Uniswap Price Prediction 2025: Bulls Charge Toward $10 – Key Levels to Watch Now

Uniswap's native token revs up for a potential breakout as traders pile into DeFi's blue-chip asset. Here's where the smart money is placing bets.

Key resistance levels loom—but liquidity pools suggest this rally has legs. The $10 target isn't just hopium; on-chain metrics show whales accumulating while retail sleeps.

Of course, some Wall Street suits still think 'liquidity provider' means a bartender during happy hour. Meanwhile, Uniswap's daily volume quietly eclipses legacy exchanges.

As the token consolidates above key technical levels, bulls are watching for a breakout that could push UNI toward the psychological $10 mark in the NEAR term.

Renewed Momentum Signals Structural Shift

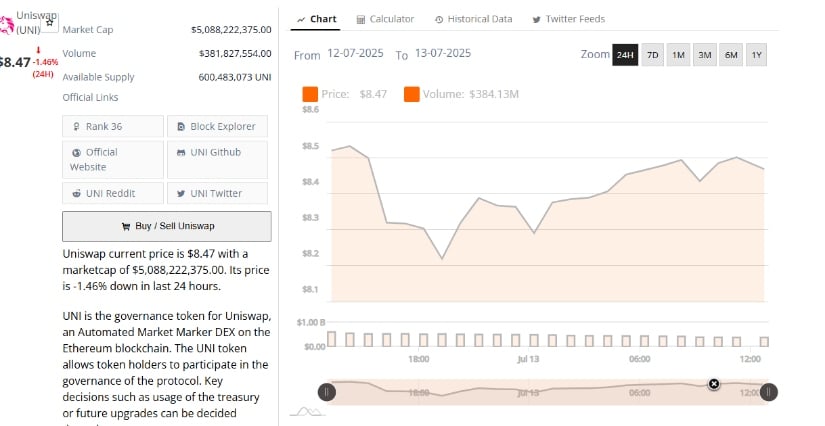

Data from BraveNewCoin shows a significant upward movement in UNI since early July. After finding support near the $7.00 level, the price rallied above $9.00 before entering a modest correction. The hourly chart highlights a series of higher highs and higher lows, reflecting strong demand and continued buying interest during pullbacks. UNI is currently consolidating around $8.40, indicating potential stabilization before the next leg up.

Source: BraveNewCoin

The global aggregated open interest in UNI futures has risen in tandem with the recent price rally, reflecting increased speculation and Leveraged participation. According to derivative data, open interest climbed steadily from July 8 to July 11, coinciding with UNI’s price surge.

However, recent divergence between flat or rising open interest and slightly declining prices suggests a buildup of long positions without additional bullish momentum. If the price weakens while OI remains elevated, the risk of liquidation-driven volatility increases.

Market participants should closely monitor price behavior near the $8.00 support zone and $9.20 resistance. A strong breakout above $9.20 with rising volume could act as confirmation of a continuation toward $10.00. On the contrary, a failure to hold $8.00 may suggest temporary exhaustion of the uptrend.

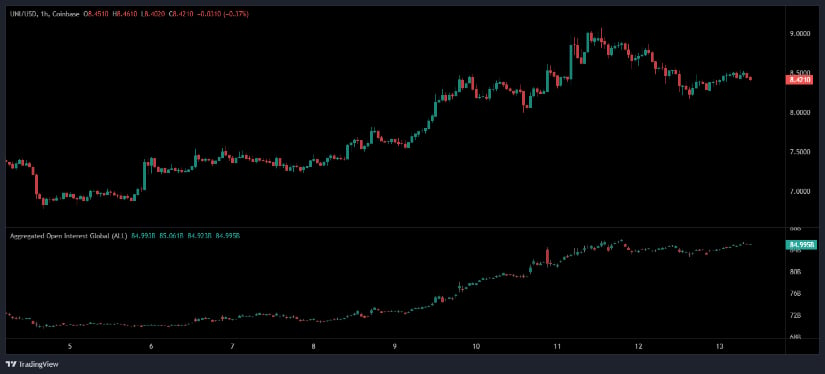

Key Resistance Breakouts Highlight Trend Reversal

Analysis from TradingView on the daily timeframe confirms a potential reversal from the prolonged downtrend seen between January and May. UNI formed a solid base between $4.55 and $5.50, with multiple bounces suggesting strong accumulation. The breakout above former resistance levels at $7.67 and $8.00 confirms a trend change, with UNI now trading at its highest levels in over a month.

Source: TradingView

Momentum indicators support the bullish narrative. The Awesome Oscillator (AO) has turned positive after months of bearish momentum, currently printing a reading of 0.965. This crossover signals that short-term price strength is overtaking longer-term bearish pressure. Additionally, the AO’s green histogram bars have expanded steadily over recent sessions, reinforcing the shift in trend dynamics.

If bulls can maintain the current price structure, the next resistance to monitor lies at $8.68. Beyond that, the $10.35 zone, which served as a significant pivot in early 2024, becomes the next target. Conversely, a loss of the $7.00 level WOULD threaten the bullish bias, potentially dragging price back into consolidation territory.

Technical Outlook Favors Bulls With Caution on Volume Divergence

At the time of writing, UNI is holding key support above the $8.00 mark, supported by both price structure and on-chain metrics. The alignment of higher lows at $4.74, $5.79, and $5.92 with corresponding higher highs positions UNI within an early uptrend structure. As long as the $8.00 floor holds, the probability of a continuation rally increases.

Source: Open Interest

However, short-term caution remains necessary as rising open interest amid declining price momentum could lead to liquidation spikes or range-bound trading. Traders should monitor for a clear break above $9.20, supported by strong volume, to validate bullish continuation.

If confirmed, the $10.00 target may come into play, aligning with broader market strength across altcoins. The current market setup points to a cautiously optimistic outlook for UNI, provided structural supports remain intact and speculative demand continues to build.