Ethereum (ETH) Bulls Charge: $3,000 Support Holds Firm as Analysts Predict Shattered ATH by 2025

Ethereum isn't just holding $3,000—it's priming for a historic breakout. Here's why traders are flipping bullish.

The $3K Floor: More Than Just Psychological Support

ETH's consolidation above $3,000 isn't casual. Liquidity pools show institutional accumulation, while retail FOMO lurks just below. This isn't a dip—it's a reload.

2025 Price Targets: When 'Upside' Becomes an Understatement

Analysts see a perfect storm: ETF inflows, L2 adoption, and that sweet, sweet deflationary burn. The path to a new ATH? Clearer than a banker's self-interest during a bull market.

The Catalyst No One's Talking About (Yet)

Hint: It's not just about the Merge anymore. DeFi's silent rebuild and institutional staking yields could trigger the mother of all gamma squeezes.

So is ETH really going to moon? Let's just say the smart money's already positioned—while traditional finance still thinks 'blockchain' is a Excel feature.

With bullish sentiment building, analysts are now forecasting a potential rally toward $8,000 by the end of 2025.This renewed momentum comes as ethereum solidifies its position as the leading smart contract platform, driven by major ecosystem upgrades, staking rewards, and expanding real-world adoption.

ETH Price Rallies on ETF Surge and Technical Breakout

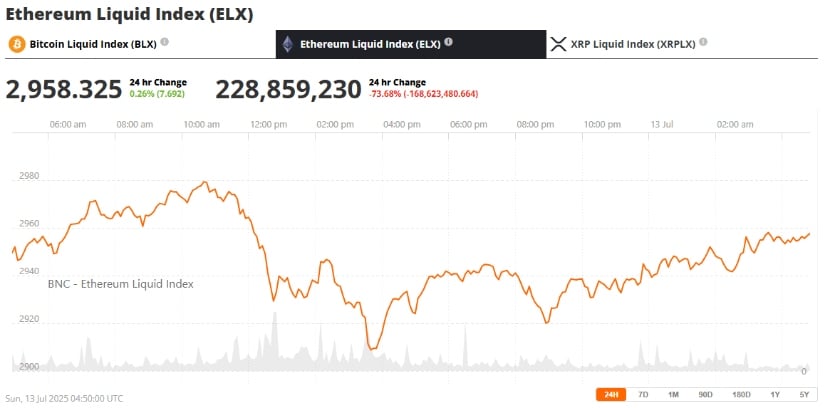

Ethereum rallied past the $3,000 mark this week, driven by a surge in ETF inflows and renewed interest across the Layer-2 ecosystem. As of July 13, ETH was trading at approximately $2,951, up more than 5% in a week, with a total trading volume of $44.75 billion. This price movement marks a 30% rebound from June’s lows NEAR $2,100 and positions ETH for a potential climb to new all-time highs by 2025.

Ethereum ETFs hit a record weekly inflow, signaling rising investor confidence and potential momentum for the next bullish phase. Source: Ceanmedia via X

Market sentiment has turned increasingly bullish following Ethereum ETF inflows reaching a record $907.99 million — the highest weekly tally since ETF trading began in July 2024. “Three of ETH ETF’s top 10 inflow days have happened this week,” said analyst Nate Geraci, adding that the demand was “largely driven by growing confidence among institutional investors.”

Market Overview: Key Resistance Levels and Technical Forecast

Ethereum’s technical outlook also supports the bullish momentum. The token has successfully broken key resistance at $2,836.5 and briefly touched $3,039. Analysts now view $3,200 as the next major hurdle. A clean breakout above that level could unlock an 80% upside, with targets ranging between $3,629 and $8,000 by the end of 2025.

The market demands patience and disciplined risk management—avoid high leverage, follow the trend, and use pullbacks strategically, as ETH still shows strong potential toward the $4,000 mark. Source: mulaudzimpho on TradingView

A weekly close above $2,836 WOULD signal a confirmed shift into a bullish trend zone. “This price structure aligns with the Fibonacci 161.8% golden extension, clearing the path to $3,323 and beyond,” noted technical analysts from FXLeaders. Momentum indicators like Ethereum RSI today also confirm upward pressure, with higher lows forming on the weekly chart.

Layer-2 Ecosystem Sees Explosive Growth

Beyond price action, Ethereum’s expanding Layer-2 (L2) ecosystem is playing a crucial role in its long-term value proposition. Arbitrum, Optimism, and Base have all recorded sharp increases in active users and Total Value Locked (TVL). Remarkably, combined L2 transactions now exceed mainnet activity — a historic first that highlights the maturing scalability of Ethereum’s infrastructure.

Arbitrum, a fast and cost-efficient Ethereum LAYER 2 solution, continues to show strong potential for broader adoption and future product innovation. Source: GiaBao via X

This growth is driven by falling gas fees and a better user experience, supported by recent advancements like EIP-4844 and the anticipated “Pectra” upgrade in Q4 2025. These changes will introduce blob-carrying transactions and pave the way for full Danksharding, making Ethereum significantly more efficient for dApp developers and end users alike.

Ethereum ETF News: Wall Street’s Growing Interest

Institutional adoption is accelerating. In a notable shift, BlackRock’s Ethereum ETF holdings crossed 2 million ETH, worth over $300 million. This contrasts with declining Bitcoin purchases, indicating a changing narrative among large investors.

BlackRock’s iShares Ethereum ETF now holds over 2 million ETH, representing 1.65% of the total supply, highlighting accelerating institutional adoption. Source: The Coin Republic via X

“The fact that institutions are buying more ETH than BTC reflects Ethereum’s appeal as a yield-bearing asset,” noted a DisruptAfrica analyst. With staking rewards, broad DeFi utility, and a robust roadmap for future upgrades, ETH is increasingly seen as a foundational asset in the crypto space.

Ethereum staking rewards and validator participation continue to grow, with over 35 million ETH staked and exchange reserves shrinking — suggesting long-term holders are not eager to sell.

Ethereum vs Bitcoin 2025: Is a Flippening Possible?

While bitcoin still leads in total ETF volume, Ethereum is catching up faster than expected. The appeal of Ethereum staking, combined with real-world applications in decentralized finance, NFTs, and tokenized assets, positions ETH as a serious contender in the broader crypto market.

Some experts believe Ethereum could outperform Bitcoin in this market cycle due to its evolving utility and Layer-2 dominance. “ETH isn’t just digital Gold — it’s programmable money that pays you,” one investor commented, referencing Ethereum’s validator rewards and staking returns.

Final Thoughts: ETH Price Prediction and Future Outlook

Ethereum has re-entered the spotlight with renewed strength around $3,000. With strong ETF demand, ecosystem innovation, and bullish technical signals, the stage is set for a potential rally toward $3,200 in the short term — and possibly as high as $8,000 by 2025.

Ethereum (ETH) was trading at around $2,958, up 0.26% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Whether Ethereum will outperform Bitcoin or not, its foundational role in the crypto economy — from DeFi and NFTs to real-world asset tokenization — makes it a top contender for long-term growth.

Ethereum price prediction remains bullish, but investors are advised to watch for confirmation above $3,200 before anticipating further upside. As always, the macroeconomic backdrop and regulatory developments will continue to play a key role in ETH’s trajectory in the coming months.