Stellar Crashes to $0.23 as Bullish Momentum Evaporates Across All Timeframes

Stellar just got a reality check. The cross-border payments token is tumbling, with its price action flashing red on every chart.

The Breakdown is Everywhere

Forget a simple pullback. The weakness isn't confined to a daily or weekly chart—it's a full-spectrum retreat. The kind that makes swing traders close their laptops and long-term holders check their blood pressure. The move to $0.23 isn't just a number; it's a signal that the recent buying frenzy has hit a wall.

What's Behind the Slide?

Markets don't need a single villain. Sometimes, it's just a collective sigh as over-leveraged positions get liquidated and the 'fear of missing out' turns into the 'fear of losing more.' Broader crypto sentiment is doing no favors, but Stellar's specific narrative around banking partnerships and fast settlements is getting drowned out by the noise of a risk-off mood. Another day, another reminder that in crypto, 'fundamentals' are often just guest stars in a price-driven drama.

The Path Forward Looks Murky

With momentum drained on all fronts, the immediate question isn't about recovery—it's about finding a floor. Technical support levels become the next battleground. Does the network's real-world utility eventually outweigh the chart patterns? Possibly. But for now, the market's voting with its sell orders. A classic case of the narrative buckling under the weight of the price action, not the other way around. Just ask any portfolio manager who tried to explain 'long-term value' during a crash—their favorite phrase is usually 'unprecedented market dynamics.'

The selloff pulls the coin back toward multi-month support levels as both price action and derivatives participation show a clear deterioration in bullish conviction. The broader market resistance and risk-off sentiment appear to be weighing heavily on the token’s short-term performance.

Price Breaks Down From Range as Open Interest Slides

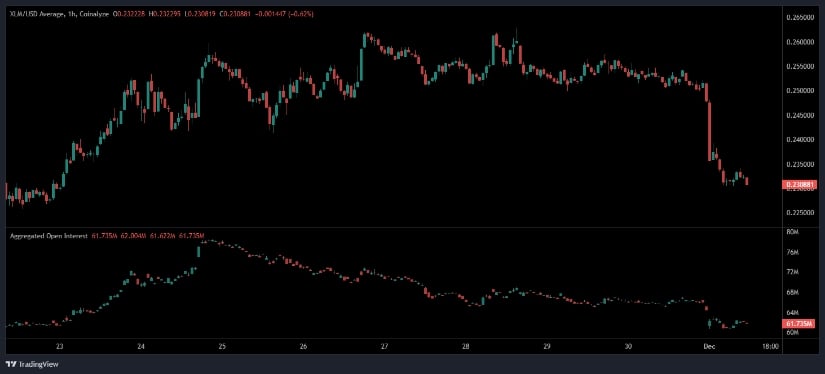

On the 1-hour chart, XLM/USD begins with a steady multi-day uptrend characterised by higher highs and strong bullish candles around the 22nd–24th. This rally shows clear buying pressure, with price pushing firmly into the $0.25–$0.26 region. However, once the uptrend peaks, momentum fades, and a sideways-to-downward consolidation emerges.

From the 26th onward, candles compress into tighter ranges, showing equilibrium between buyers and sellers before a major breakdown. The final segment of the chart reveals a sharp crash, dragging the coin toward $0.23 with significant bearish momentum — a clear exit from the prior consolidation structure.

Source: Open Interest

Open interest provides critical confirmation. During the initial rally, OI rises aggressively, signalling new long positions fueling the uptrend. But once the market shifts sideways, OI begins a persistent decline. This indicates that traders are closing positions, reducing exposure, and stepping away from the market.

By the time price collapses, OI has already fallen significantly — showing that the selloff is driven by lack of conviction rather than aggressive new shorting. The decline to roughly 61.7M OI reflects a more cautious and neutral environment among derivatives traders.

Stellar Down 8.58% as Liquidity Holds Steady

BraveNewCoin lists stellar at $0.23, with a market capitalisation of $7,485,870,124 and a 24-hour trading volume of $145,972,806. The token ranks 24th by market cap, supported by an available supply of 32,313,233,731 tokens.

The strong drop in price contradicts the still-healthy liquidity, suggesting that traders are reacting more to broader market weakness and technical breakdowns rather than fundamental news. For now, the token remains firmly within a defensive trading zone as investors wait for stabilisation.

Downtrend Deepens as MACD and CMF Stay Bearish

The daily chart shows a steady macro downtrend since the mid-year peak NEAR $0.52. After the July–August rally, the coin began forming lower highs and lower lows — a classic distribution pattern.

Recent weeks have seen compressed volatility and sideways drifting, but the latest breakdown reinforces the continuation of bearish structure.

Source: TradingView

The MACD indicator remains negative, with the MACD line at –0.0118 and the signal line at –0.0135. Despite histogram bars turning slightly green, the values remain well below zero, showing that momentum has not yet shifted in favour of buyers. Any bullish crossover from this region WOULD still be considered corrective rather than trend-reversing.

Chaikin Money FLOW (CMF) sits at –0.09, reflecting sustained capital outflows and the absence of meaningful accumulation. Sellers continue to maintain control, and until CMF recovers above zero, the token lacks the volume-weighted support necessary for a reliable reversal.