Avalanche (AVAX) Primed for Breakout: Bullish AB=CD Pattern Signals $19.20 Surge Ahead

Avalanche (AVAX) is flashing a textbook bullish signal—and traders are taking notice. The AB=CD pattern, a classic technical setup, suggests an imminent push toward $19.20. Here’s why the charts are screaming buy.

The Pattern That Pays

When harmonic patterns align, markets listen. AVAX’s current formation mirrors historical rallies where symmetry translated to double-digit gains. No crystal ball needed—just pure price-action math.

Short-Term Fuel, Long-Term Fire?

While $19.20 is the near-term target, breakout volume could turn this into a springboard. Of course, in crypto, ‘sure things’ vanish faster than a hedge fund’s ethics during a margin call.

The Trader’s Edge

Watch for confirmation above key resistance. Miss this, and you’re left bagholding excuses instead of profits. Charts don’t lie—but they do love humbling the overconfident.

Grayscale just added Avalanche to its Top 20 crypto list for Q3 2025, and the timing couldn’t be more interesting. Technicals are starting to align for a 20-30% move, as AVAX prints a bullish AB=CD pattern and on-chain activity hits record highs.

Grayscale Adds AVAX to Its Top 20 List

Grayscale’s newly released Top 20 crypto list for Q3 2025 features Avalanche as one of the most notable additions. The move brings fresh institutional attention to AVAX, which has quietly been rebuilding momentum behind the scenes. Its inclusion under the “DeFi/L1 Ecosystem” category hints that Grayscale sees renewed potential in Avalanche’s network, particularly as L1 narratives regain momentum.

AVAX reclaims institutional spotlight with Grayscale inclusion. Source: Grayscale via X

While the broader market continues to focus on majors like Bitcoin and Ethereum, AVAX’s return to a spotlighted position suggests a possible shift in the capital rotation cycle.

AVAX Prints Clean AB=CD Pattern With $19.20 in Sight

After making Grayscale’s Q3 shortlist, AVAX is now flashing a bullish harmonic signal on the lower timeframes. Analyst Jesse Peralta outlines a textbook AB=CD formation, suggesting a potential extension toward the $19.20 region.

![]()

AVAX forms a textbook AB=CD pattern with $19.20 in focus, hinting at a potential bullish breakout. Source: Jesse Peralta via X

With price now curling off the $16.80 area, early signs of follow-through are starting to appear. The $19.20 target lines up with prior resistance from late June, meaning if AVAX clears the $18.30 zone cleanly, the pattern could complete quickly. With institutional eyes back on Avalanche and price now forming technically cleaner structures, a short-term rally doesn’t seem far-fetched, especially if volume starts picking up on the next leg.

Avalanche Price Prediction: Macro Double Bottom Sets Stage for $50 Test

Avalanche just printed a textbook double bottom on the macro chart, holding firm at long-term support NEAR the $18 to $17 zone. This pattern, identified by crypto analyst Investor Jordan, suggests a possible structural reversal is underway. On the weekly timeframe, price has respected this range three times over the last 18 months, making it one of the strongest historical demand zones for AVAX.

AVAX confirms macro double bottom near $17.70 support, with eyes now set on a $50 breakout. Source: Investor Jordan via X

With the neckline now sitting around the $24 to $25 level, a breakout above that region WOULD confirm the pattern and open up a move towards $50. Momentum is starting to build in Avalanche’s favor. The strength is curling upward on both weekly and daily charts, signaling renewed buying interest.

Avalanche Inflows Remain Strong

While price action continues to tighten just below key resistance, Avalanche is quietly attracting serious capital. Over the past 24 hours, AVAX recorded a net inflow of $3.84 million, second only to Ethereum. According to data shared by Emperor Osmo, this isn’t a one-off spike. It reflects a broader pattern of sustained deposits that has carried through much of Q1 and now into Q2.

AVAX records $3.84M in daily inflows, signaling steady investor confidence. Source: Emperor Osmo via X

This kind of consistent inflow is likely to have a positive impact on Avalanche’s price. After weeks of holding macro support and showing clean technical structures, like the recent AB=CD pattern and double bottom, this new wave of liquidity could be the fuel AVAX needs to break above the $25 neckline.

Avalanche On-Chain Hit New Highs as Demand Surges

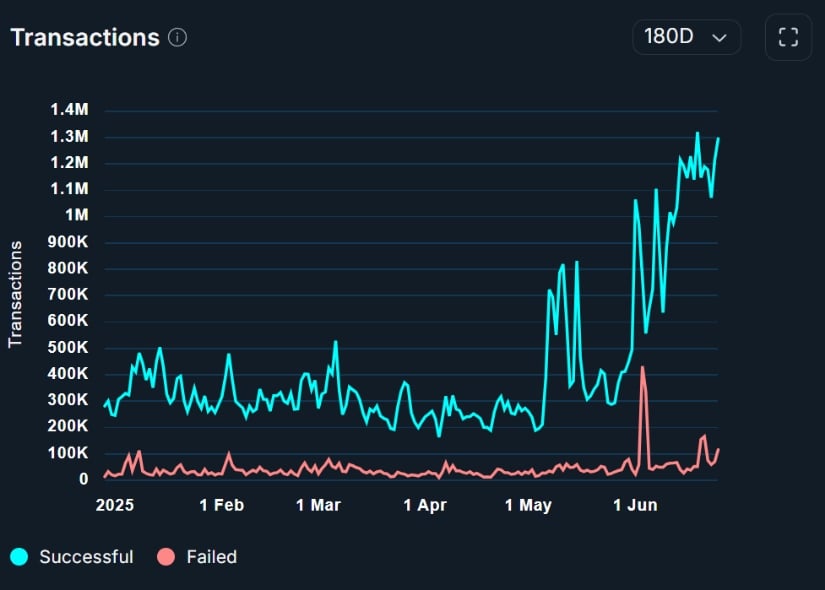

Avalanche just posted another all-time high in daily transaction volume, clocking in over 1.3 million confirmed transfers in a single day. The surge shows no signs of slowing down, especially on the C-Chain, where consistent throughput is becoming the new norm.

Avalanche hits record 1.3M daily transactions as network demand surges ahead of key resistance. Source: Emperor Osmo via X

With AVAX consolidating beneath major resistance levels, the network metrics are picturing a strong story. Momentum is quietly building, and what AVAX now needs is a spot ETF to anchor institutional flows and the much-anticipated RUSH 2.0 upgrade. If both catalysts line up, the path to $50 is just a warm-up. A break above $25 could start an aggressive leg higher, with crypto analyst hmmxavier even eyeing $147 in the next 60 days.

Final Thoughts

AVAX isn’t just riding hype; it’s building a solid case on multiple fronts. From clean technical setups to strong inflows and record-breaking on-chain activity, the signals are already aligning in its favor.

The double bottom neckline at $25 is now the key battleground. If AVAX can break through this level with conviction, momentum could accelerate quickly, putting the $50 target firmly in sight.