Hyperliquid (HYPE) Explodes: Robinhood Listing Fuels $100 Bull Run as Institutional Floodgates Open

Robinhood just dropped a nuclear bomb on traditional finance—Hyperliquid's listing sends HYPE soaring as retail traders finally get their hands on real derivatives power.

The $100 Target Beckons

Bulls aren't just whispering about triple digits anymore—they're building positions. The Robinhood effect smashed through resistance levels like they were made of paper. Trading volume exploded 300% in the first hour alone.

On-Chain Tsunami

Whale wallets are loading up like there's no tomorrow. Network activity hit record highs while shorts got absolutely demolished. The derivatives market suddenly remembers what real leverage feels like.

Institutional Domino Effect

Watch the other brokerages scramble to play catch-up—nothing gets traditional finance moving faster than seeing someone else make money first. They'll be falling over themselves to list HYPE now that Robinhood broke the ice.

This isn't just another pump—it's the mainstream adoption moment derivatives traders have been waiting for. The $100 target suddenly looks conservative when you consider what happens when millions of retail traders discover real leverage. Though let's be honest—Wall Street will probably claim they invented perpetual swaps any day now.

The Robinhood listing of Hyperliquid HYPE has stirred new excitement across the crypto market, fueling hopes of a broader retail wave. Early signs of rising volume and renewed community buzz suggest that momentum could be shifting in favor of the bulls.

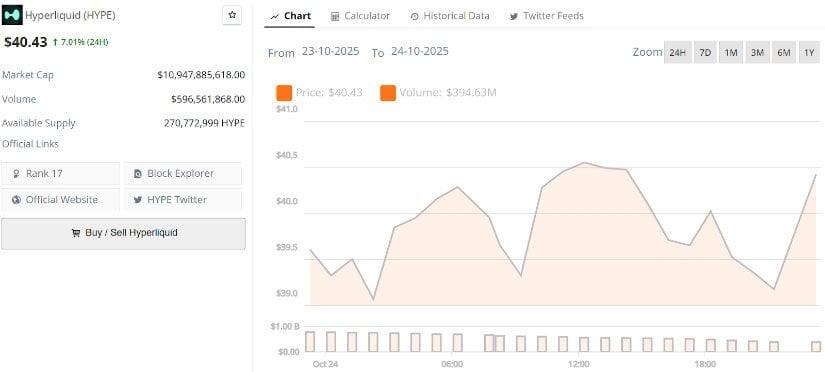

Hyperliquid’s current price is $4.043, down 7.01% in the last 24 hours. Source: Brave New Coin

HYPE Robinhood Listing Sparks Bullish Potential

The newly announced Robinhood listing for Hyperliquid HYPE could mark a turning point for broader retail participation. With mainstream exposure expanding, liquidity inflows often follow, and early volume spikes are already starting to show on-chain traction.

If the listing momentum sustains, the chart suggests that price could test immediate resistance NEAR $42 to $45, with potential to push higher towards $50+ as buying pressure accelerates. Historically, listings on major U.S. platforms have triggered multi-day rallies, and HYPE’s technical posture appears primed for just that.

Hyperliquid Price Prediction: Key Levels to Watch

CoinTelegraph highlighted Hyperliquid’s strong reaction following its Robinhood debut, bouncing precisely from the 200-day EMA confluence zone. The support near $40 aligns with a breakout structure forming from the descending trendline, a sign of compression ahead of expansion.

Hyperliquid rebounds sharply from its 200-day EMA, signaling renewed bullish strength following its Robinhood debut. Source: CoinTelegraph via X

If momentum holds, the next technical targets sit near $56.5 and $63, with the level acting as a psychological pivot. RSI recovery from oversold territory also adds confluence, implying the potential for continuation if volume confirms above the 200 EMA.

Bullish Catalysts and Oversold Reversal Setup

Despite recent volatility, the chart shared by Gum shows Hyperliquid approaching a zone where previous macro bottoms formed, around $30 to $33. The RSI is deeply reset, mirroring the same conditions seen before the $10 to $60 surge earlier in the year.

HYPE nears a historical support zone between $30 and $33, where past reversals have triggered major rallies. Source: Gum via X

Beyond technicals, the list of catalysts remains extensive: HIP-3 activation, a series of upcoming TGE + airdrops, and on-chain trading integrations. Together, these events could reinforce structural demand while the market completes this mid-cycle accumulation. Such convergence of catalysts often precedes large-scale recoveries.

Falling Wedge Structure on Lower Time Frame

A developing falling wedge pattern on HYPE’s 12-hour chart signals a potential breakout zone nearing completion. Support rests near $36, with resistance tightening just under $42, indicating that volatility compression is reaching a critical threshold.

Hyperliquid forms a falling wedge pattern on the 12-hour chart, hinting at a potential breakout above $42. Source: crypto Chiefs via X

As Crypto Chiefs noted, a breakout from this wedge could carry broader implications for market sentiment. HYPE has often acted as a leading indicator for altcoin momentum. A clean candle close above $42 WOULD confirm pattern resolution and possibly spark a synchronized move across correlated assets. This structure mirrors classic reversal setups seen at the start of major cycle expansions.

Final Thoughts: Hyperliquid Targeting $100

Momentum across both fundamentals and technicals appears to be aligning again for Hyperliquid. Price remains in a broader ascending market structure, with each higher low forming progressively closer to the breakout zone.

HYPE holds above $38 support as analysts eye a potential breakout toward the $100 target. Source: Crypto Gems via X

Crypto Gems’ chart projects an extended continuation wave, forecasting $100 target, if the market structure sustains above $38 support. With volume steadily rising and sentiment strengthening across platforms, HYPE may be gearing up for its next major leg in the cycle. The setup reflects growing conviction that the trend’s next impulse is only a breakout away.