BREAKING: Ripple’s Permissioned DEX Goes Live as XRP Disrupts U.S. Mortgage Sector

Ripple just flipped the script—again. The blockchain pioneer launched its permissioned decentralized exchange (DEX) today, tightening its grip on institutional crypto markets. Meanwhile, XRP is making unexpected inroads into America's mortgage industry. Guess bankers finally realized blockchain won't bite.

Why This Matters

Ripple's DEX isn't your garden-variety DeFi playground. This is a walled garden for compliance-hungry institutions—the same players who still think 'crypto' means money laundering. The move strategically bypasses regulatory landmines while giving TradFi a familiar on-ramp.

Mortgage Market Infiltration

XRP's creeping into U.S. home loans isn't some crypto-bro fantasy. Multiple lenders now accept it for mortgage payments—because nothing says 'American dream' like settling your 30-year fixed rate in a currency that swings 10% before breakfast. Take that, Fannie Mae.

The Bottom Line

Ripple's playing chess while others play checkers. Their DEX launch and XRP's mortgage adoption prove crypto's not just for degenerates anymore—it's for bankers who want to look edgy without actually risking anything. How very... institutional of them.

The new infrastructure allows regulated financial institutions to engage in secure, compliant trading without compromising the decentralized nature of the XRP Ledger.

Ripple Unveils Permissioned DEX to Open Institutional DeFi on XRP Ledger

According to Ripple’s official announcement, the Permissioned DEX enables financial entities to trade or MOVE value within a controlled environment on the XRP Ledger. This innovation strikes a balance between regulatory compliance and the core values of blockchain technology—scalability, decentralization, and cost-efficiency.

The Permissioned DEX on the XRP Ledger enables secure, compliant access to DeFi for institutional participants. Source: @yoshitaka_kitao via X

The feature allows app developers to create “permissioned order books” for assets such as XRP, stablecoins, or wrapped tokens. Only listed accounts can access these environments, forming what Ripple calls a Permissioned Domain.

Yoshitaka Kitao, CEO of Japan’s SBI Group and a long-time Ripple backer, praised the move. “This is a pivotal development for bringing real-world financial applications onto the XRPL,” he said on X (formerly Twitter).

Ripple Ledger Upgrade Marks “Huge Progress,” Says Garlinghouse

Coinciding with the DEX launch, RippleX has rolled out Version 2.5.0 of the XRP Ledger’s Core software, “rippled,” a release that Ripple CEO Brad Garlinghouse called a moment of “huge progress.” The update has been dubbed the most comprehensive upgrade yet by developers within the XRP ecosystem.

Among the newly introduced features are TokenEscrow and Batch Transactions, which simplify complex smart contract operations. These tools are expected to significantly benefit developers working on DeFi apps, payment gateways, and enterprise finance tools using the Ripple ledger.

Ripple CEO Brad Garlinghouse praised the development, describing it as “huge progress.” Source: Brad Garlinghouse via X

Also notable is the official rollout of PermissionedDEX and PermissionDelegation, giving institutions the tools to set access rules and delegate account control securely—enhancing trust for corporate users and regulators alike.

Ripple’s engineering team also implemented backend enhancements, including improved validator message handling and faster transaction throughput, reinforcing XRP’s position as a reliable protocol for high-volume enterprise use.

XRP Finds Real-World Use Case in U.S. Mortgage Policy Shift

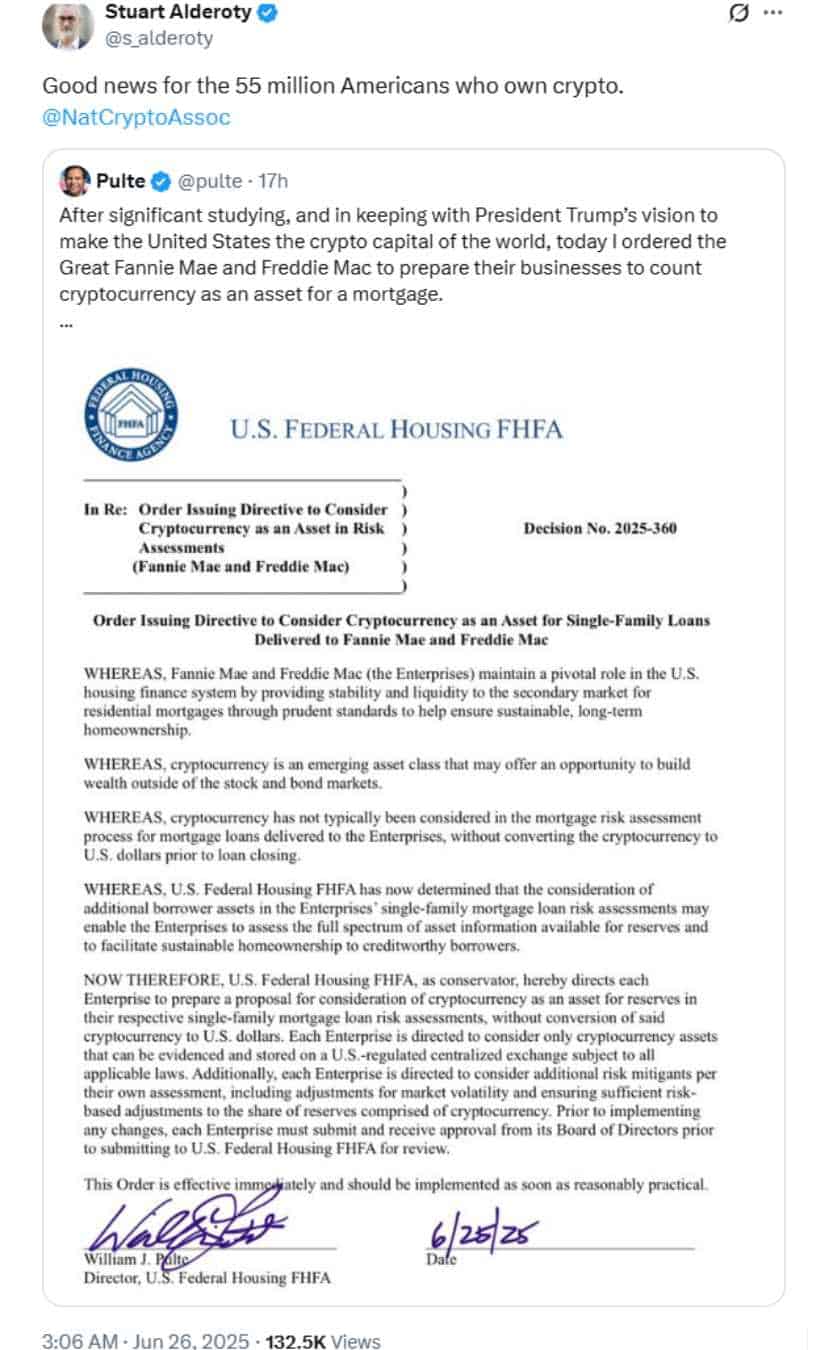

In a development that could reshape crypto adoption in the financial sector, Ripple’s Chief Legal Officer Stuart Alderoty weighed in on a historic shift in U.S. housing policy. Under a new directive from the Federal Housing Finance Agency (FHFA), mortgage giants Fannie Mae and Freddie Mac have been instructed to consider cryptocurrency holdings—including XRP—as legitimate financial assets in mortgage applications.

Ripple Chief Legal Officer Stuart Alderoty called the crypto mortgage breakthrough a positive development for 55 million American crypto holders. Source: Stuart Alderoty via X

“This is good news for the 55 million Americans who own crypto,” Alderoty said. The decision marks a major milestone in the evolution of digital assets from speculative instruments to recognized components of household finance.

The policy, supported by the TRUMP administration, opens the door for crypto holders to include their digital portfolios when applying for home loans. This move could prove especially beneficial for self-employed individuals and younger investors who hold a significant portion of their wealth in crypto.

Ripple Crypto Poised for Broader Institutional Integration

With the launch of the Permissioned DEX, Ripple is enabling regulated entities to use XRP for a range of financial services—such as cross-border B2B payments, contractor payrolls, and stablecoin/fiat FX swaps. These are critical features for building institutional trust in the Ripple exchange ecosystem.

Moreover, this infrastructure ensures that Ripple can deliver low-fee, high-speed, and compliant solutions, reinforcing XRP’s role as a currency tailored for enterprise use.

Ripple’s XRP was trading at around $2.17, down 1.04% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

As on-chain data continues to point to undervaluation and the XRP price stabilizes above $2.17, analysts suggest that Ripple’s growing real-world utility could help propel its market standing. The XRP price prediction for Q3 remains bullish, fueled by rising adoption and an increasingly favorable regulatory environment.

Final Thoughts: Ripple Lays Groundwork for Long-Term Growth

Ripple’s recent developments paint a clear picture of its strategic direction—bridging the gap between traditional finance and blockchain-powered innovation. From launching an institution-ready DEX on the XRP Ledger to playing a role in reshaping U.S. mortgage policy, Ripple continues to deliver on its long-term vision.

These moves also carry implications for the ongoing XRP lawsuit and future SEC Ripple debates. As Ripple deepens its compliance footprint and enhances XRP’s utility in regulated markets, the distinction between crypto as a speculative asset and a financial tool becomes increasingly clear.