Cardano Price Prediction 2025: Will ADA Defend Multi-Year Support or Crash to $0.30?

Cardano's ADA faces a moment of truth. The digital asset, long championed for its methodical, peer-reviewed approach, now teeters on the edge of a critical juncture. The question isn't about smart contracts or governance models—it's about pure, unadulterated price action.

The Battle for the Floor

A multi-year support level holds the line. This isn't just another technical zone; it's the foundation upon which countless bullish theses were built. Break it, and the narrative shifts from patient accumulation to potential capitulation. The charts whisper a stark alternative: a descent toward $0.30, a level that would erase years of incremental gains and test the faith of even the most devoted 'HODLers.'

Market Forces vs. Foundational Belief

Technical indicators paint a tense picture. Trading volume, momentum oscillators, and order book depth all contribute to the high-stakes drama. Meanwhile, the broader crypto market offers little solace, acting more like an anchor than a rising tide. It's a classic clash between a project's fundamental promise and the market's ruthless, short-term calculus—where a single candlestick often carries more weight than a white paper.

No room for 'enables' or 'facilitates' here. The price either holds or it breaks. Developers can debate Haskell and Plutus, but the market votes with capital, and its patience wears thin. The coming days will reveal whether Cardano's meticulously engineered foundation can withstand the pressure, or if it becomes another lesson in how crypto markets love to humble even the most academically sound projects. After all, in this game, a cynical trader might note, a working product sometimes matters less than a working exit liquidity.

Cardano price continues to face heavy downward pressure, with ADA now trading NEAR $0.41, holding just above a multi-year ascending support line that has historically anchored every major cycle bottom. The recent 24-hour drop has renewed concerns among traders as ADA tests a structural zone that could decide whether the asset stabilizes or extends lower into the $0.30 region.

Despite the ongoing decline, market participants remain split: some see ADA as entering a generational buy zone, while others warn that a confirmed breakdown could trigger a deeper multi-month bearish continuation. With volatility rising, all eyes are now on whether Cardano can defend its long-term trendline.

Multi-Year Trendline Faces Its Biggest Test Yet

A widely followed higher-timeframe chart shared earlier by Sssebi highlights ADA tapping its multi-year support zone for the first time since 2020. This trendline has historically sparked major bullish reversals, but the current retest arrives amid weakening market structure and lack of strong bid support.

Cardano’s multi-year trendline, untouched since 2020, is now being retested as ADA presses into a historically critical support zone. Source: Sssebi via X

At the same time, Jesse Peralta’s chart shows that ADA may have already broken a major intermediate support, accelerating the drop into the $0.41–$0.37 region. This breakdown aligns with weakening volume profile levels and suggests price is gravitating towards a deeper liquidity pocket near $0.30, a zone often referenced by reversal traders as the final “flush” area before recovery attempts.

ADA slipping beneath key intermediate support, pulling price toward the heavier liquidity zone near $0.30. Source: Jesse Peralta via X

If ADA stabilizes above the multi-year trendline, a short-term bounce could retest resistance at $0.46–$0.50. But if the trendline breaks decisively, the structural shift may open the door to new cycle lows.

Bullish and Bearish Analysts Remain Deeply Divided

Sentiment across ADA analysts shows unusually wide divergence. While some market watchers are preparing for further decline, others believe the current conditions may offer one of the biggest opportunities of the cycle.

Smith’s outlook frames the current pullback as a rare discount phase, arguing ADA still carries multi-X upside potential into the next cycle. Source: Smith via X

For example, Smith maintains a high-conviction outlook, arguing that ADA still holds “10X potential” with a cycle target above $3.00, viewing the recent selloff as a discount accumulation phase. In contrast, CryptoMindset issued one of the most bearish calls, warning of a potential collapse in 2026 that could revisit 2018-level prices if ADA loses its long-term trendline support.

Losing the long-term trendline could trigger a deeper slide toward 2018-level prices, marking one of the cycle’s bleakest outlooks. Source: CryptoMindset via X

Community traders remain equally split. Optimists highlight ADA’s historical ability to recover from DEEP corrections, while critics argue that market inertia and weakening fundamentals could drag price lower before any major comeback.

Support, Resistance, and Short-Term Structure

Cardano price now trades in a high-risk zone where both upside and downside scenarios remain active depending on whether long-term support holds.

Support Levels

-

$0.37–$0.41: Current zone; fragile structure but still active

-

$0.30: Major liquidity pocket; strong bounce potential

-

Multi-year trendline: Last structural defense for long-term holders

Resistance Levels

-

$0.46–$0.50: First bullish confirmation zone

-

$0.62: Mid-range resistance and higher-timeframe breaker

-

$1.00+: Long-term recovery target if cycle strength returns

Should Cardano price hold the current support, upside moves towards $0.50–$0.62 remain possible. Failure, however, could trigger a prolonged drift into the $0.30 zone.

Final Thoughts: Can ADA Recover in 2025 or Does the Breakdown Continue?

Cardano’s multi-year trendline has become the most important level in the market right now. Its ability to hold this structural zone will determine whether cardano price begins forming a long-term bottom, or enters a deeper corrective phase into 2026. Market sentiment is sharply divided, but the technicals suggest volatility is likely to remain elevated.

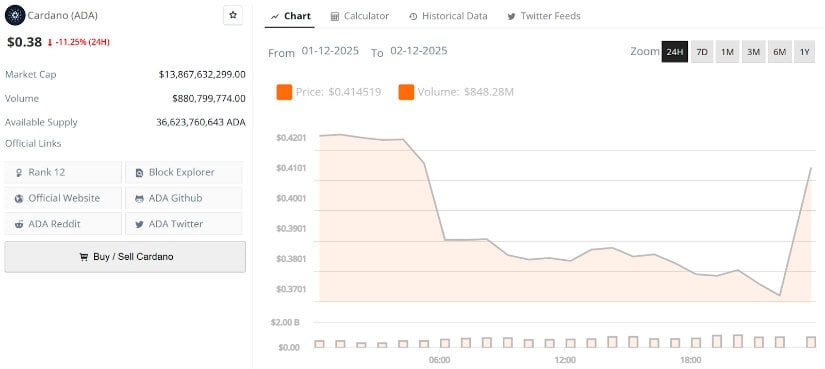

Cardano price is trading around $0.38, down 11.25% in the last 24 hours. Source: Brave New Coin

Short-term participants will be watching the $0.46–$0.50 region for signs of renewed strength, while long-term investors are focused on whether ADA Cardano price can maintain its historical trendline support. Cardano price prediction models for 2025 remain uncertain, but this phase will likely define ADA’s next major cycle.