Worldcoin Price Prediction: WLD Primed for Major Breakout After Extended Consolidation Phase

WLD finally shows signs of life after months of sideways trading—technical indicators suggest the consolidation period might be ending.

The Setup

Traders are watching key resistance levels as Worldcoin attempts to break free from its prolonged holding pattern. Volume patterns hint at accumulating interest while traditional finance experts continue dismissing crypto as 'speculative gambling.'

Market Mechanics

Historical data reveals extended consolidation phases often precede significant price movements. The current technical structure mirrors previous breakout scenarios where patience paid off handsomely for believers.

Potential Trajectory

Multiple timeframe analysis suggests WLD could test higher price zones if current support holds. Of course, in crypto markets, the only certainty is that Wall Street will claim they saw it coming all along—after the fact.

Analysts suggest that sustained buying above this level could trigger a reversal, with the potential for gradual recovery toward $1.50 if momentum builds.

Chart Point to Reversal Setup Near $0.88

In a recent X post, analyst TOP GAINER TODAY highlighted a possible bullish structure forming on the WLD/USDT pair. The token was trading near $0.885, up roughly 2.55%, with a clear ascending support trendline suggesting that a base may be forming after months of decline. The analyst outlined an optimistic projection toward $16, though acknowledged that such a move WOULD require major catalysts, such as increased volume or strong market sentiment.

Source: X

Technically, the coin’s structure shows price compressing above a key zone at $0.85–$0.88, which has served as multi-week support. A breakout and close above $1.00 would mark the first meaningful bullish shift since mid-summer, potentially opening the way toward $1.50 and $2.00 resistance. However, without clear confirmation of renewed volume inflows, such upside remains speculative.

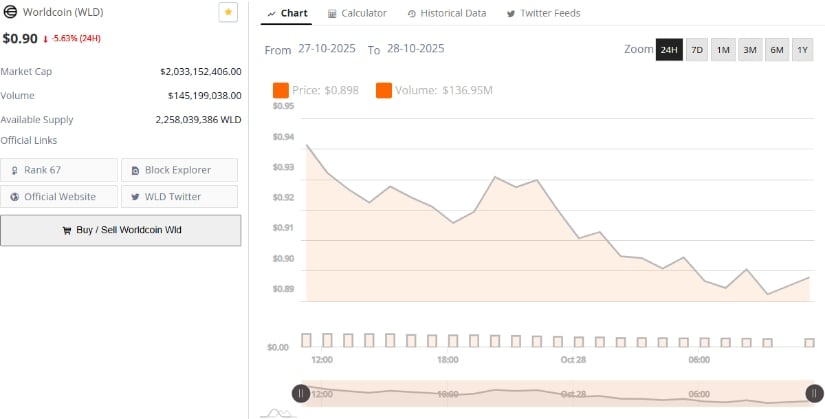

Market Overview Shows Stable Structure

According to BraveNewCoin, Worldcoin trades at $0.90, marking a 5.63% decline over the past 24 hours. The project holds a market cap of $2.03 billion with 2.25 billion tokens in circulation and $145.1 million in 24-hour trading volume. Despite short-term weakness, the price continues to respect local support, indicating that long-term holders remain active.

Source: BraveNewCoin

Market activity has shown a notable drop in volatility compared to earlier this month, suggesting stabilization rather than panic selling. This calmer phase could lay the groundwork for accumulation as participants reassess risk exposure. A confirmed rebound above $1.00 would likely attract renewed speculative attention and improve liquidity inflows.

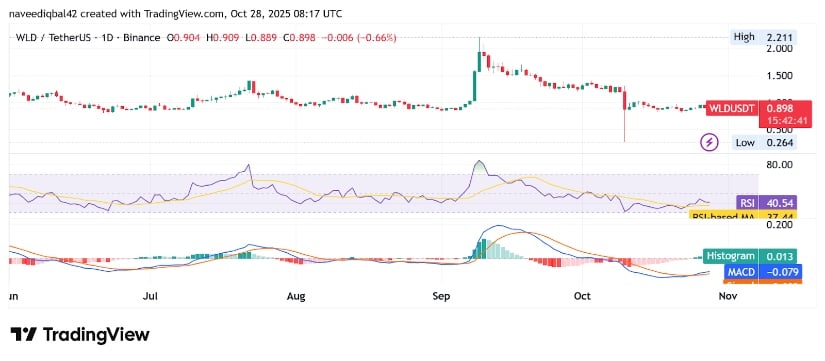

Technical Indicators Show Gradual Stabilization

At the time of writing, WLD/USDT trades at $0.898, down 0.66% on the day, as shown on the TradingView daily chart. The Relative Strength Index (RSI) stands at 40.54, trending slightly upward from prior oversold levels, indicating a weakening of bearish pressure. The MACD, currently at –0.079, remains below its signal line, but the histogram’s positive value (0.013) suggests early momentum recovery.

Source: TradingView

This pattern reflects an ongoing battle between consolidation and potential reversal. If buyers sustain price action above $0.85 and drive the RSI toward 50, short-term momentum could shift positively, paving the way for a test of the $1.00 resistance. Conversely, a close below $0.85 could expose the token to a retest of deeper support near $0.70. For now, the token’s steady base and mild momentum recovery hint at cautious Optimism within the broader crypto environment.