Hyperliquid (HYPE) Price Prediction: Bulls Battle to Defend $34–$36 Zone as Traders Watch for Next Move

Hyperliquid traders are digging in for a fight at critical support levels.

The $34–$36 Defense Line

Bulls are throwing everything they've got to hold the $34–$36 zone—watching for any sign of weakness that could trigger the next major price movement. Market sentiment hangs in the balance as liquidity clusters around these key technical levels.

Meanwhile, traditional finance guys are still trying to figure out how to short something that trades 24/7. The $34–$36 range isn't just numbers on a chart—it's the battleground where HYPE's near-term fate gets decided. Break above and the momentum could snowball; break below and well, let's just say the bulls have other plans.

Hyperliquid is entering a crucial phase as price action tightens between major support and resistance zones. After a strong rally earlier this quarter, momentum has started to cool, leading participants to question whether this is just a healthy correction or the start of a deeper pullback.

HYPE Price Weakens as Support Gets Tested

HYPE is once again testing a key support zone NEAR $34 to $36, where buyers previously stepped in to defend the price. The broader chart shows that momentum has shifted lower after repeated rejections from $45 to $47, a zone that now acts as resistance.

Hyperliquid’s HYPE tests its crucial $34–$36 support zone after repeated rejections from higher resistance levels. Source: CCIEtrader via X

While the RSI shows slight oversold conditions, the structure remains fragile below the 20-EMA. As CCIEtrader noted, the short-term outlook leans slightly cautious unless HYPE can reclaim $38 to $40 with strength. For now, the $32 to $34 region remains critical to avoid a deeper correction.

Hyperliquid Price Prediction: Watching for Deeper Correction Levels

The recent breakdown from $43 pushed HYPE back toward its lower trendline, hinting that the correction phase may extend. The 0.618 Fib retracement sits near $28, while the 0.75 zone at $21 to $22 marks the deeper support region. These levels could attract buyers if momentum continues to weaken.

Hyperliquid’s correction deepens as price retests lower Fibonacci levels near $28. Source: ShangoTrades via X

If price recovers and closes back above $41.5 to $42, it WOULD signal renewed strength. Otherwise, as ShangoTrades suggested, the current pullback could still stretch further before a proper reversal forms. Short-term sentiment remains mixed, but the mid-range holds the key to the next move.

On-Chain Data Shows Contrary View

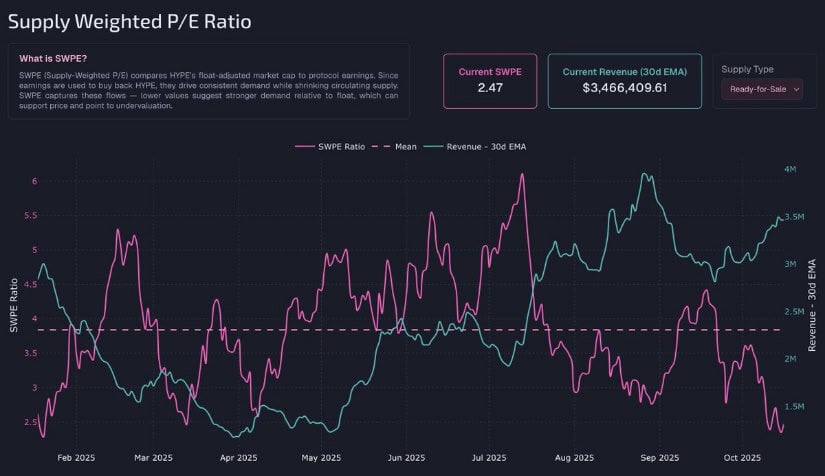

Based on revenue metrics, HYPE remains fundamentally undervalued. McKenna highlighted that at $39, the token is cheaper relative to its earnings than it was at $13 earlier in the cycle. The supply-weighted P/E ratio is sitting near 2.47, while 30-day revenue has climbed above $3.4 million, showing that network income continues to rise even during the correction.

Hyperliquid’s rising revenue and low P/E ratio suggest the decline is sentiment-driven, not fundamental. Source: McKenna via X

This on-chain strength signals that Hyperliquid’s value is still backed by steady real activity, suggesting that the decline could be sentiment-driven rather than fundamental.

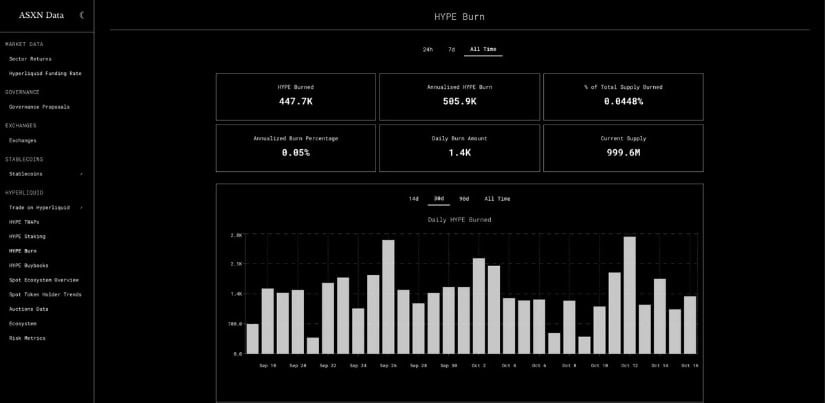

Burn Activity Adds Long-Term Bullish Support

Over 447,700 HYPE tokens, worth nearly $16.8 million, have now been burned, reducing total supply and supporting long-term token value. The total buyback by All Finance has reached over $1.24 billion USD, showing that treasury inflows and ecosystem burns are actively working to stabilize the system.

Over 447,700 HYPE tokens worth $16.8M have been burned, reinforcing Hyperliquid’s strong deflationary model. Source: 0xMojojo via X

As 0xMojojo emphasized, these consistent burns show that Hyperliquid’s deflationary mechanism remains strong. Even with market volatility, this ongoing reduction in circulating supply gives long-term holders a clear bullish edge once broader sentiment improves.

Accumulation Zones Offer Opportunity for Bulls

Despite volatility, dippy_eth pointed out potential accumulation levels if the decline extends further. The chart highlights ideal re-entry points around $32 to $34 for short-term rebounds and $26 to $28 for stronger accumulation.

Hyperliquid shows key accumulation zones between $26 and $34, offering potential rebound opportunities for patient bulls. Source: dippy_eth via X

HYPE remains one of the most dominant projects of this cycle, and as long as it stays within its rising long-term trendline, the overall outlook remains constructive. Once the market steadies, these zones could offer meaningful recovery potential for patient buyers.

Final Thoughts

Despite the recent Hyperliquid pullback, on-chain strength and continuous token burns show that the project remains fundamentally healthy. If the price continues holding above $32 to $34, these zones could become the base for a mid-term reversal.

The undervaluation data from McKenna and the long-term burn narrative from 0xMojojo both point toward growing value resilience. With strong revenue, lower supply, and clear support levels in place, Hyperliquid’s price prediction continues to favor recovery once sentiment improves across the broader market.