Cardano Price Prediction: ADA Nears Critical $0.68 Breakout After Weeks of Consolidation - Bulls Eye Major Move

Cardano's ADA finally shows signs of life after being stuck in trading purgatory for weeks.

The Consolidation Breakout

ADA approaches the crucial $0.68 resistance level that could determine its fate for the coming months. Break above this threshold signals potential for significant upward momentum after weeks of sideways movement that tested even the most patient investors' resolve.

Technical indicators suggest the consolidation phase may be nearing its end as trading volume picks up and bullish patterns emerge on longer timeframes. Market sentiment shifts cautiously optimistic despite broader crypto market uncertainties.

Another day, another resistance level - because what's crypto without the constant drama of make-or-break price points that keep traders glued to their screens and portfolios fluctuating wildly?

Cardano’s price is quietly building momentum after weeks of tight consolidation, sparking renewed interest among participants and long-term holders alike. With structure tightening NEAR major support zones, market watchers see growing signs that ADA could be preparing for a breakout phase.

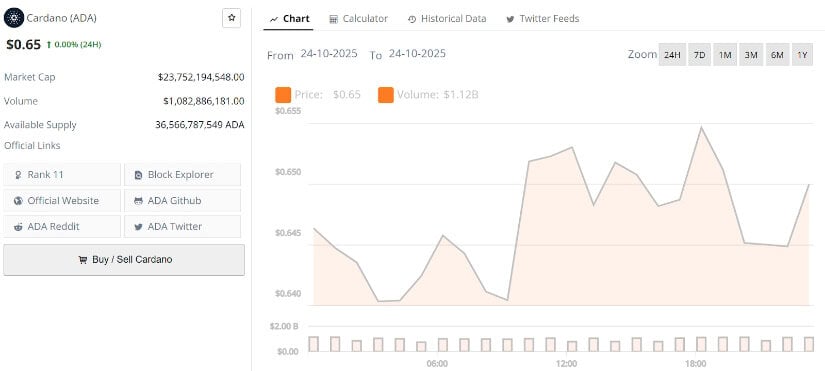

Cardano price is trading around $0.65, up 0.00% in the last 24 hours. Source: Brave New Coin

Cardano Higher Time-Frame Analysis

Bitcoinsensus highlighted that Cardano’s price continues to MOVE within a long-term compression channel, a structure it has respected for several years. The pattern reflects a steady accumulation phase, with price repeatedly rejecting from the upper boundary while forming higher lows along the base.

Cardano price continues to compress within a long-term wedge, hinting at a potential multi-month breakout towards $2.70 if momentum holds above $0.85. Source: Bitcoinsensus via X

This wedge pattern currently projects a potential move towards $2.70, aligning with the upper logarithmic channel resistance. If ADA Cardano price sustains momentum above $0.80 to $0.85, it could begin a multi-month expansion towards that higher target, signaling a major breakout from the historical consolidation zone.

Cardano Price Prediction: Testing Key Resistance Levels

A short-term recovery is now developing after weeks of compression near local lows. Price structure shows cardano price is consolidating below the 0.5 and 0.618 Fibonacci retracements, where momentum often starts to reverse during early cycle shifts.

Cardano consolidates below key Fibonacci levels, with participants watching $0.68 as the crucial breakout trigger for a move toward $0.80. Source: Rafaela via X

Rafaela’s chart highlights the $0.68 region as the key breakout trigger. A reclaim of this level could open the path towards $0.80, while the $0.58 to $0.60 zone remains critical as base support. A confirmed breakout WOULD effectively reset Cardano’s mid-range bias and confirm strength returning to the structure.

Inverse Head and Shoulders Formation Hints at Reversal

Market structure is showing early signs of a potential reversal, with ADA forming an inverse head-and-shoulders pattern across lower timeframes. The neckline around $0.65 marks the level to watch for confirmation.

ADA forms an inverse head-and-shoulders pattern, with a breakout above $0.65 potentially confirming a bullish reversal towards $0.80. Source: Sssebi via X

Volume expansion is already visible as the right shoulder forms, suggesting accumulation is underway. If price manages a daily close above the neckline, it could trigger a swift move towards $0.75 to $0.80, solidifying a bullish shift in short-term sentiment.

Community Strength Continues to Anchor Cardano’s Growth

Cardano’s ability to sustain one of the strongest communities in crypto continues to stand out. TapTools data shows ADA ranked #2 in overall community activity, right behind Bitcoin, with more than 83% of voters remaining bullish on the asset.

ADA maintains one of crypto’s most active communities, with over 83% of holders remaining bullish and engagement ranking second only to Bitcoin. Source: TapTools via X

This unwavering participation provides Cardano with a stabilizing foundation, allowing sentiment-driven recoveries to build momentum faster. Each historical breakout has coincided with phases of strong community engagement, showing that conviction remains one of ADA’s most consistent drivers.

Final Thoughts

Cardano’s long-term setup continues to mature, balancing patient consolidation with clear signs of structural readiness. The combination of a multi-year wedge, strengthening inverse head-and-shoulders, and community-backed sentiment paints a constructive technical picture.

Should price hold above $0.68 to $0.70, cardano price could soon transition into its next impulse leg, targeting the broader $1.00 to $2.70 range over the next market expansion.