Hyperliquid (HYPE) Price Prediction: Volume Surges, Whales Flee, and the $40 Showdown

Hyperliquid (HYPE) is making waves—again. Trading volume just spiked, whales are cashing out, and the $40 resistance level is the battleground du jour. Here's the breakdown.

Volume Spikes: Liquidity Floods In

Someone's betting big. HYPE's trading volume surged—no, exploded—as traders piled in. Whether it's FOMO or a calculated play, the market's buzzing.

Whale Exodus: Big Money Walks

Meanwhile, the whales are heading for the exits. Smart money or scared money? Depends who you ask. Either way, their moves are shaking the order book.

The $40 Resistance: Make or Break

All eyes on $40. Bulls are charging, bears are lurking, and the charts are screaming for a breakout—or a brutal rejection. Classic crypto drama.

Bottom line: HYPE's got momentum, but it's a high-stakes game. And let's be real—when has crypto ever made sense? Place your bets.

Hyperliquid is entering a critical phase, with several key signals now converging at once. Market watchers are closely tracking the $40 million unstaking event set for July 15, a surge in trading volume, and a rising tug-of-war between bullish aggression and short-term sell pressure.

$40M Hyperliquid Unstaking Event Set for 15th July

Over $40 million worth of Hyperliquid is set to be unstaked on July 15, just ahead of the much-anticipated Kinetiq launch. According to Messari, three whale wallets alone account for $33.5 million of that figure, signaling serious capital repositioning. Rather than a typical unlock event leading to sell pressure, this looks more like whales preparing to reallocate toward Kinetiq’s staking protocol.

Hyperliquid whales prepare to rotate $40M ahead of Kinetiq, signaling strategic accumulation over exit moves. Source: Messari via X

The seven-day unstaking window comes at a moment when HYPE’s price is consolidating near its highs and supply is already tight. If this $40M shift moves into Kinetiq’s ecosystem instead of exchanges, it could reduce available liquidity further and strengthen the case for a post-launch squeeze. For participants watching HYPE’s price structure, this development adds a key LAYER to track: the effect of rotation, not rejection.

Surge in Trading Volume Signals HYPE May Be Gearing Up

Following the $40 million unstaking event set for July 15, HYPE is now making noise on the volume front. In the last 24 hours, it recorded a 62.94% jump in trading volume, as highlighted by crypto Raven. That spike put HYPE among the top movers across all tracked assets, second only to XRP in volume growth. For a token sitting in a tight consolidation zone, this kind of activity could be an early sign of upcoming directional movement.

Hyperliquid sees a 62.94% surge in trading volume. Source: Crypto Raven via X

Volume spikes like this, especially ahead of a major ecosystem shift like the Kinetiq launch, shouldn’t be ignored. It suggests that eyes are already positioning ahead of what could be a low liquidity environment. Combined with the recent whale unstaking activity and price holding NEAR $38–$40, this burst in trading volume may be setting the stage for the next leg.

HYPE Open to Two-Path Scenario

The 12-hour chart of HYPE shared by analyst iamcfw lays out a clear two-path scenario just as the $40M unstaking event looms. Structurally, price is hovering above the previous all-time high zone, now retested as support, and dancing along the 50 EMA. The chart outlines a potential local 5-wave completion, which could kick off a new impulsive leg if HYPE Hyperliquid Price reclaims the $40 to $42 region with strength.

HYPE’s chart shows a possible 5-wave structure, with a breakout above $42 or a dip below $36 likely to define the next major move. Source: iamcfw via X

On the flip side, the setup also leaves room for a short-term correction. If price loses momentum and breaks under the prior ATH zone near $36, a retest of the bullish order block around $30 to $32 becomes likely. However, in the broader context of increasing volume and the incoming Kinetiq-driven supply shift, that dip could be short-lived.

Downside Risk Remains as HYPE Tests Mid-Range

While bullish scenarios for HYPE remain in play, Dieguito Charts brings a more cautious perspective, noting a possible short setup targeting the $30 to $28 zone. The structure shown suggests lower highs forming into a mid-range squeeze, with no strong breakout confirmation yet. The highlighted region also aligns with a prior demand zone that hasn’t been revisited since the rally in early June, making it a logical spot for liquidity grabs if support at $36 cracks.

HYPE forms lower highs near mid-range, with downside targets at $30–$28 if $36 support gives way. Source: Dieguito Charts via X

This potential short view doesn’t necessarily counter the broader narrative from previous H2s, but it reinforces the importance of short-term positioning. Until HYPE decisively flips $40 to $42 into support, price could remain vulnerable to deeper pullbacks, especially with the Kinetiq unstaking still unfolding.

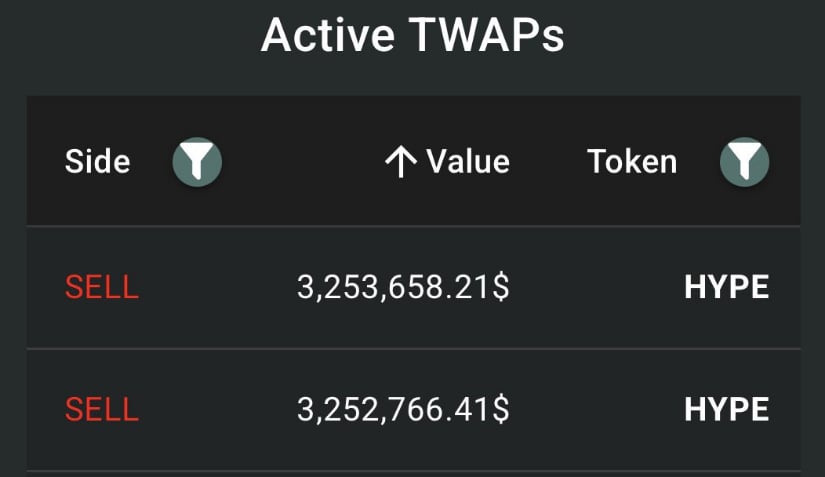

$6.5M TWAP Sell Order Tests HYPE’s Short-Term Strength

A $6.5 million Time-Weighted Average Price (TWAP) sell order just hit the HYPE market, split into two symmetrical $3.25M chunks over a 2-hour window. While not a full-blown panic signal, it’s a tactical MOVE that usually points to someone offloading size without disrupting price too aggressively.

A $6.5M TWAP sell order hits HYPE. Source: Henrik via X

Contextually, this comes as HYPE sits on the edge of two narratives, rotation-driven accumulation and short-term downside risk. Following the $40M unstaking heading into Kinetiq and the recent volume explosion, this TWAP could be a hedge or a preemptive exit. If the price can chew through this kind of sell pressure and still reclaim $40+, it WOULD add serious weight to the bullish structure. Until then, eyes remain on how Hyperliquid manages these large, controlled exits.

Final Thoughts: Correction Due For HYPE?

Hype Hyperliquid price is at a crossroads as on one side, there is a major whale unstaking and volume exploding, while on the other hand, the chart still leaves room for a dip if $36 breaks, and the recent TWAP sell order confirms a potential sign of pressure.

A short-term correction wouldn’t necessarily break the bigger picture. With HYPE holding deflationary tokenomics and positioning for a fresh ecosystem shift, even a pullback toward $30 to $32 could be seen as an opportunity rather than weakness.