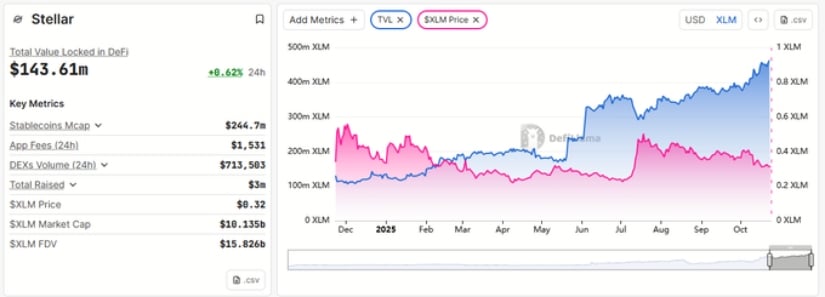

Stellar Soars: XLM Defies Gravity at $0.32 While TVL Explodes to Record 456 Million Tokens

Stellar's fortress holds strong while its treasury swells to unprecedented heights.

The Unshakeable Foundation

XLM continues to demonstrate remarkable stability, maintaining its position at $0.32 despite market turbulence. Meanwhile, the network's total value locked has skyrocketed to a staggering 456 million tokens—proof that smart money recognizes real utility when it sees it.The Institutional Whisper

This isn't retail FOMO—this is the quiet accumulation phase that precedes major institutional moves. While traditional finance debates digital assets over expensive lunches, Stellar's ecosystem quietly builds the infrastructure that will eventually replace their legacy systems.Market Mechanics in Motion

The TVL surge represents more than just numbers—it signals growing developer confidence and real-world adoption. Each locked token strengthens the network's security while creating scarcity in the circulating supply.Defying Gravity While Building Momentum

Stellar manages the rare feat of maintaining price stability during explosive ecosystem growth. Most projects would kill for either outcome—XLM achieves both simultaneously. Because apparently in crypto, you can have your cake and watch it appreciate too.

Following its impressive summer rally, the token is now testing key support levels as buyers and sellers battle for short-term control. The current setup highlights a critical phase where consolidation could define the coin’s next major move.

TVL Growth Signals Fundamental Strength

Stellar’s Total Value Locked (TVL) in decentralized finance (DeFi) protocols has reached an all-time high of 456 million tokens (approximately $143.61 million). This milestone arrives despite the token’s 50% decline from its December 2024 highs, with the current price holding around $0.32.

Source: X

The surge in TVL is being fueled by deeper integrations of stablecoins, liquidity pools, and staking mechanisms that reward holders for locking the asset across the ecosystem. Additionally, the memecoin’s Soroban smart contract platform has strengthened the network’s competitiveness by offering faster and cheaper transactions than legacy blockchains such as ethereum and Solana.

Supporting this momentum, stablecoin activity on the asset continues to thrive, with a market capitalization exceeding $244 million, a key factor in cementing its position as a preferred network for remittances and cross-border settlements.

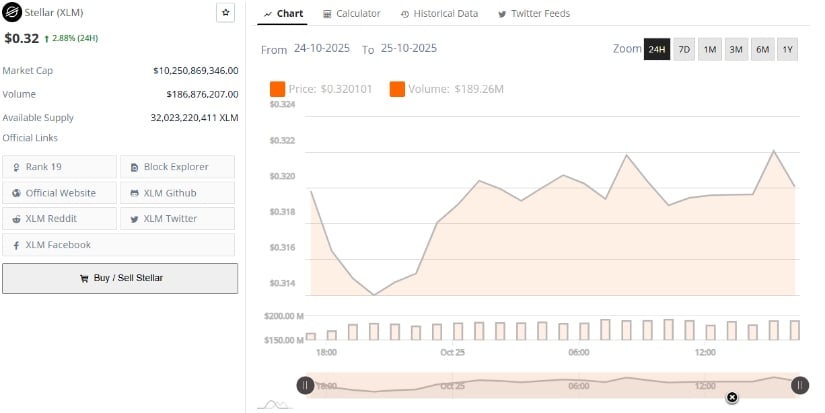

Market Holds Steady at $0.32 Amid Market Volatility

According to BraveNewCoin data, stellar is currently priced at $0.32, marking a 2.88% gain in the past 24 hours. Its market capitalization stands at $10.25 billion, ranking 19th overall, with a 24-hour trading volume of $186.8 million. Despite recent volatility, the price has shown resilience following a recovery from October’s lows.

Source: BraveNewCoin

The network’s growing adoption across DeFi and payments continues to underpin investor confidence. On-chain data indicates that substantial amounts of the token are being withdrawn from exchanges for staking and long-term holding.

This behavior aligns with accumulation patterns often seen before major uptrends, reflecting strong hands entering the market. With broader macro conditions stabilizing and blockchain utility increasing, the crypto’s fundamentals continue to look promising despite recent downside pressure.

Technical Indicators Suggest Consolidation Phase

On the other hand, first, the price action showed a strong bullish rally in July 2025, when XLM surged from around $0.20 to a high of about $0.52. Since then, the price has entered a downtrend, characterized by lower highs and notable volatility, dipping to $0.16 in October before rebounding to $0.32. This structure reflects a period of distribution following the rally, pointing to a potential consolidation zone forming NEAR current levels.

Source: TradingView

Second, the Bollinger Bands Power (BBPower) histogram has displayed predominantly negative readings, signaling subdued bullish momentum and heightened volatility. A cluster of red bars in early October coincided with the sharp price drop, while the gradual shift toward neutral in late October implies a fading of bearish pressure. Although the short-term outlook remains cautious, the indicator hints at a possible stabilization phase developing.

Third, the Chaikin Money Flow (CMF) stands at a positive 0.09, showing that capital inflows slightly outweigh outflows, even during the correction. This subtle accumulation supports the idea that investors are positioning for a potential rebound. Taken together, these indicators reveal a neutral-to-bullish setup, suggesting the cryptocurrency is entering a base-building phase where price stabilization could precede renewed upward movement.