Germany Blew Its Bitcoin Chance—Now Retail Investors Are Piling Into Bitcoin Hyper (And It’s Not Hard to See Why)

Bitcoin’s rocket ride left Germany on the launchpad—but retail traders aren’t making the same mistake twice.

Why Bitcoin Hyper? Because ‘slow and steady’ just means missing the next bull run.

The FOMO is real: After watching early BTC adopters retire on memes, German investors are diving headfirst into the next crypto wave. No paperwork, no banks—just pure, uncut volatility.

Meanwhile, traditional finance still thinks ‘blockchain’ is a new type of Scandinavian furniture. Stay poor, we guess.

In what could be called one of the worst crypto blunders of the decade, Germany sold off its entire Bitcoin holdings for $3.13B in July 2024.

Fast-forward to July 2025, bitcoin has not only doubled in price but is positioned to break into a new all-time high (again).

What’s more? Layer-2 technologies like Bitcoin Hyper ($HYPER) are unlocking the Bitcoin blockchain’s true potential with much-needed scalability upgrades.

The surging interest in the $HYPER token presale, now racing toward the $3M mark, makes one thing clear: retail investors aren’t sitting this rally out. They’re getting in early, before Bitcoin leaves the station again.

Germany’s $3B Blunder

In 2024, Germany sold off 50K bitcoins seized during a major anti-piracy operation. Looking back, the timing couldn’t have been worse.

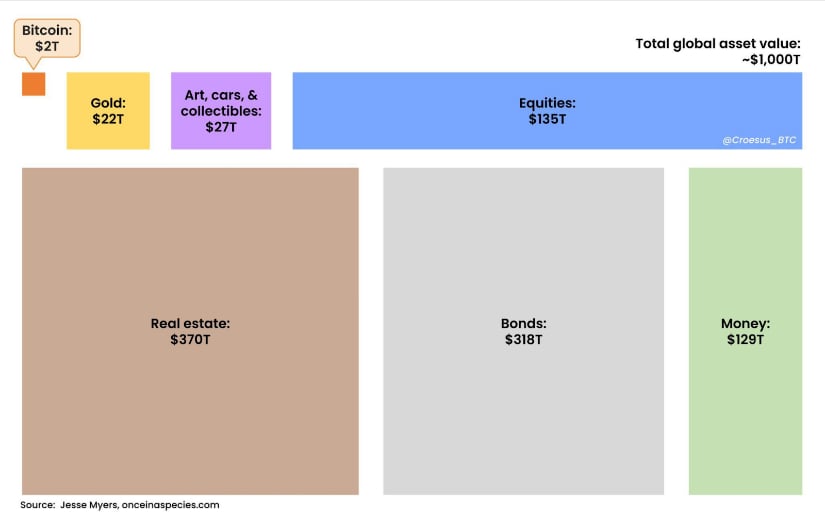

That stash would be worth over $6.64B today. Bitcoin’s recent surge has briefly driven its market cap to $2.4T, outperforming Amazon and making it the fifth most valuable asset in the world.

Source: James Lavish

While Germany was cashing out, countries like El Salvador and Bhutan were accumulating more $BTC as a long-term hedge.

Even in the U.S., where regulation is still murky, the government is actively stepping into crypto. In March 2025, President Donald J. Trump signed an Executive Order to establish a Strategic Bitcoin Reserve and a broader U.S. Digital Asset Stockpile that would use government-seized crypto as reserve assets.

A series of industry-friendly bills is progressing through Congress, including one that WOULD establish a regulatory framework for stablecoins.

Germany isn’t exactly anti-crypto. In fact, it’s one of the most active issuers of MiCA licenses in the EU and has embraced blockchain innovation. Yet, Germany’s MOVE has become a cautionary tale for investors worldwide: poor timing can cost billions.

Bitcoin Aims for $135K

Bitcoin has finally moved out of the slow, sideways phase it was in for months, piercing through $120K and briefly setting a new all-time high at $123,091.

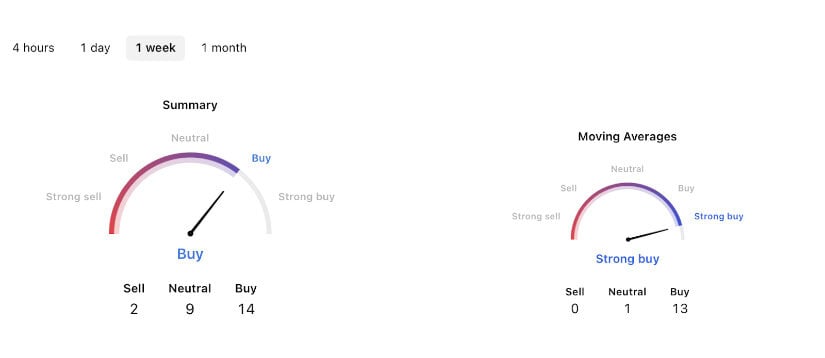

The bold move signals the start of a new uptrend, as technical signs remain solid.

Source: TradingView

If the current trend continues, Bitcoin could climb toward $135K before cooling off, according to Fairlead Strategies’ Katie Stockton.

What’s more interesting is what’s not happening: retail participation.

Despite the rally, on-chain metrics show retail wallet activity hasn’t caught up. Exchange inflows are dominated by larger wallets, and typical retail indicators like Google search trends and crypto app rankings remain relatively subdued.

“Retail isn’t here yet! Not real retail. Not the 2020–2021 kind. That crowd shows up when $BTC hits $150k+ and mainstream media has no choice but to cover it daily. […] Yes, institutions accumulate early and seed narratives. But once momentum hits escape velocity, retail follows.” explains Nic Puckrin, investor and founder of The Coin Bureau.

This creates a rare window, where retail investors can still get in before FOMO kicks in. And while $BTC may already be in six-figure territory, $HYPER offers a way to get early exposure to the next phase of Bitcoin-native innovation.

Bitcoin Hyper ($HYPER) Prepares to Upscale Bitcoin L1

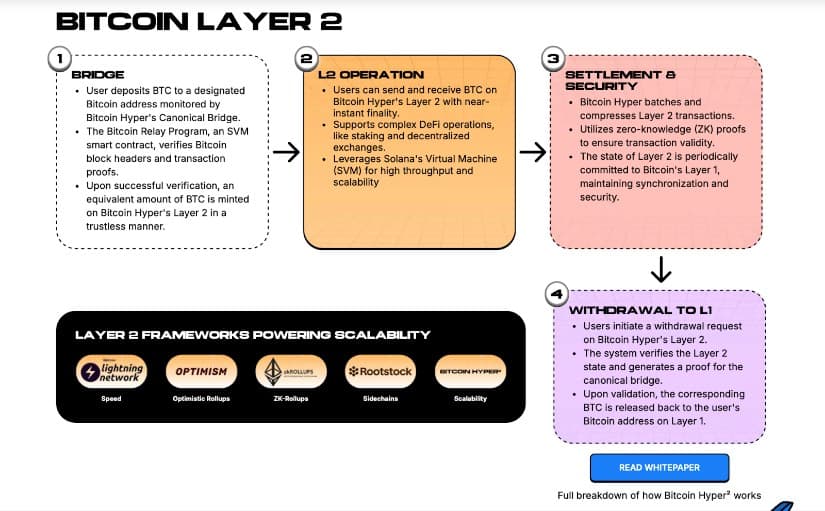

Bitcoin Hyper is an upcoming Layer-2 solution integrating the Solana VIRTUAL Machine (SVM). It is designed to fix Bitcoin’s long-standing scalability and utility issues.

While Bitcoin remains the Gold standard for store-of-value in crypto, it’s been functionally limited, slow, and expensive. Bitcoin has yet to become compatible with modern DeFi or dApps.

Bitcoin Hyper changes that. It unlocks sub-second transactions, near-zero fees, and cross-chain functionality, all secured by the Bitcoin Layer-1 itself via zero-knowledge proofs and regular settlement with the L2 via a canonical bridge.

The native token, $HYPER, fuels everything on the Bitcoin Hyper network, including:

- Transaction fees

- Staking

- Governance

- On-chain dApp access

Presale participants get first-in access to these utilities when the L2 launches in Q3 2025, plus staking rewards throughout the presale (currently delivering 305% APY).

Moreover, in Q4 2025, the project team is going to roll out its own DAO, where the $HYPER token ensures exclusive governance rights. Soon after, the devs will onboard DeFi, NFT, and gaming-focused dApps on the chain.

Conclusion: Bitcoin Never Disappoints. #1 Crypto Keeps Climbing

Germany’s Bitcoin sell-off is a clear reminder of how costly poor timing can be.

Now, as Bitcoin sets its sights on $135K and the ecosystem continues to evolve, a new opportunity is shaping up. One that builds directly on Bitcoin’s growing momentum.

Bitcoin Hyper is expanding what $BTC can actually do, and investors are taking notice. The $HYPER token presale has already crossed $2.8M, driven by those who don’t want to be late twice.

The presale uses dynamic pricing, so the earlier you get in, the better your deal. Entry points will rise with each new phase, and staking rewards will shrink over time. This is how early-stage conviction is rewarded.

Visit the official Bitcoin Hyper website to learn more about the project or join the presale.

As always, take time to do your own research. No crypto project guarantees returns. This article isn’t financial advice.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.