Bitcoin’s Hyper-Deflationary Surge Positions Crypto to Eclipse US Dollar Dominance

Digital gold is quietly mounting its assault on fiat's fortress walls.

The Unstoppable Ascent

Bitcoin's programmed scarcity mechanism—halving supply while demand skyrockets—creates economic physics that make traditional monetary policy look archaic. With each cycle, BTC eats deeper into dollar territory.The Hyper-Bitcoinization Catalyst

Institutional adoption meets technological inevitability. Lightning Network settlements now process faster than Visa, while sovereign nations stack BTC reserves like digital Fort Knox. The math doesn't lie—finite assets always outperform infinite printers.Wall Street's Awkward Embrace

Even legacy institutions can't ignore returns that make their traditional portfolios blush. They'll fight the revolution until they can front-run it—typical banker mentality.The Tipping Point

When reserve currency status shifts, it happens not with a whimper but with blockchain finality. Your grandchildren may ask what 'dollar hegemony' meant—and you'll show them Bitcoin's ATH chart instead.

KEY POINTS:

![]() Dollar’s historic dominance drops as 94% of financial authorities plan to embrace crypto or already have.

Dollar’s historic dominance drops as 94% of financial authorities plan to embrace crypto or already have.

![]() The blockchain government is set to grow over 3,417%, from a market cap of $22.5B in 2024 to $791.5B in 2030.

The blockchain government is set to grow over 3,417%, from a market cap of $22.5B in 2024 to $791.5B in 2030.

![]() Bitcoin Hyper ($HYPER) reaches $25.1M with a token price of $0.013185, as investors pour in.

Bitcoin Hyper ($HYPER) reaches $25.1M with a token price of $0.013185, as investors pour in.

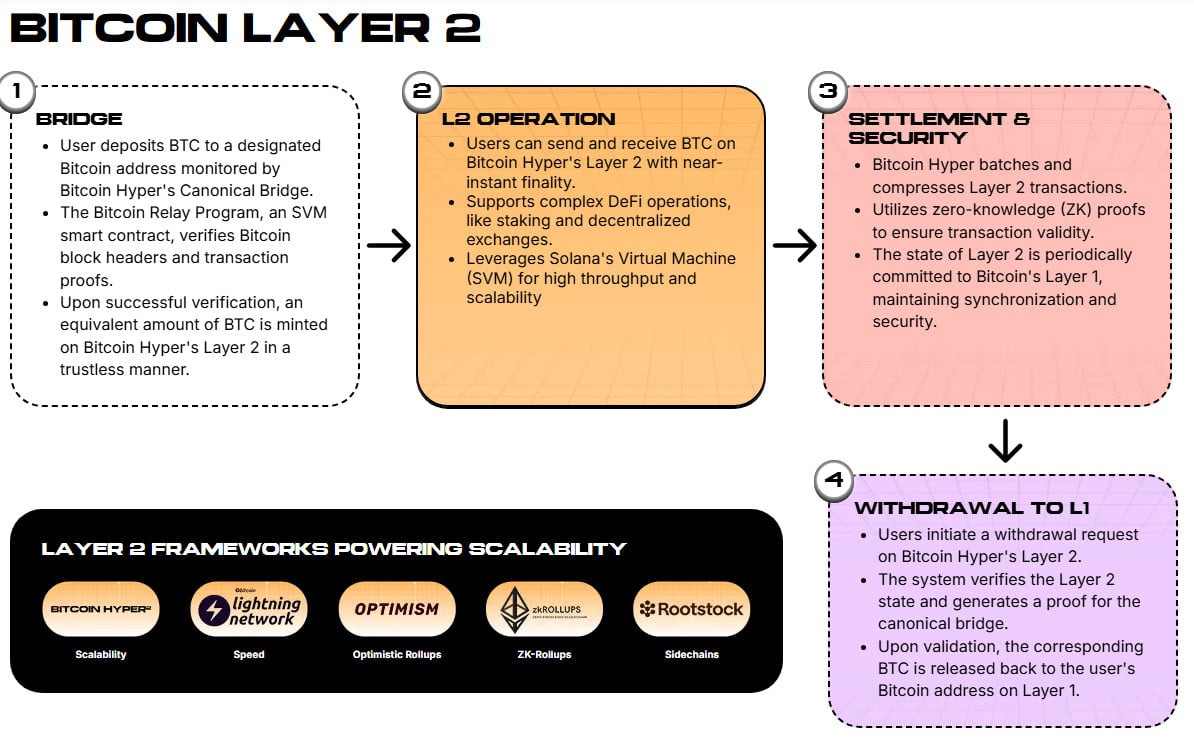

![]() As Bitcoin’s Layer 2, Hyper promises a faster, cheaper, and more scalable Bitcoin ecosystem and plans a release window of Q4 2025-Q1 2026.

As Bitcoin’s Layer 2, Hyper promises a faster, cheaper, and more scalable Bitcoin ecosystem and plans a release window of Q4 2025-Q1 2026.

This number comes from a June 2024 study by BIS, which noticed that ‘central banks are proceeding at their own speed, taking diverse approaches and considering different design features’.

The same study observed that 75% of the responding jurisdictions were already working on a ‘framework to regulate stablecoins and other cryptoassets’.

Combine this with the dollar’s historically-low share of global reserves, 56.32% in Q1 2025, and we get a bleak picture: the US dollar is losing ground fast against crypto.

This is good news for Bitcoin, which is already in full recovery mode, now retesting the $116K breakpoint.

Q4 announces itself as extremely bullish, especially with bitcoin Hyper ($HYPER) targeting a Q4 2025-Q1 2026 release date if everything goes to plan. And everything does seem to go to plan, considering $HYPER’s $25M presale which grows by the day.

Why Crypto Dominance is Inevitable

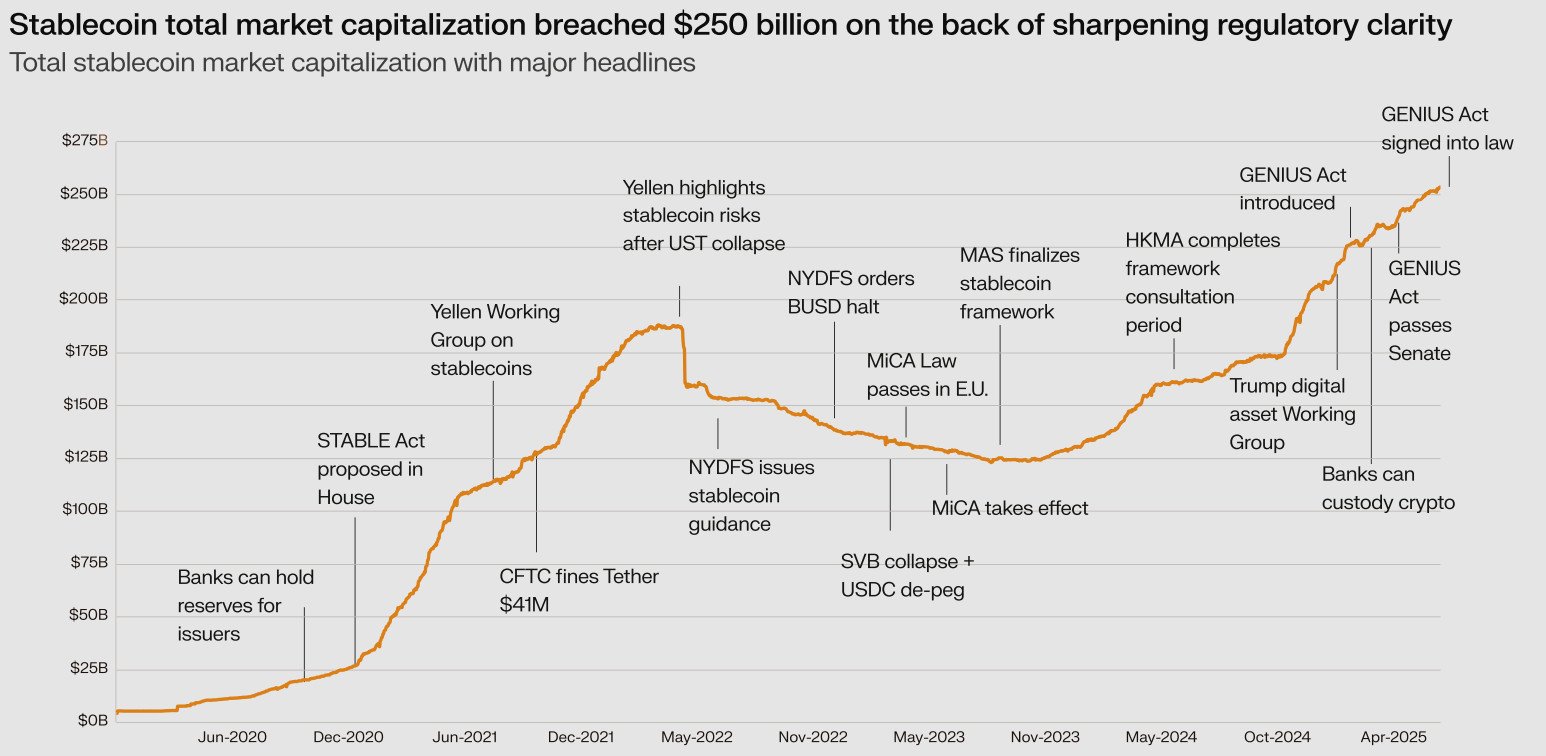

A Messari report showed that the stablecoin market cap broke $250B following an increase in regulatory clarity across multiple sectors.

This hints at rampant adoption, especially at institutional level, as investors grow more confident in stablecoin as hedges against the depreciating fiat.

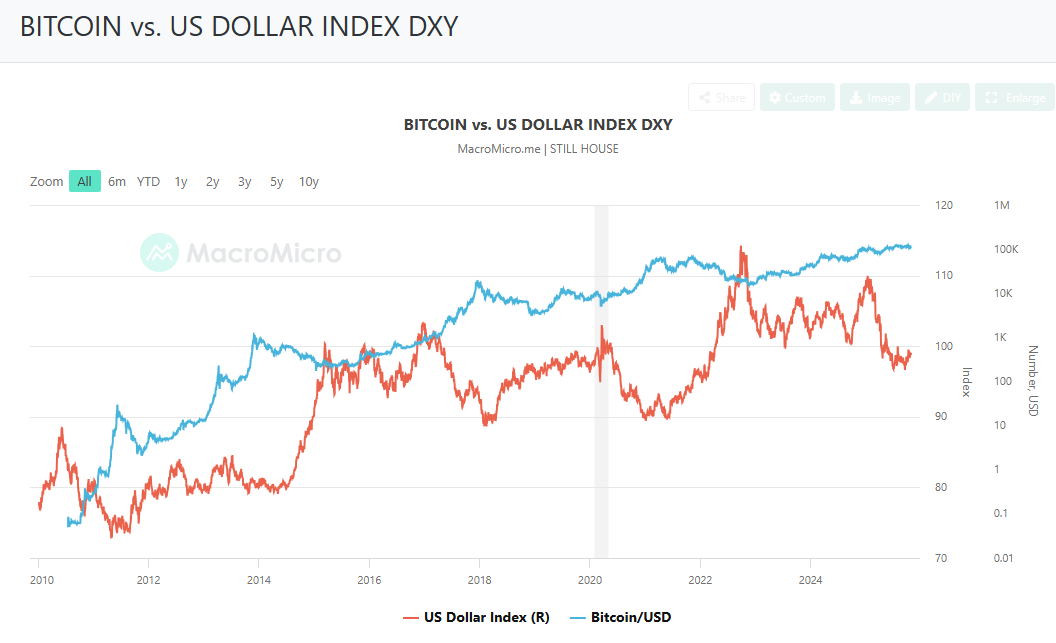

Bitcoin’s historic performance compared to that of the US dollar speaks volumes in this sense. Between 2010 and 2017, Bitcoin grew faster and higher, showing lower volatility than the dollar, and the discrepancy is only growing.

Then we have the growing adoption cycle, which has 4.04M $BTC already in treasuries between 353 entities, 207 of them being public companies and counting.

It’s then understandable why Research and Markets WOULD project a market cap of $791.5B for the blockchain government by 2030, compared to 2024’s $22.5B. A growth rate of 3,417%, fueled by factors like growing adoption, the rising demand for data privacy and security, and developments in the AI sector.

The latter is especially impactful, with the demand for Machine-to-Machine (M2M) growing to such a pace that experts estimate a $250B market cap by 2033. It was $100B last year.With such fast-pace developments across so many sectors, it’s understandable why the US dollar can’t keep up.

October 10’s market crash is the clearest indicator that the crypto sector is on a one way trip. The crash eliminated over $19B in Leveraged positions, causing Bitcoin to crumble by 15% in a matter of hours.

Despite that, Bitcoin endured and recovered pretty quickly, which prompted analysts at TD Cowen to praise its resilience and predict a price point of $141K by December thanks to that.

With Bitcoin set up for a Q4 banger, Bitcoin Hyper’s $25M presale will likely contribute to that as investors pour in.

How Bitcoin Hyper Turns Bitcoin Faster and More Scalable

Bitcoin Hyper ($HYPER) promises to solve Bitcoin’s most pressing problem: its performance limitation.

The Bitcoin network sits at a performance capacity of seven transactions per second (TPS), which is far below industry standards. By comparison, solana is first on the list of the fastest blockchains by TPS, while Bitcoin is on the 24th spot.

Hyper aims to change that with the help of tools like the Canonical Bridge, which mints the users’ tokens into the Hyper LAYER with near instant finality. The wrapped bitcoins become available on

Hyper’s Layer 2 as soon as the Bitcoin Relay Program confirms the transaction details.

The Solana VIRTUAL Machine (SVM) adds another layer of firepower, enabling lightning-fast smart contract execution that dramatically boosts performance and slashes latency.

By integrating these tools, Hyper eliminates Bitcoin’s fee-driven bottleneck, where miners typically prioritize high-fee transactions, pushing smaller ones to the back of the line and sometimes leaving users waiting for hours during peak congestion.

With Hyper, Bitcoin becomes faster, cheaper, and more responsive, a scalable network ready to handle real-world payments, DeFi, and beyond. It’s the kind of leap that could finally propel Bitcoin into true mainstream utility.

The presale is now at $25.1M, with a token price of $0.013185.

A realistic price prediction for $HYPER puts the token at $1.2 or higher by 2030, given successful implementation and widespread adoption. Based on today’s presale price, this translates into a 5-year ROI of 9,001%.Given Bitcoin Hyper’s ($HYPER) projected release window between Q4 2025 and Q1 2026, depending on ‘prevailing market conditions and demand’, the earlier you join in, the better.