Cardano (ADA) Holds Strong at $0.50: Bulls Target $0.70 Breakout in Coming Weeks

Cardano's ADA defends a critical support level—igniting bullish momentum as traders eye higher resistances.

Key Levels to Watch

The $0.50 floor has become a battleground for ADA. Hold here, and the path clears for a retest of $0.70—a level that crushed rallies twice this year. Break below? Bears will feast like Wall Street bankers at a taxpayer-funded bailout buffet.

Technical Setup Favors Bulls

RSI coils near oversold territory, while volume patterns hint at accumulation. If Bitcoin holds steady, ADA could mirror its Q4 2023 rally—where gains exceeded 150% in eight weeks.

Make-or-Break Moment

All eyes on the $0.55 pivot. Clear that, and the $0.70 resistance becomes the next profit-taking zone. Fail? The 'strong fundamentals' crowd will need another narrative—fast.

Despite a quiet trading week, Cardano price continues to attract attention as buyers fiercely defend the $0.50 zone. The steady inflows and repeated rebounds around this support suggest that bulls are quietly positioning for a comeback.

$0.50 Holds the Key for Cardano’s Next Rebound

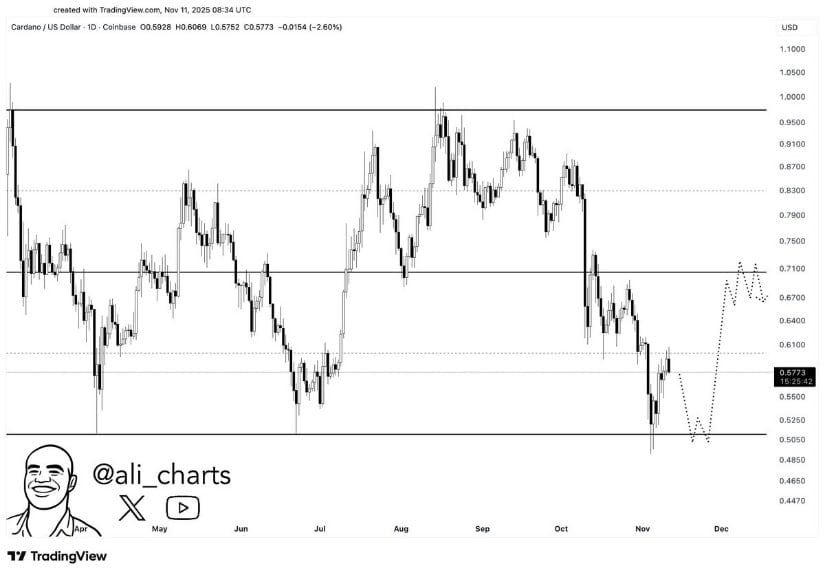

Cardano’s structure continues to respect the major support at $0.50, a zone that has repeatedly absorbed selling pressure over recent sessions. Ali Martinez’s chart shows price reacting cleanly to this horizontal level, hinting at a potential base formation if buyers sustain momentum. Candlestick wicks around this area emphasize how liquidity is being trapped below, suggesting a buildup before the next expansion move.

Cardano price continues to defend the crucial $0.50 support zone, signaling strong buyer interest and a potential base for the next rebound. Source: Ali Martinez via X

If $0.50 remains intact, a recovery towards $0.70 appears plausible. The mid-range resistance at $0.60 could act as a checkpoint where short-term traders take profit before continuation. The market’s current compression phase favors a gradual reclaim rather than a sharp reversal, but holding this level keeps the broader recovery structure valid.

Liquidity Walls Indicate ADA’s Upside Roadmap

After tapping into a dense buy wall, Cardano has shown signs of short-term recovery momentum. CW8900’s chart highlights how liquidity imbalances are shifting upward, with three major sell walls visible up to $0.63. This clustering suggests a layered resistance structure that price may gradually break through.

Cardano’s liquidity map reveals strong buy-side support and layered sell walls up to $0.63, outlining a clear roadmap for ADA’s next breakout attempt. Source: CW8900 via X

As bids strengthen around $0.55, the path to $0.63 opens, offering a measured progression of liquidity grabs. If these walls get cleared with volume confirmation, ADA cardano price could extend its short-term breakout towards the upper supply at $0.67.

On-Chain Accumulation Strengthens Cardano’s Long-Term Outlook

Fresh data from TapTools reveals a telling on-chain trend, over $2 billion worth of ADA has been withdrawn from exchanges in the past year. This marks a significant net outflow, implying long-term holders continue accumulating off-exchange.

Over $2 billion worth of ADA has been withdrawn from exchanges. Source: TapTools via X

This off-chain buildup aligns with the typical pre-expansion behavior seen in prior ADA cycles. Reduced exchange balances often precede structural recoveries, as selling pressure eases while liquidity thins.

Cardano Price Prediction Targeting $2.00

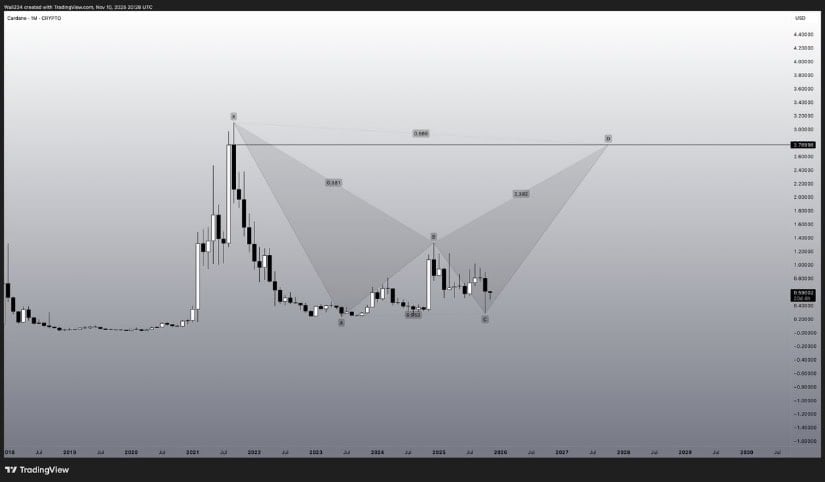

Waleed Ahmed’s macro chart paints a potentially explosive harmonic pattern that mirrors earlier phases of Cardano’s cycle. The structure outlines a large XA–BC projection, with the completion point around the $2.00 zone, which aligns with the 0.886 Fibonacci retracement of its prior peak. This suggests a long-term accumulation-to-expansion phase could be underway if price maintains current higher lows.

Cardano’s harmonic setup points toward a potential $2.00 target, hinting at a long-term bullish reversal ahead. Source: Waleed Ahmed via X

On the shorter timeframes, cardano price remains above its structural base, with mid-range levels between $0.65 to $0.70 serving as near-term checkpoints. A confirmed weekly close above $0.70 could reignite momentum towards $1.10, marking the first leg of a multi-month expansion wave. If the harmonic pattern plays out as drawn, ADA’s macro bias could remain bullish well into 2026.

Final Thoughts: Community Bets on the $0.57 Floor

Cardano’s community sentiment remains resolute, with participants like Cardatson confidently asserting that Cardano price won’t ever fall below $0.57 once recovery begins. This conviction reflects growing alignment between long-term holders, on-chain metrics, and technical setups that all point to stabilization.

Cardano price is trading around $0.56, down -5.47% in the last 24 hours. Source: Brave New Coin

While Cardano price remains confined within its mid-cycle range, market participants continue to treat every dip as accumulation territory. The combination of fundamental accumulation, strong community backing, and resilient support zones creates a foundation that could fuel the next sustained leg higher, especially if momentum reclaims the $0.65 to $0.70 zone.