Cardano’s ADA Mirrors Bitcoin’s Bullish Fractal – $0.65 Target in Sight as Bulls Charge

Cardano’s ADA is painting a chart pattern eerily similar to Bitcoin’s historic rallies—and traders are betting history repeats. Here’s why $0.65 could be just the beginning.

The Bitcoin Blueprint

ADA’s price action is tracing a fractal that previously propelled BTC to parabolic highs. Technical analysts note the same consolidation-breakout sequence that triggered Bitcoin’s past bull runs.

The $0.65 Gateway

A decisive break above this resistance level could open the floodgates for a sustained uptrend. Market sentiment suggests institutional accumulation—because nothing screams 'smart money' like chasing a 3-year-old pattern.

Beyond the Hype

While the fractal sparks optimism, Cardano’s ecosystem growth—DeFi TVL up 120% this year—adds fundamental fuel. Just don’t mention that most projects still run on Ethereum. Bulls ignore, bears snort—price marches on.

After weeks of sideways price action and uncertainty, Cardano is starting to show positive signs again, and this time, it might be more than just a short-term bounce. Backed by strong technical patterns, ADA is flashing early signals that resemble Bitcoin’s legendary 2013–2017 cycle.

Cardano Mirrors Bitcoin’s Early Cycle Setup

Cardano is starting to flash some familiar signals, according to analyst Gajewskey, who points to a potential fractal match with Bitcoin’s 2013–2017 cycle. The chart comparison highlights a similar Wyckoff-style “SOS” (Sign of Strength) zone forming in ADA’s current structure, just like BTC’s consolidation before its massive breakout. If this structural similarity materializes, ADA could be positioned for a significant upside move.

Cardano’s structure mirrors Bitcoin’s early breakout phase. Source: gajewskey via X

Technically, the setup suggests a clear reaccumulation pattern following a multi-month range. Analyst gajewskey is targeting a price range of $4 to $8 for ADA. While fractals do have their limitations, they do offer historical blueprints, and if this one plays out, it paints a bullish roadmap for Cardano.

Ichimoku Cloud Turns Into Strong Support

Following the potential fractal setup, ADA’s behavior on the higher timeframes is adding more weight to the bullish narrative. On the 2-week chart, cardano has managed to break above the Ichimoku Cloud and has been steadily retesting the top of the cloud as support since early 2025. Famous crypto analyst, Cantonese Cat, believes this type of sustained interaction with the cloud top is often seen in early stages of trend reversals or major reaccumulation phases.

Cardano holds strong above the Ichimoku Cloud on the 2-week chart, signaling a potential early-stage trend reversal. Source: Cantonese Cat via X

ADA hasn’t closed a single candle back inside the cloud below $0.55 despite broader market volatility. When combined with the earlier Wyckoff-style “Sign of Strength” formation and the emerging macro structure, it strengthens the case that ADA might not just be mirroring BTC’s early-cycle setup; it is actively following it through.

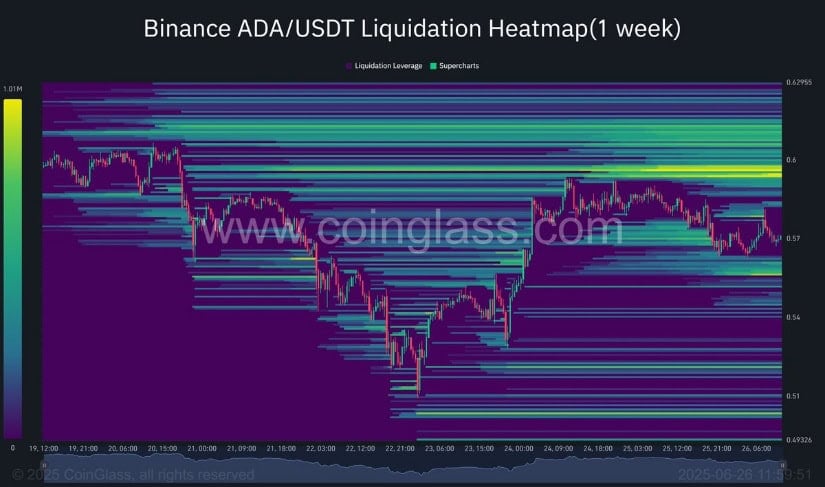

Heatmap Hints at a Liquidity Hunt Toward $0.62

Cardano’s liquidation heatmap is now showing a cluster of short liquidations building just above the $0.60 zone. Jesse Peralta highlights this in his latest post, pointing out that the $0.62 level is lighting up on Binance’s ADA/USDT liquidation map. This concentration of open short interest suggests that if ADA pushes just a little higher above $0.60, it could trigger a wave of liquidations.

Over $4 million in ADA short positions cluster NEAR $0.62. Source: Jesse Peralta via X

Between $0.59 and $0.62, there’s over $4 million in short positions stacked up. This creates a high-liquidity pocket that price tends to MOVE towards, especially during a momentum shift.

ADA’s LTF Establishing Inverse Head and Shoulders

Cardano’s short-term chart is showing signs of reversal. On the 4-hour timeframe, analyst Av_Sebastian has mapped out a clear inverse head and shoulders pattern. Price is now attempting to break above the neckline, but first needs to clear the 50-moving average, which has acted as a dynamic resistance over the last few weeks. If bulls can get through that, the next target sits near the top of the falling channel, around $0.65.

Cardano forms an inverse head and shoulders on the 4H chart, with bulls eyeing a breakout towards $0.65. Source: Av_Sebastian via X

This pattern adds short-term confirmation to what we’ve already seen on the higher timeframes. Av_Sebastian is backing the idea that ADA isn’t just primed for a short-term bounce but could eventually reclaim its place among the top five assets. That kind of sentiment, especially when paired with a clean reversal pattern and supportive community momentum, is a positive sign. If price clears the neckline and breaks above the 50-MA with volume, it could shift the short-term narrative and open the door for broader recovery.

Final Thoughts: Is Cardano’s Reversal Imminent?

Cardano is showing some powerful signs that it could be in the early stages of a major trend shift, not just on the charts, but across market sentiment too. From the Wyckoff-style SOS zone to the Ichimoku breakout and a clean inverse head and shoulders pattern, ADA’s technicals are lining up like they did for Bitcoin in past cycles.

That said, the short-term $0.62 liquidity zone will be key. If ADA can flip that level with strong volume, it could unlock a move toward much higher levels.