Top Cryptocurrencies to Watch as BlackRock Expands into AI & Stablecoins: Why Digitap ($TAP) Tops the List

BlackRock's latest pivot sends shockwaves through crypto—AI and stablecoins are officially institutional-grade plays.

Forget the speculative noise. When the world's largest asset manager moves, markets follow. Their recent filings reveal a strategic embrace of artificial intelligence infrastructure and dollar-pegged digital assets, signaling a maturation phase that separates real utility from meme-driven hype.

So where does the smart money flow?

The AI-Crypto Convergence

It's not about chatbots writing code. The real value lies in blockchain networks that automate complex financial operations—settlement, compliance, asset tokenization—without the usual parade of intermediaries taking their cut. Projects building decentralized compute markets or verifiable AI data feeds are drawing serious venture attention, while legacy finance still tries to bolt 'AI' onto decades-old systems for the shareholder report.

The Stablecoin Surge Beyond Speculation

Stablecoins are shedding their image as mere crypto on-ramps. They're becoming the settlement layer for everything from cross-border payroll to real-time treasury management. BlackRock's interest confirms what insiders knew: the yield and efficiency gains are too large to ignore, even if it makes traditional bankers squirm.

Why Digitap ($TAP) Catches the Institutional Eye

Enter Digitap. It doesn't just ride the trend—it operates at the intersection. The protocol reportedly leverages AI to optimize stablecoin liquidity pools and automated market making, aiming to reduce slippage and improve capital efficiency. Think of it as a high-frequency trading brain for decentralized finance, but one that's accessible without a Wall Street license.

The pitch? Bypass the traditional finance toll booths. Instead of paying banks and brokers to move and manage digital dollars, Digitap's system uses algorithmic management to potentially enhance yields and execution. It's the kind of infrastructure play that gets portfolio managers nodding—actual utility, not just promises.

A Measured Dose of Reality

Let's be clear: for every genuine innovation, a dozen projects will slap 'AI-powered' on their whitepaper and hope you don't read it. Due diligence is non-negotiable. Look for live products, verifiable transaction volume, and teams that build instead of just promoting.

The bottom line: BlackRock's move is a lighthouse, cutting through the fog. It highlights sectors with staying power. Digitap's positioning at the crossroads of AI execution and stablecoin utility makes it a compelling case study in this new phase—where working technology starts to matter more than viral tweets. The race is no longer just about adoption, but about who builds the indispensable plumbing. And as always in finance, the real money is made in the pipes, not the puddles.

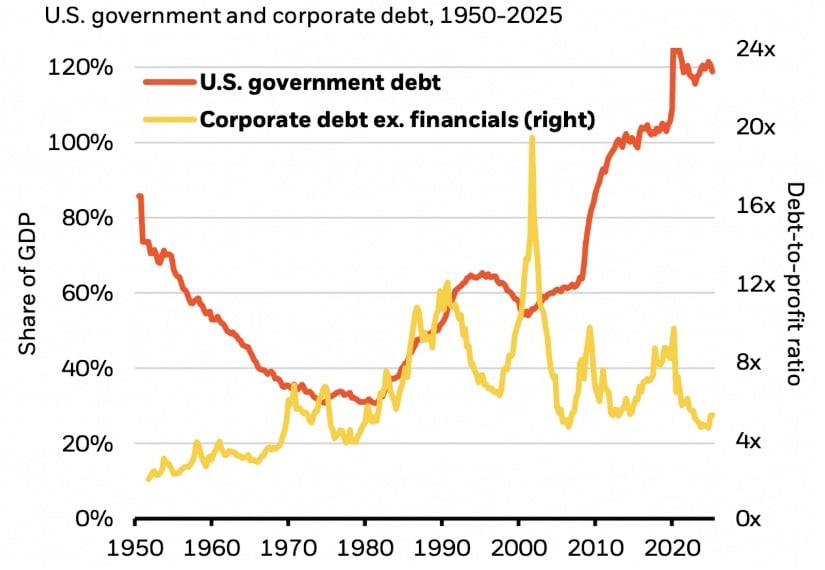

BlackRock’s 2026 outlook highlights several pressures on the economy. U.S. debt is expected to rise above $38 trillion, bonds are weakening, and tokenization is accelerating across the financial sector. With that backdrop, investors searching for the best crypto to buy now are turning toward platforms built for the next phase of digital finance.

While institutional capital concentrates on established assets like Bitcoin, early-stage projects such as Digitap ($TAP) are emerging as the clearest asymmetric opportunities.

Source: BlackRock 2026 Global Outlook

BlackRock Outlook Signals Early Rotation Into Altcoins

BlackRock’s latest AI-driven macro report signals a turning point in how institutional money will interact with digital assets over the coming year. The firm highlights an emerging disconnect between traditional financial instruments and the expanding digital economy, noting that AI-driven leverage and fiscal uncertainty are reshaping risk models across Wall Street.

As institutions reassess exposure to aging financial infrastructure, the role of digital assets becomes increasingly central to long-term portfolio strategy.

Source: Altcoin Season Index – CoinMarketCap

The Altcoin Season Index chart reflects this shift in real time. Over the past 90 days, the altcoin market cap fluctuated NEAR the upper band of 1.8 trillion dollars before sliding toward 1.5 trillion dollars, while the index itself fell toward the low twenties.

This pattern indicates that capital is consolidating in preparation for new market leadership rather than exiting the space entirely, which aligns with BlackRock’s view that tokenization and stablecoins are forming the next major financial rails.

USE THE CODE “TAPPER20” FOR 20% OFF FIRST-TIME PURCHASES

How Digitap Bridges Fiat And Crypto in One Banking System

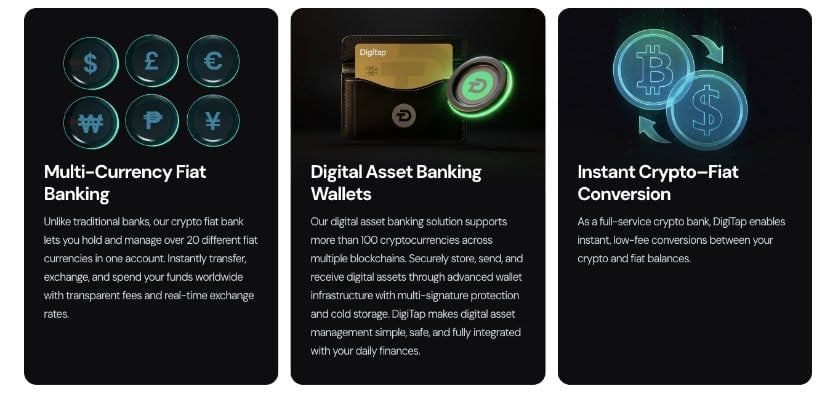

Before comparing Digitap to trending market tokens, it’s important to understand its foundational appeal. Digitap is building an omni-banking platform designed for a world where AI, tokenization, and digital payments converge.

Unlike traditional banks that restrict crypto access, Digitap integrates fiat and digital currencies into one unified account, enabling users to hold, send, and exchange more than 20 fiat currencies and over 100 cryptocurrencies.

Digitap’s global payment freedom supports SEPA, SWIFT, and blockchain transfers, solving the fragmentation and slow settlement times that legacy banks struggle with. This ties directly into BlackRock’s narrative: as financial systems become strained, users will migrate toward platforms offering lower fees, faster transfers, borderless access, and complete control over their funds.

The $TAP token powers this ecosystem by delivering lower fees, enhanced access, and cashback rewards. As computing demand surges and crypto adoption rises, Digitap’s position as a compliant, hybrid banking solution becomes increasingly relevant. This establishes the foundation for why Digitap is entering conversations about the best crypto to buy now.

$TAP Presale Growth Shows Strong Early Demand and Traction

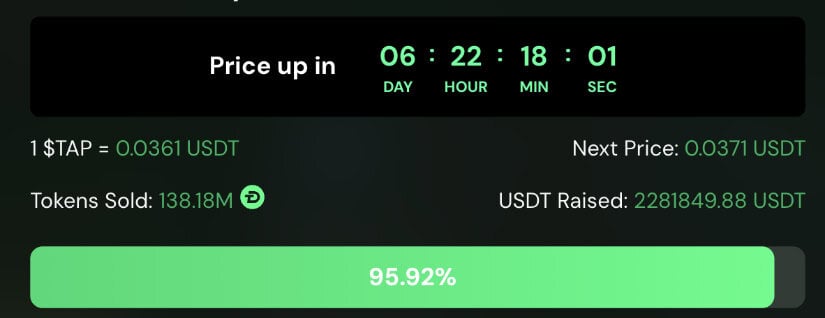

Digitap’s $TAP presale continues to show strong traction. Since launch, the token has advanced through several predetermined tiers—from0.0125 at announcement to0.0361 in the current stage. This progression provides participants with a clear sense of how early allocations compare to later phases, which is often a key consideration in structured presales

With, demand appears steady, and the next programmed price step is already in place. For participants, this means each stage offers a transparent reference point: earlier entry simply provides access to a lower presale band, while later stages naturally come at higher preset levels.

This is where presale mechanics can create asymmetric potential as a token that advances through ascending presale tiers enters the public markets with a defined pricing history. If $TAP were to debut near its upper presale range, early supporters WOULD have participated at structurally lower price points than those available closer to launch.

With over 138 million tokens sold and more than $2.2 million raised, Digitap’s traction mirrors patterns seen in previous best crypto presales that later became category leaders. The current first-purchase bonus of +499 $TAP is active for new buyers, adding an additional incentive window during the final presale phase.

Why $TAP Appeals to Buyers Seeking Practical Crypto Utility

Retail investors searching for the best cryptos to buy now increasingly focus on projects that deliver real utility and early-stage pricing with meaningful upside potential. Digitap stands out by directly addressing Core financial pain points such as fragmented accounts, high transfer fees, blocked transactions, and limited crypto-fiat interoperability. Its product is already live, placing it ahead of many emerging competitors that rely on unproven concepts.

As the presale nears completion, rising demand, steady price growth, and a clear development roadmap strengthen the case for Digitap as a compelling altcoin to buy.

https://presale.digitap.app

https://digitap.app

https://linktr.ee/digitap.app

https://gleam.io/bfpzx/digitap-250000-giveaway