Chainlink Shatters Downtrend: $22 Target in Sight as Bulls Take Control

Chainlink's price just ripped through a critical resistance level—and now the $22 target looks like a foregone conclusion.

The breakout playbook

LINK bulls finally got the confirmation they needed after weeks of grinding sideways. That downtrend line? Obliterated. Now the oracle token's chart reads like a bull market checklist: higher lows, surging volume, and a textbook breakout retest.

Why $22 matters

The next psychological barrier sits at $22—a level that would've seemed laughable during last quarter's 'crypto winter' (back when hedge funds were busy shorting their grandma's retirement fund). Technicals suggest the rally has legs, though liquidity above $20 remains the wild card.

The cynical take

Of course, Wall Street will claim they 'always believed in the fundamentals'—right after they finish dumping their bags on retail at $21.99.

As LINK stabilizes above critical support levels, the price structure presents opportunities for further gains.

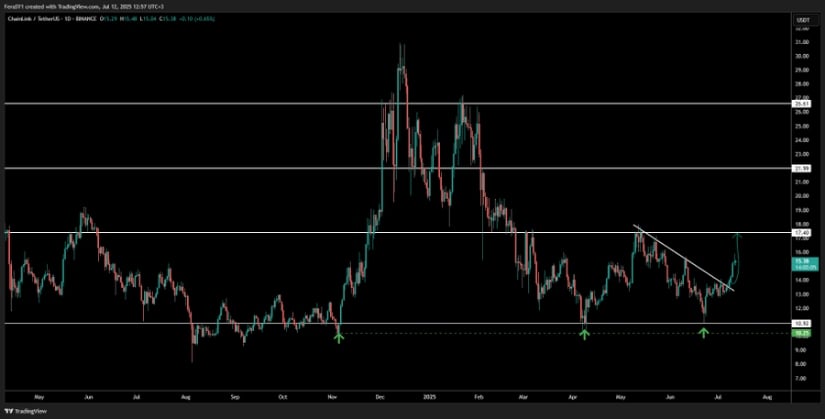

Bullish Continuation Signals: Breakout MomentumThe daily LINK/USDT chart shared by crypto Feras outlines a clear technical shift after the token pushed above a long-standing descending resistance trendline. This pattern, supported by higher lows near the $10.50 support level, reflects strengthening bullish sentiment.

The breakout brought LINK into the $15.80–$16.00 range, setting its sights on the next key resistance at $17.40. According to Crypto Feras, this level serves as a pivotal marker; a clean break above could lead the asset toward a target NEAR $22.00, based on historical price zones and volume profile indicators.

Source: X

Price structure confirms a higher-high formation, validating the breakout as more than a temporary spike. However, caution remains in place as a failure to reclaim and hold $17.40 could signal exhaustion. Traders are closely watching for a successful retest and confirmation candle to support further entries. As long as LINK sustains above the new trendline support, the short-to-mid-term structure remains intact.

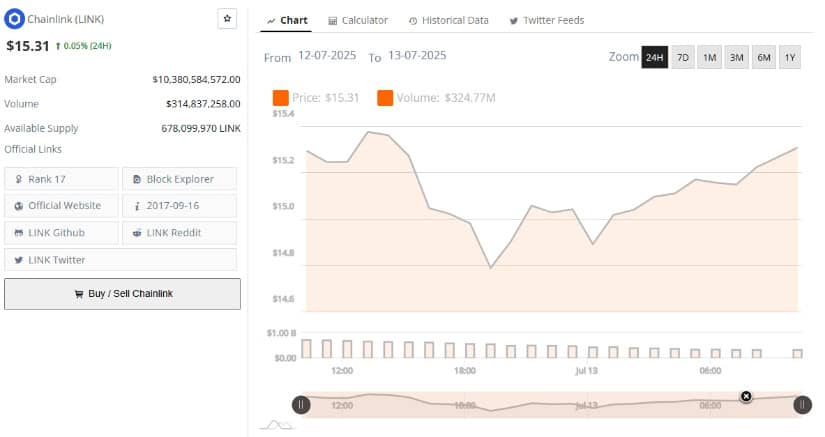

24-Hour Data Shows Resilient Recovery Amid Fluctuations

BraveNewCoin data for the 24-hour trading period between July 12 and July 13 shows a moderate gain of 0.05%, with LINK ending the session at $15.31. The price recovered from an intraday low of $14.70 after an early dip and held above $15.00 for the remainder of the day.

This rebound, though modest, occurred without any abrupt volume spikes, pointing to a steady demand profile. LINK’s market capitalization currently sits at approximately $10.38 billion, securing its position within the top 20 cryptocurrencies.

Source: BraveNewCoin

Volume remained consistent, reaching $324.77 million, reflecting active engagement without directional bias. This balance indicates that while traders reacted to short-term fluctuations, the broader sentiment held firm. A key area for short-term continuation lies between $15.30 and $15.40; should this range provide support, LINK could MOVE back toward the $15.50–$16.00 resistance.

Momentum Indicators Support Price Structure Shift

At the time of writing, the LINK/USD daily chart reflects a clear uptrend above $15.00, with a recent high near $15.80 before retracing slightly to $15.25. This structure follows a series of higher lows that began in late June, signaling a constructive bullish setup.

The Awesome Oscillator (AO) confirms this momentum, currently reading +1.36, with expanding green bars over consecutive sessions. The shift from red to green on the histogram marks a transition phase from neutral to bullish territory.

Source: TradingView

The Chaikin Money FLOW (CMF) sits at +0.16, further validating the bullish sentiment by indicating sustained capital inflow. The CMF has maintained positive values throughout July, suggesting that investor accumulation is ongoing.

If LINK holds above the $15 psychological barrier and continues to attract volume, the projected targets at $17.40 and $22.00 remain plausible within the near-term trading horizon.