Solana Soars: SOL Targets $300 Milestone as Hong Kong Spot ETF Ignites Institutional Frenzy

Hong Kong's groundbreaking spot ETF approval sends shockwaves through crypto markets—Solana rockets toward the $300 threshold as institutional capital floods in.

The Institutional Gold Rush

Wall Street whales are circling SOL like never before. Hong Kong's regulatory green light for spot ETFs unlocks billions in previously sidelined capital—pension funds, asset managers, and family offices are all diving headfirst into Solana's ecosystem.

Technical Breakout Confirmed

SOL smashed through multiple resistance levels in a single trading session. The $300 target isn't just hopeful speculation—it's becoming technical reality as buying volume triples historical averages. Market structure suggests this could be the start of a sustained uptrend rather than another crypto pump-and-dump.

Asian Market Domination

Hong Kong's strategic move positions Solana as the preferred altcoin for Asian institutional exposure. While traditional finance veterans debate whether this is 'real adoption' or just another speculative bubble—the money flows don't lie. Sometimes the market moves faster than the analysts can update their spreadsheets.

The $300 price target now looks conservative as Solana eats Bitcoin's lunch in the institutional adoption race. Wall Street finally discovered there's more to crypto than just Bitcoin—though it only took them a decade and a half to figure it out.

Solana price just got a major boost after Hong Kong approved the world’s first spot solana ETF. The news sparked renewed confidence across the market, with participants eyeing SOL’s strong technical setup around the $200 zone. As excitement builds, many believe this ETF launch could be the spark that fuels Solana’s next big breakout.

ETF Catalyst Reinforces Solana’s Institutional Appeal

Hong Kong’s approval of its first-ever spot Solana ETF marks a pivotal moment for the blockchain’s global recognition. This launch positions Solana alongside Bitcoin and ethereum in the institutional spotlight, reinforcing its legitimacy as a long-term investment asset. Beyond the short-term hype, this ETF signals confidence from Asian markets, known for early adoption in tech-based assets, potentially unlocking new liquidity and investor inflows in the coming weeks.

With Solana already ranking high in daily volumes and developer activity, this regulatory milestone amplifies its growth narrative. It could serve as the missing link driving sustained capital inflow into SOL-based products, especially as institutions continue diversifying across alternative Layer-1 assets.

Solana Technical Setup Shows Breakout Potential

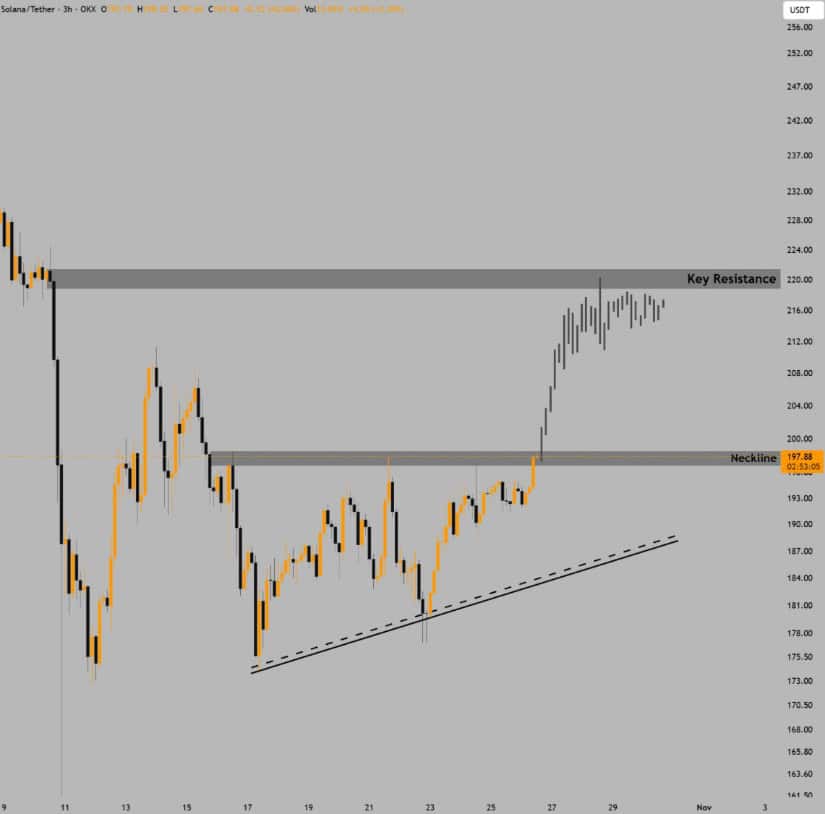

According to ShangoTrades, Solana price is once again coiling near resistance, with price pressing against the $200 zone, a critical breakout level that has historically triggered sharp expansions. The ascending trendline from $175 continues to support the move, showing strong demand on dips and clean structure formation.

Solana price consolidates just below the $200 breakout zone, signaling strong bullish momentum as demand builds on each dip. Source: ShangoTrades via X

If bulls can secure a daily close above $200, the next target lies at $220, with volume likely to expand. A breakout here would confirm a continuation of Solana’s bullish pattern, aligning with the broader recovery in high-beta crypto assets.

Fibonacci Confluence Adds to Bullish Case

Solana’s weekly chart shows a textbook retest of the 0.886 Fibonacci retracement, precisely at the $174–$176 range, while maintaining position above the Bull Market Support Band. This combination often signals the end of corrective phases and the beginning of a new expansion leg.

Solana holds firmly above key Fibonacci levels, hinting at renewed bullish momentum and potential upside toward the $240 zone. Source: Chad via X

Chad believes that momentum indicators like RSI are holding midline support, suggesting there’s still room for upside without overstretching. As long as solana price remains above the 0.786 and 0.886 retracement levels, the broader structure continues to favor higher targets, possibly towards $240 and beyond in upcoming weeks.

Solana Price Prediction: Range Expansion Likely

Ali Martinez analysis highlights that $180 remains the key pivot zone, acting as a strong springboard within the parallel ascending channel. The Solana price structure projects potential upside moves towards $230 and even $290, should Solana maintain its trend integrity. The alignment of higher lows within this channel shows consistent accumulation behavior from market participants.

Solana’s bullish channel structure points to potential range expansion, with key levels between $210 and $220 defining the next breakout zone. Source: Ali Martinez via X

Technical confluence around the mid-range of $210 to $220 marks a crucial decision zone for continuation. If bulls maintain dominance and on-chain momentum follows the ETF news, solana price prediction could be preparing for a new leg higher into uncharted territory by year-end.

Final Thoughts: Can Solana Price Hit ATH?

The combination of fundamental catalysts and technical confluence makes the case for Solana Price retesting its all-time highs more compelling than ever. With Hong Kong launching the first spot Solana ETF, institutional exposure is now stepping into what was once a retail-driven market. This expansion of liquidity, paired with Solana’s unmatched transaction throughput and developer traction, forms the backbone of a strong macro uptrend narrative.

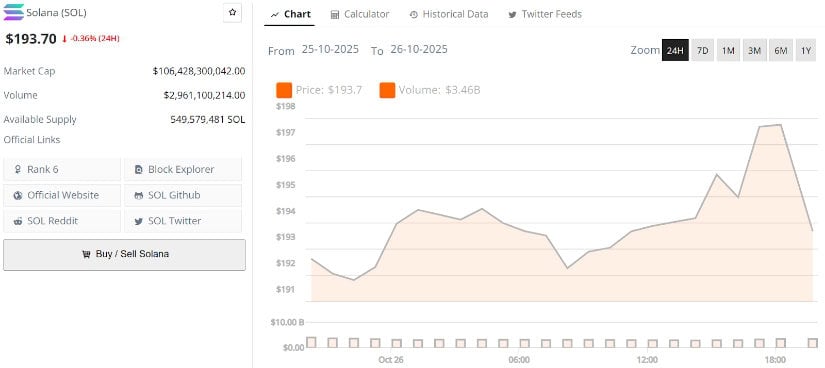

Solana price is $193.70, down -0.36% in the last 24 hours. Source: Brave New Coin

From a structural standpoint, Solana price continues to build higher lows while consolidating beneath the critical $200 to $220 resistance zone. A confirmed breakout above this level, ideally supported by increasing volume and ETF-related inflows, could trigger a fast extension towards $260 to $290, bringing Solana within striking distance of its $300+ all-time highs. If market momentum sustains into early 2026, that milestone may shift from possibility to probability.