🚀 Ethereum (ETH) Price Prediction: Whale Buying Spree & ETF Surge Fuel $4,000 Breakout in 2025

Ethereum's gearing up for a rocket ride—whales are loading their bags and ETF inflows are hitting record highs. Is $4,000 the next stop?

Whales Bet Big on ETH

Deep-pocketed investors are snapping up Ethereum like it's going out of style—which, given Wall Street's sudden love affair with crypto ETFs, it definitely isn't. The smart money's positioning for what could be the altcoin's most explosive rally since the last 'altseason.'

ETF Gold Rush Turns to Ethereum

After Bitcoin ETFs sucked up all the oxygen in the room, institutional capital's finally flowing into ETH products. Because nothing gets TradFi excited like repackaging decentralized tech into fee-generating wrappers.

$4,000 or Bust?

Technical setups suggest ETH's coiled tighter than a spring—break past key resistance levels and we could see a cascade of FOMO buying. Just don't ask what happens if macro winds shift and crypto becomes the 'sell everything' casualty again.

With open interest and corporate treasury holdings at multi-month highs, analysts see strong potential for ethereum to break above $4,000 in the coming weeks.

Ethereum Price Today: Holding Strong Near $3K

Ethereum price today is hovering around $2,981, showing resilience after briefly climbing past the psychological $3,000 mark for the first time since February. Despite a minor daily pullback of 1.8%, ETH has posted an impressive 17.93% gain over the past week, supported by record-breaking ETF inflows and rising whale accumulation.

Ethereum (ETH) was trading at around $2,981.53, down 1.87% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Trading volume has also surged significantly, increasing over 95% in the past seven days to $32.34 billion, a sign of intensified market participation across both retail and institutional channels.

ETF Inflows Signal Institutional Confidence

One of the most powerful catalysts behind Ethereum’s recent rally is the overwhelming institutional demand via spot ETH ETFs. According to SoSoValue and Glassnode, U.S.-listed Ethereum exchange-traded funds recorded their largest weekly net inflow to date, with 225,857 ETH flowing into funds.

Ethereum breaks above $3K as spot ETFs see record 225,857 ETH inflows, highlighting surging institutional demand. Source: glassnode via X

This inflow—worth nearly $700 million—marked the 12th consecutive week of net positive flows, pushing total Ethereum ETF inflows this year past $4 billion. Analysts at CoinShares noted that 30% of these inflows occurred in just the last two weeks, underscoring the pace at which institutional interest is accelerating.

Notably, BlackRock’s ETHA ETF alone attracted $137 million in daily net inflows, bringing its cumulative inflow to $6.29 billion. This robust demand showcases how Ethereum is steadily solidifying its place as a Core institutional asset.

Corporate Treasuries Join the Ethereum Accumulation Trend

While ETFs have dominated headlines, another equally significant trend has emerged: corporate treasury accumulation of Ethereum.

Companies like SharpLink, BitMine Immersion Technologies, and Bit Digital have added hundreds of thousands of ETH to their reserves over the past month. In total, more than 545,000 ETH—equivalent to approximately $1.6 billion—has been acquired by corporate treasuries in just 30 days.

SharpLink, chaired by ConsenSys founder Joseph Lubin, has become the largest corporate Ethereum holder, acquiring over 255,000 ETH through multiple large-scale transactions this July alone. Lubin humorously dubbed himself a “self-appointed representative of The League of Extraordinary ETH Accumulator Gentlemen.”

This trend mirrors the Bitcoin treasury boom of previous cycles, suggesting Ethereum is becoming a preferred digital reserve asset among institutions.

Whale Activity: Accumulation Outweighs Distribution

On-chain data from Santiment and CryptoQuant reveals that Ethereum whale wallets have been actively accumulating. Despite isolated sell-offs—such as a whale offloading $200 million worth of ETH earlier this week—the broader trend leans bullish.

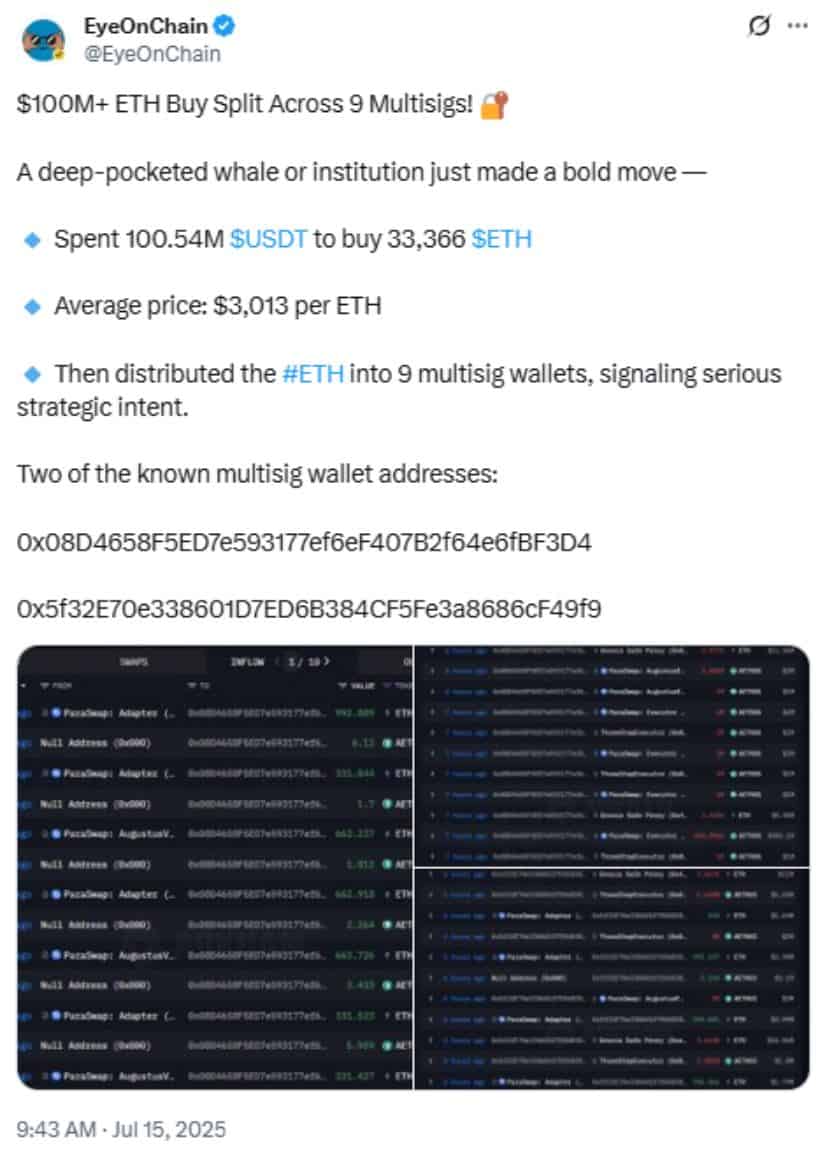

A major buyer spent over $100M to acquire 33,366 ETH across 9 multisig wallets, averaging $3,013 per ETH. Source: @EyeOnChain via X

Whale wallet transaction counts are increasing, and Ethereum’s Open Interest has surged above $21.5 billion, marking a 12-month high. Rising open interest alongside price increases typically signals new capital inflows, not just Leveraged recycling of existing positions.

“The convergence of spot accumulation and rising futures open interest suggests both long-term conviction and short-term trading appetite,” said analyst Marc In The Matrix.

Technical Analysis: ETH Eyes $4,000 Next

From a technical standpoint, Ethereum has broken above the 0.618 Fibonacci retracement level at $3,045, turning it into a new support zone. The next key resistance is seen at $3,295, corresponding to the 0.786 Fibonacci level.

Ethereum eyes $4,000 as bullish momentum builds, with pullbacks seen as buying opportunities. Source: @TedPillows via X

If ETH manages a daily close above $3,300, analysts say the path to $4,000 becomes increasingly probable. Popular trader CryptoBusy has identified an Inverted Head and Shoulders formation on the daily chart—a bullish reversal pattern that suggests more upside.

Analyst CryptoCaesar compared the current price structure to Ethereum’s 2016–2017 rounded base, which preceded ETH’s first parabolic run. “This isn’t just a technical breakout—this time it’s backed by ETF demand and real-world utility,” Caesar noted.

Final Thoughts: Ethereum Is Gearing Up for a Major Breakout

Ethereum appears to be at a pivotal juncture. With institutional ETFs absorbing record amounts of ETH, corporate treasuries diversifying into the asset, and whales positioning for long-term growth, the ingredients for a breakout are clearly in place.

Whale accumulation strengthens as Ethereum regains momentum after years of slower growth. Source: Timonrosso on TradingView

While price consolidation below $3,000 remains possible in the short term, the broader market structure suggests growing conviction. If current support levels hold and inflows persist, Ethereum’s march toward $4,000—and possibly beyond—may be a matter of when, not if.