Bitcoin Hits $92K Wall: Is a November Low Retest Inevitable?

Bitcoin's latest rally just slammed into a familiar ceiling. The $92,000 resistance level is holding firm, turning bullish momentum into a tense standoff.

The Pressure Cooker

Every test of a major resistance zone like this is a battle of conviction. Buyers push, sellers defend, and the charts scream with the tension. Right now, the sellers have the upper hand, forcing a consolidation that feels more like a coiled spring than a calm pause.

History's Shadow

With upward movement stifled, the market's gaze inevitably shifts downward. The specter of a retest of November's lows now looms—a classic technical playbook move when a key hurdle isn't cleared. It's not a prediction of doom, but a recognition of gravity. Assets rarely hover; they either break out or pull back to gather strength.

Watch the volume on any dip. A shallow retest on low volume could be the healthy reset Bitcoin needs for its next leg up. A high-volume sell-off, however, would tell a different story. For now, the king of crypto is stuck between a rock and a hard place—or more accurately, between $92K and its last major floor. Sometimes the market needs to take one step back to later vault two steps forward, a concept that still baffles the traditional finance crowd waiting for their quarterly reports.

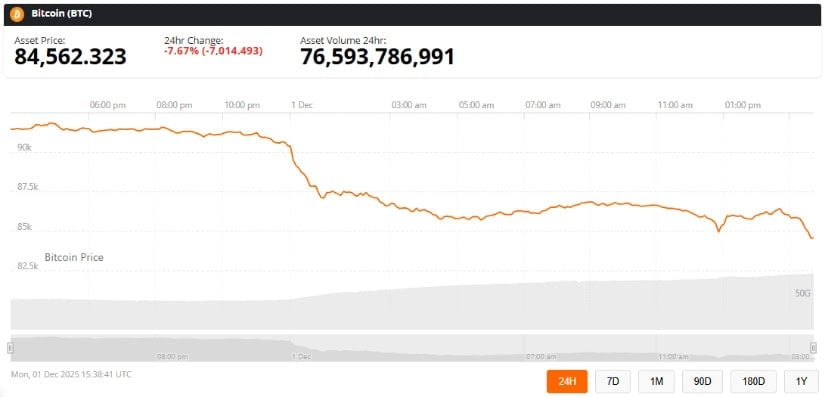

The cryptocurrency is consolidating around the $86,000 level after a nearly $7,000 drop. Analysts suggest Bitcoin must reclaim the $88,000–$89,000 support zone to avoid a potential retest of November lows near $78,000.

Bitcoin Rejection at Key Resistance

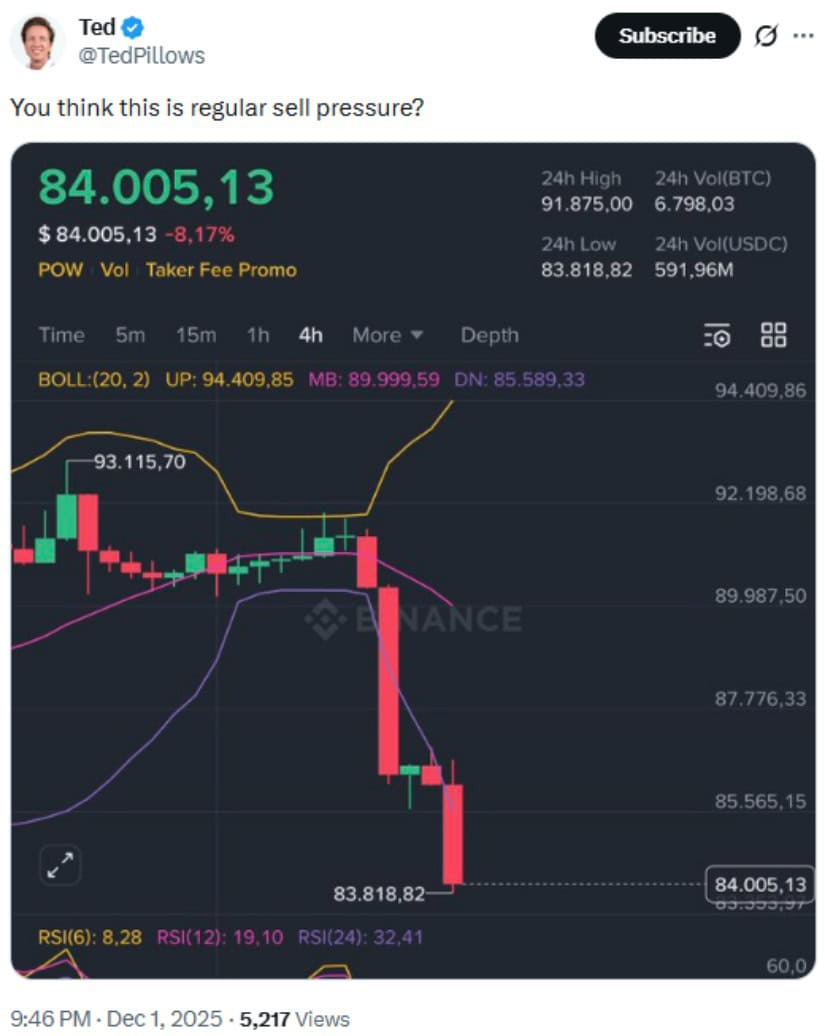

Crypto analyst Ted Pillows, who actively tracks Bitcoin market movements on X, commented, “$BTC got rejected from the $92,000-$93,000 resistance level. It dumped nearly $7,000 and is now consolidating around the $86,000 zone.”

Bitcoin was rejected at $92K–$93K resistance, dropping $7K to $86K, with support at $88K–$89K key to avoiding a retest of November lows. Source: @TedPillows via X

The intraday volatility on December 1, 2025, saw bitcoin dip as low as $84,005.13, representing an 8.17% drop and wiping out roughly $150 billion in market capitalization. Technical indicators such as the Relative Strength Index (RSI)—which measures overbought or oversold conditions—suggest that Bitcoin may be oversold, signaling a potential rebound if support levels hold.

Market Factors Driving the Decline

The recent downturn coincided with comments from Bank of Japan Governor Kazuo Ueda, hinting at a possible December rate hike. This strengthened the Japanese yen and weighed on global risk assets, including cryptocurrencies. Analysts have also highlighted liquidity hunts and short-term market manipulation as potential contributing factors (CoinDesk, 2025).

Bitcoin faces a DEEP correction, retracing recent gains, with potential for one more drop below $80K before a possible rebound. Source: MLDpwnz on TradingView

TradingView analyst MLDpwnz, an experienced crypto chart technician, observed, “The monthly candle closed bearish with a lower wick. RSI has dropped into deep-correction territory, and the current structure increasingly resembles 2021.”

Technical Outlook and Support Levels

Bitcoin is at a crucial decision point. Analysts from Binance Research and Brave New Coin note that failure to reclaim the $88,000–$89,000 support zone could open the door to lower levels, potentially revisiting November lows NEAR $78,000. Some bearish strategists warn that sentiment could push prices further down to $82,000 or even $80,000 if global risk aversion intensifies.

Bitcoin drops 8% to $84K, breaking key Bollinger Bands, with RSI signaling oversold conditions hinting at a possible rebound. Source: @TedPillows via X

On the upside, historical trends show that December has often been Bitcoin’s strongest month. Since 2013, December has delivered an average return of +30%, providing Optimism for potential end-of-year gains. Upcoming U.S. Federal Reserve policy decisions may also influence momentum if monetary conditions ease.

Final Thoughts

Bitcoin continues to face resistance near $92,000, with oversold conditions potentially sparking a rebound. However, failure to reclaim support may result in a retest of November lows. Traders and investors should carefully monitor ETF activity, Federal Reserve policy, and global risk sentiment before making decisions.

Bitcoin was trading at around 84,562, down 7.67% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

Despite the current turbulence, historical patterns and institutional interest suggest that Bitcoin’s price could stabilize and potentially rally toward the end of December, offering opportunities for long-term holders.