Dogwifhat Primed for Explosive Rally: Bulls Charge Toward $0.95 USDT Threshold

Memecoin mania refuses to die—Dogwifhat (WIF) teeters on the edge of a major breakout as traders pile into the joke-turned-juggernaut.

The Setup:

After weeks of consolidation, WIF's chart paints a textbook bullish pattern. The 0.95 USDT resistance level now stands as the last barrier before price discovery mode.

The Play:

FOMO-driven retail traders are front-running hedge funds this time—a rare sight since the 2021 bull run. Liquidity pools above $0.80 suggest whales are accumulating rather than dumping.

The Catch:

Technical indicators scream overbought, but since when did that matter in crypto? Just ask the 'stablecoin' projects still pegged to hopium.

One thing's certain: if WIF flips 0.95 USDT into support, even the most cynical traders might need to ape in—if only to short it at $1.

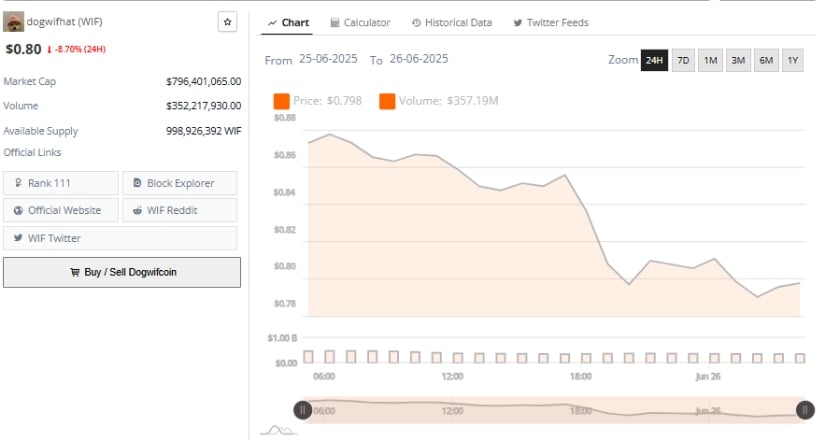

The token, built on the solana blockchain and ranked 111th by market capitalization, currently trades at $0.80 after dropping 8.70% within the past 24 hours.

Despite the pullback, trading volume remains substantial, indicating continued interest and liquidity in the market. Analysts are closely monitoring key price levels, with short-term setups indicating a potential MOVE toward the 0.95 USDT mark.

Short-Term Setup Highlights Key Resistance Zones

A recent one-hour chart shared by analyst @A_soulstrades on X reveals a developing short setup for the WIF/USDT pair. The analysis was also highlighted during a Unity Academy livestream, where the chart depicted a SAFE trade structure even before a price wick formed.

The price rallied from a local low NEAR $0.70 on June 22 to just over $0.90, showing a strong reaction from oversold levels. However, it has since entered a phase of consolidation, facing resistance near the daily open and mid-range values from previous sessions.

Source: X

Currently, WIF is fluctuating around the $0.84 mark, sitting near the 0.5 Fibonacci retracement level of the recent bullish leg. The price structure shows repeated rejections near key resistance zones, signaling a struggle for bullish continuation.

If the token can clear the $0.88 to $0.90 area decisively, technical indicators suggest a potential push toward the 0.95 USDT region, aligning with the previous monthly mid-range. A failure to hold above the $0.82 level, however, may result in a short-term correction back toward the $0.74–$0.75 support zone, where multiple intraday liquidity zones have previously formed.

Dogwifhat Price Prediction: Daily Chart and Technical Indicators Reflect Cautious Optimism

Data from Brave New Coin shows Dogwifhat’s price prediction market capitalization stands at $796.4 million, with a 24-hour trading volume exceeding $352 million. Despite its recent loss, WIF remains actively traded, and its circulating supply sits just below 999 million tokens.

The daily chart on TradingView indicates that the token has yet to recover from its long-term downtrend, which began after reaching an all-time high of $2.224. Since then, WIF has moved through a period of consolidation and modest recovery.

Source: Brave New Coin

Momentum indicators such as the MACD are currently neutral. The MACD line and signal line are both at -0.035, with a histogram value of 0.001, signaling that the market lacks a clear directional bias.

These technical levels suggest indecision, which could either precede a breakout or a continuation of sideways movement. A crossover into positive territory WOULD strengthen the bullish narrative and increase the likelihood of a price move toward the $0.95 mark.

Market Sentiment and Volume Trends Suggest Support for Rebound

The Chaikin Money FLOW (CMF) indicator is slightly negative at -0.01, reflecting weak capital inflows at the time of writing. While this does not indicate strong accumulation, the metric has improved from previous lows.

Sustained improvement in CMF alongside increasing volume could provide the foundation for a more significant upward movement. If CMF crosses into positive territory, it would suggest that buyers are gradually regaining control of the market.

Source: TradingView

Despite the current volatility, Dogwifhat’s price prediction continues to benefit from active community engagement and high visibility on social platforms. Its presence within the Solana ecosystem also provides infrastructural advantages such as low transaction costs and fast settlements.

For short-term holders and technical traders, the $0.88 to $0.90 resistance range remains pivotal. A confirmed breakout above this zone could see WIF test the $0.95 mark in the near term, provided that momentum indicators and liquidity levels continue to support the move.