ETHEREUM EXPLOSION: Bulls Charge from $3,700 Support Toward $4,300 Target Following Massive $280M BitMine Purchase

ETHEREUM IGNITES: $280 Million Institutional Bet Fuels Rally

The $3,700 Support Wall Holds Strong

Ethereum bulls aren't just testing resistance—they're bulldozing through it. That $3,700 support level everyone was watching? Solid as a rock. Now the smart money's eyeing $4,300 as the next major target.

BitMine's Quarter-Billion Dollar Vote of Confidence

When a single entity drops $280 million on ETH, the market notices. BitMine's massive acquisition screams institutional conviction—the kind that moves markets and leaves retail traders scrambling to catch up. Classic Wall Street timing, really—buy when everyone else is still checking their charts.

The Technical Setup Screens Breakout

This isn't just another pump. The charts show legitimate momentum building since that $3,700 bounce. Volume patterns confirm this isn't retail FOMO—this is calculated accumulation by players who measure positions in commas and zeros.

Because nothing says 'we believe in decentralized finance' like a centralized entity making nine-figure bets that could move the entire market. The irony's thicker than a Bitcoin maximalist's denial about ETH's staying power.

After weeks of consolidation NEAR critical levels, Ethereum’s price action is showing renewed momentum. Market participants are monitoring the $4,000 mark, which has historically acted as a psychological barrier and potential launchpad for further gains.

Ethereum Prepares for $4,000 Test After $3,700 Bounce

Ethereum (ETH) is showing renewed signs of strength after bouncing off key support between $3,600 and $3,700. Traders are now eyeing the $4,000 level, a critical psychological barrier, as a potential confirmation point for the next bullish leg.

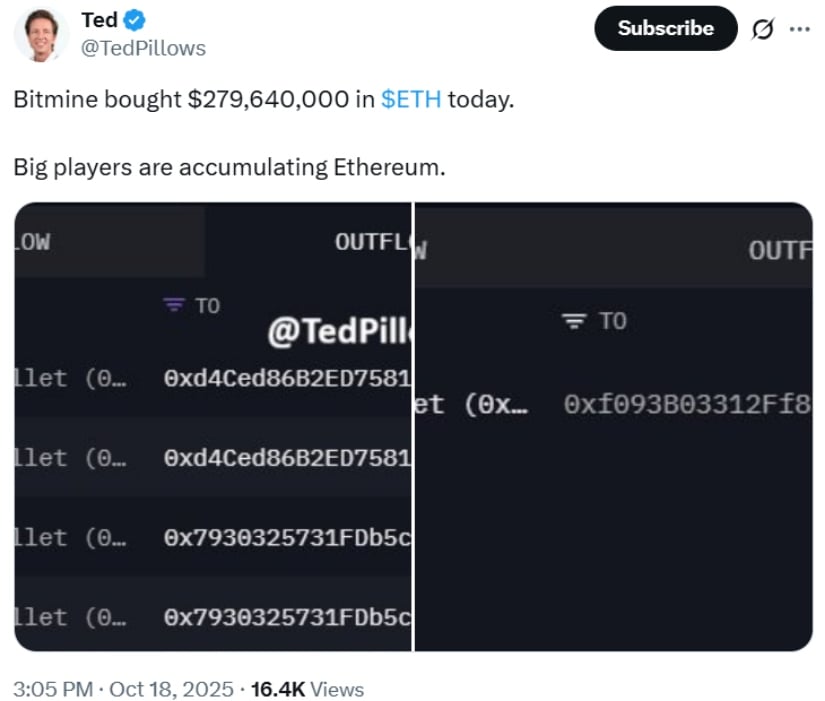

Ethereum (ETH) bounces off $3,600–$3,700 support, eyeing a reclaim of $4,000 as a key sign of bullish strength. Source: @TedPillows via X

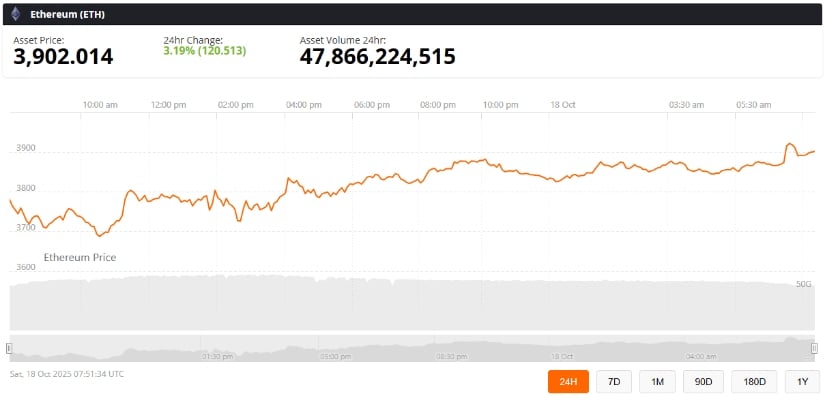

As of October 18, 2025, ethereum trades at $3,893, up 2.9% in the past 24 hours, with a trading volume of $47.9 billion. Crypto analyst Ted @TedPillows notes, “$ETH is trying to reclaim a key support level. If Ethereum can reclaim the $4,000 level, it’ll be the first sign of strength.” His 4-hour ETH/USDT chart highlights a clear bounce from $3,600–$3,700, with $4,000 as the next resistance to watch.

BitMine’s Massive ETH Buy Signals Institutional Confidence

Institutional activity is heating up. BitMine Immersion Technologies reportedly purchased $279.64 million in ETH, moving roughly 72,898 ETH from FalconX and BitGo hot wallets in the last 10–14 hours.

BitMine makes a massive $279.64M ETH purchase, signaling strong institutional accumulation of Ethereum. Source: @TedPillows via X

Tom Lee, BitMine’s chairman, continues to expand the company’s Ethereum holdings, now exceeding 3.03 million ETH—valued at over $11.8 billion. According to reports, BitMine is targeting about 5% of the total ETH supply through strategic accumulation.

“This latest purchase follows prior acquisitions, including 202,037 ETH earlier this month amid price dips,” noted news10.com, highlighting a clear buy-the-dip strategy. While institutional buying adds bullish momentum; market participants remain cautious following recent ETF outflows totaling $232 million.

Technical Outlook: $4,000 Is the Key

Technically, Ethereum is testing a pivotal level. Korinek_Trades points to a weekly Elliott Wave setup indicating a potential MOVE toward ~$4,968.

Ethereum sets up for a potential Wave 5 rally toward $5K after retracing to typical Wave 4 levels, signaling an imminent bullish move. Source: @korinek_trades via X

“The market has retraced into common wave 4 levels, forming a bull flag within wave 4. With an incomplete bullish count and bearish sentiment at recent lows, a strong upward move could be coming,” he explained. Intermediate resistance sits around $4,100, while wave 5 could push ETH toward ~$4,968 if momentum continues.

Key levels to watch:

- Support: $3,600–$3,700

- Immediate Resistance: $4,000

- Next Resistance: $4,100–$4,300

- Potential Target: ~$4,968

Market Sentiment and Outlook

Ethereum’s short-term trajectory appears bullish, supported by institutional accumulation and technical setups. A successful break above $4,000 could open the door for a move toward $4,300 and higher.

Ethereum (ETH) was trading at around $3,902, up 3.19% in the last 24 hours at press time. Source: ethereum price via Brave New Coin

However, traders should remain aware of short-term volatility from recent ETF outflows and broader market trends. With strong support levels holding and major players like BitMine increasing their exposure, Ethereum remains in focus for potential medium-term gains.