Avalanche (AVAX) Technical Breakout: $25-$30 Recovery Zone In Sight As Key Levels Align

Avalanche bulls are charging toward higher ground as critical technical formations signal potential upside momentum.

The Setup Everyone's Watching

AVAX's chart patterns are converging to create what technical analysts call a 'perfect storm' scenario. The $25-$30 zone isn't just arbitrary numbers—it represents the convergence of multiple historical resistance-turned-support levels that could trigger the next leg up.

Why This Recovery Matters

Unlike traditional finance where recovery zones are often theoretical constructs, crypto technical levels actually influence trader behavior. When key levels align across multiple timeframes, you get coordinated buying pressure that moves markets faster than any Wall Street analyst can update their spreadsheet.

Market structure suggests AVAX is building the foundation for sustainable growth rather than another pump-and-dump spectacle. The technicals are speaking louder than the usual crypto Twitter hype—and they're saying this could be more than just a dead cat bounce.

Of course, in crypto land, 'technical analysis' is just educated guessing with better graphics—but when the charts align this neatly, even the skeptics pay attention.

AVAX crypto is showing signs of stabilization after a steep correction, with price consolidating near key support around $19.35. The structure now resembles a falling wedge, a setup often preceding bullish reversals.

Avalanche Fundamentals Strengthen with Institutional Backing

The Avalanche ecosystem continues to solidify its position among leading blockchains, recently attracting $500 million tokenized into BlackRock’s BUIDL fund. This development pushed Avalanche to 4th place in RWA (Real World Assets) total value locked, sitting just behind Ethereum, zkSync, and Polygon.

-

$1.24B RWA TVL positions Avalanche as a top institutional layer

-

Real-world integration through BlackRock signals growing investor trust

-

Expanding DeFi participation reinforces Avalanche’s liquidity base

Avalanche secures $500M in tokenized assets through BlackRock’s BUIDL fund. Source: Avalanche via X

The narrative around institutional DeFi is becoming clearer, and Avalanche’s active partnerships are positioning it as one of the main beneficiaries of the tokenization wave heading into 2026.

Can AVAX Crypto Break the Downtrend?

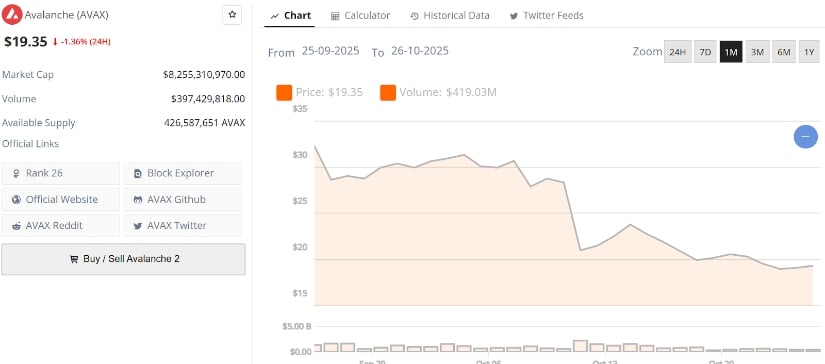

AVAX price is currently trading around $19.35, with a market cap of $8.25 billion and a 24-hour volume exceeding $397 million. Price action over the past month reflects a corrective leg from above $30, now stabilizing NEAR the mid-$19 support zone.

Avalanche’s current price is $19.35, down 1.36% in the last 24 hours. Source: Brave New Coin

Technically, the $19 level marks a crucial pivot; holding it could confirm a local bottom. A recovery above $21.50 to $22.00 WOULD be the first sign of momentum shift, potentially unlocking a retest of $25 to $27, aligning with previous structure highs. On the downside, $17 remains the key defense zone.

Falling Wedge Pattern Signals a Reversal Setup

The chart shared by Jesse Peralta highlights a falling wedge pattern, a classic reversal formation that typically precedes bullish breakouts. AVAX has been compressing between $18.50 support and $20.50 resistance, with momentum building near the lower trendline.

AVAX falling wedge pattern tightens between $18.50 and $20.50, hinting at a potential breakout as volatility compresses. Source: Jesse Peralta via X

A confirmed breakout above $20 could trigger a quick extension towards $25, while a rejection could see a retest of the $18 zone before expansion. Volume contraction inside the wedge supports the idea that volatility is nearing its inflection point, suggesting a MOVE is imminent.

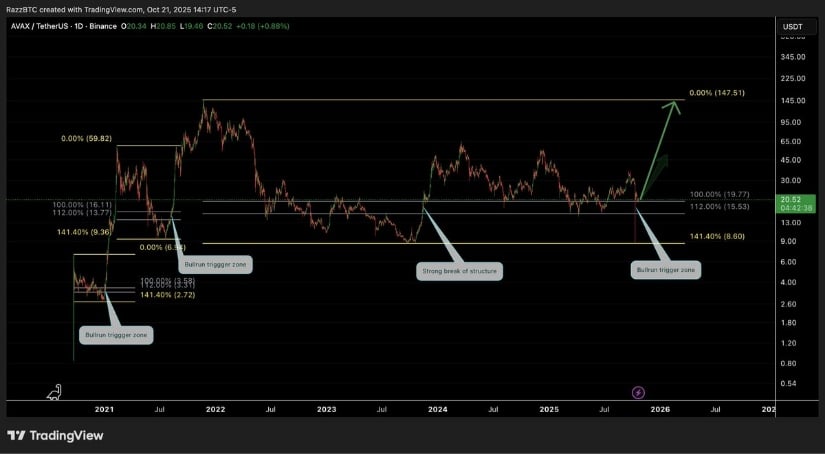

AVAX Price Prediction Aiming Towards $100

Razz’s analysis compares Avalanche’s current market structure to previous accumulation phases, where similar pullbacks led to explosive expansions. The Fibonacci retracement structure projects a potential long-term move towards $147, aligning with historical rally multipliers.

Avalanche’s market structure mirrors past accumulation cycles, with Fibonacci projections pointing toward a potential long-term move near $147. Source: Razz via X

The “bullrun trigger zone” around $8 to $10 from prior cycles has now shifted to $18 to $20, indicating a new structural base. As long as the price sustains higher lows and volume continues to climb, AVAX could be entering its next macro phase, echoing the “same playbook, better times” narrative.

Final Thoughts: AVAX’s Path Forward

AVAX crypto is showing all the early signs of a maturing cycle, strong institutional traction, defined technical structure, and consistent on-chain growth. While short-term resistance near $20 to $22 remains a hurdle, the blend of RWA integration and chart-based strength paints a constructive picture for the coming months.

If buyers manage to confirm a clean breakout above the falling wedge, momentum could quickly build towards $25 to $30, validating the bullish bias forming across multiple analysts. Fundamentally and technically, price seems to be laying the groundwork for a bullish AVAX price Prediction.