid. With ETF popularity, miners’ and institutions’ careful accumulation, all the puzzle pieces are there to form a mature, increasing market that’s poised to further MOVE up. Whether or not and when BTC is at $500,000 by 2030, the big picture of mass adoption and digital scarcity gives Bitcoin an unmistakable edge in the new world of finance.