$10B VC Tsunami in Q2: 5 Crypto Titans Fuel Rally as SUBBD Token Rides the Wave

Crypto's institutional money spigot just blasted wide open. Five heavyweight firms pumped $10 billion into digital assets last quarter—and now the altcoins are lining up for their cut.

VCs gone wild: The smart money's back in crypto (just don't ask about their 2022 portfolios). While suits chase infrastructure plays, speculative tokens like SUBBD are positioning for the trickle-down effect.

Market psychology 101: When the whales start feeding, the minnows get ambitious. SUBBD's team claims their tokenomics are 'institution-ready'—though we've heard that before from projects that cratered faster than a leveraged degen's account balance.

The real tell? Watch where quarter three's capital flows. If this is another VC sugar rush, the hangover could be brutal. But for now—pour the champagne and mind the exit doors.

Venture capital (VC) investment in the crypto sector has seen a significant shift in 2025, with Q2 figures dramatically outperforming those of last year.

With five prominent crypto firms leading the charge in Q2 funding, crypto is firmly on the radar for serious institutional investment. This surge, coupled with the ongoing peak in AI investment, creates a fertile ground for innovative projects like SUBBD Token ($SUBBD) to thrive.

Q2 2025 saw $10B+ in crypto VC funding, outpacing 2024’s total. Here’s why it matters.

Crypto VC Boom Signals Market Strength

Total VC inflows for the whole of 2024 amounted to $7.7B, according to CryptoRank. This year started with stronger momentum, as Q1 2025 saw $4.8B in investments, already amounting to 60% of 2024’s total.

Most Q1 deals were seed rounds, indicating a healthy pipeline of crypto startups and a continued search for solid, scalable business models in emerging areas.

Source: CryptoRank

Q1 2025 also saw several major mergers and acquisitions (M&As), highlighting a growing trend of consolidation among established crypto players. In March, crypto exchange Kraken snapped up futures trading platform NinjaTrader in a substantial $1.5B deal, marking a significant convergence of TradFi and crypto markets.

In January, Web3 payment provider MoonPay sealed a $175M buyout of Helio, a Solana-based crypto payment processor, aiming to offer a more comprehensive on-chain payment system.

As CryptoRank noted, Q1 2025 ‘marked the strongest quarter for crypto VC since Q3 2022.’ Well, MOVE over, Q1 2025. The second quarter has raised the bar.

Big money is flowing into Bitcoin-focused projects and Core infrastructure. This influx, coupled with clearer global regulations, highlights crypto’s growing institutional appeal.Another noteworthy M&A was on May 27, when Strive Asset Management announced a $750M private investment to fund its first wave of Bitcoin accumulation. It aims to raise up to $1.5B once warrants have been exercised.

This came after a merger with Nasdaq-listed Asset Entities, which effectively makes Strive the first listed asset management bitcoin treasury company.

Twenty One Capital also put its money where its mouth is, securing $585M. ‘We’re not here to beat the market, we’re here to build a new one,’ stated CEO Jack Mallers. ‘A public stock, built by Bitcoiners, for Bitcoiners.’

Formed by Tether, SoftBank, and Mallers in April by merging with Cantor Equity Partners, Twenty One gives investors direct $BTC exposure and promotes Bitcoin adoption, with plans to expand into Bitcoin-native financial products.

Tokenization of real-world assets (RWAs) also saw significant investment, with Securitize adding $400M to the Q2 VC pot. In April, it partnered with Mantle to introduce the Mantle Index Four Fund, a new institutional-grade digital asset offering. The deal highlights how tokenization is connecting traditional finance with blockchain and pushing fractional ownership closer to mainstream adoption.

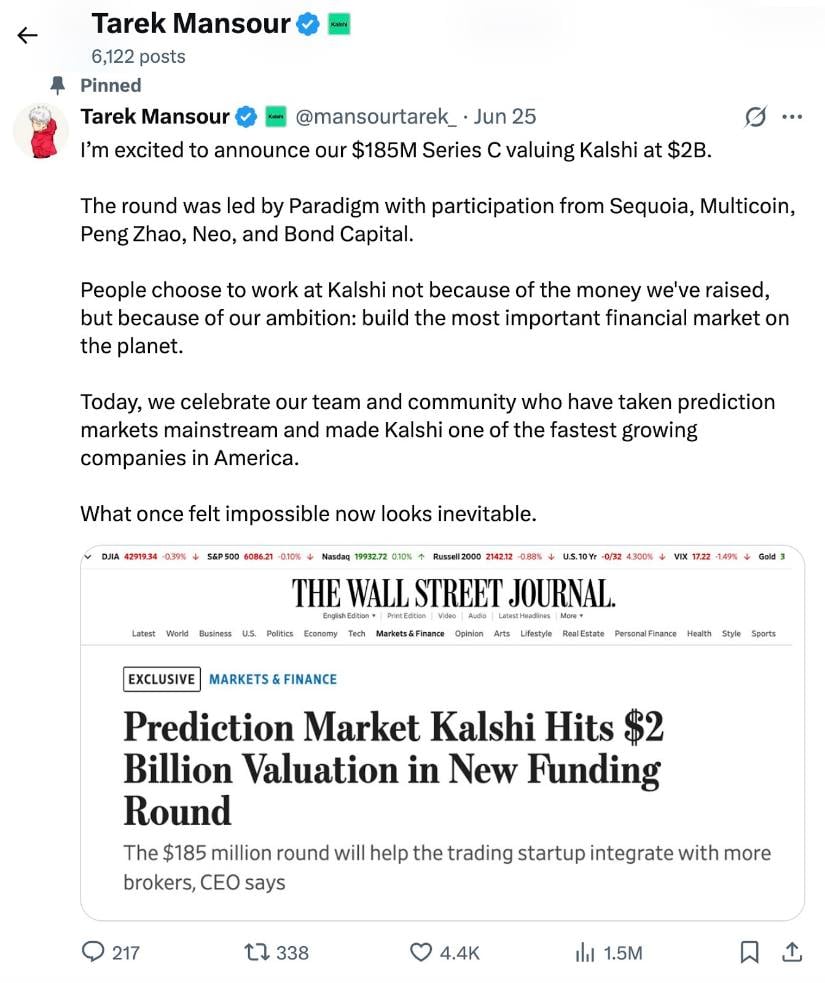

Prediction market platform Kalshi, meanwhile, has raised $185M in a Series C funding round led by Paradigm. This investment pushed Kalshi’s valuation up to $2B, signaling growing investor confidence in prediction markets.

Last but not least of the big Q2 contributors, Auradine, a blockchain and AI infrastructure solutions provider, secured an additional $153M in a Series 3 funding round, bringing its total capital raise to over $300M.

Auradine also announced a new business group – AuraLinks AI. It will focus on developing open-standard networking solutions for next-gen AI datacenters, highlighting the convergence of AI and blockchain.

Crypto Investment Driving AI and the Rise of SUBBD Token

Crypto Valley Venture Capital reports that 53% – $59.6B – of global VC funding went to the AI sector in Q1. AI is seeing enormous backing, so it stands to reason that combining crypto and AI is a recipe for success.

This is exactly where SUBBD Token ($SUBBD) is positioned. $SUBBD is the native token behind a next-gen content-creation platform that integrates advanced tools for AI automation.

The SUBBD platform helps content creators tap into a 250M+ fanbase and unlock multiple revenue streams in both crypto and fiat, directly from their audience. That means no middlemen and management fees.

The platform’s AI components include a smart AI assistant for chatting with fans, editing content, and streamlining everyday tasks. Meanwhile, the free SUBBD Creator Academy will teach creators how to use AI automation efficiently and grow their brands.

SUBBD isn’t only a platform for creators. It’s also designed for an amplified fan experience, and holding $SUBBD comes with attractive benefits.These benefits include exclusive interactions with your favorite content creators, access to premium content, special holder discounts, and governance rights. What’s more, you’ll also be able to create your own AI-generated images, adding another LAYER of utility and engagement.

SUBBD Token is currently in presale – effectively its own initial capital raise before listing on decentralized and centralized exchanges. With over $777 already raised, this altcoin is gaining traction.

Currently, 1 $SUBBD costs $0.0559, but a price increase is imminent. The good news? Staking is fixed at 20% APY, which is rare for crypto presales.

Riding the Crypto VC Wave

Bitcoin is surging, VC is booming, and AI is the Apple of investors’ eye… Happy days all round. With such impressive Q2 figures underscoring institutional confidence, we can’t wait to see how Q3 pans out.

The current market also makes SUBBD Token an attractive investment, particularly with its blend of content creation (another growing market) and AI technology.

Nothing is guaranteed, of course – and that’s particularly true of the unpredictable crypto market. So be sure to DYOR before making any investment.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.