Optimism (OP) Battles Below $0.70 as Bears Maintain Grip

Optimism faces stiff resistance at the $0.70 threshold—sellers aren't budging.

Market Pressure Intensifies

The Layer-2 token struggles to gain upward momentum as selling pressure continues to dominate trading sessions. Each attempt to break through the psychological barrier gets met with immediate pushback from bears controlling the order books.

Technical Outlook Remains Challenging

With the price action confined below the critical $0.70 level, technical indicators suggest continued consolidation in the near term. The pattern mirrors broader market hesitation—traders waiting for clearer signals before committing to major positions.

Volume analysis shows decreased activity during upward moves compared to selling periods, indicating weak conviction among buyers. This imbalance creates a scenario where even minor sell orders trigger disproportionate price movements downward.

Another day in crypto—where 'fundamental value' often takes a backseat to order book dynamics and trader sentiment. The $0.70 level now becomes the line in the sand separating recovery from continued correction.

While some signs of accumulation are emerging, traders remain cautious as the asset struggles to reclaim key resistance levels.

Short-Term Charts Reveal Persistent Downtrend

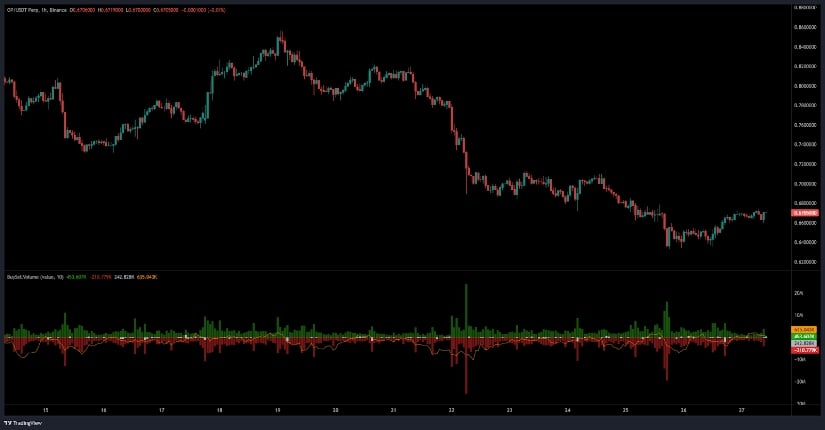

On the 1-hour chart from Binance, OP/USDT has been in a clear downtrend, falling from above $0.84 to the current level NEAR $0.67. The structure is marked by lower highs and lower lows, with bearish momentum accelerating through the midpoint of the decline.

Recent candles show sideways movement, hinting at either short-term consolidation or the market pausing after heavy selling pressure.

Source: Open Interest

Volume data adds context: over the last ten periods, buy volume (~453.6K) has exceeded sell volume (~210.8K). However, this has not translated into price strength, suggesting that buyers may be quietly accumulating, but the broader momentum still favors sellers. Unless the token can break above key resistance, rallies may remain shallow and short-lived.

Market Data Suggests Only Modest Recovery Potential

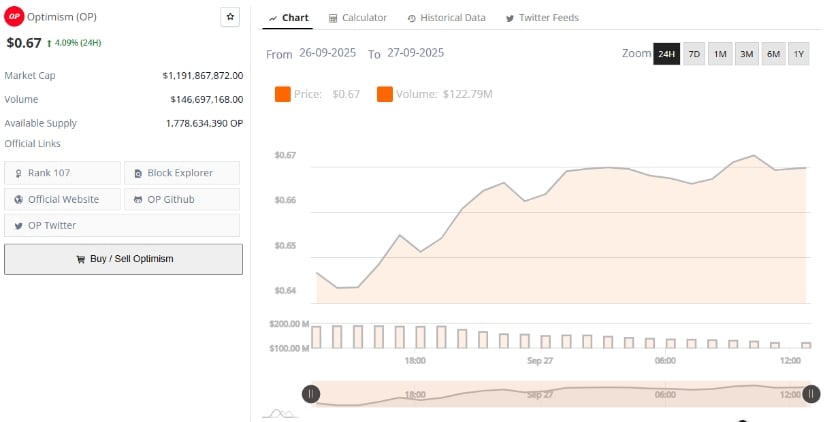

According to BraveNewCoin, Optimism is currently priced at $0.67, showing a 4.09% increase in the last 24 hours. The project carries a market capitalization of $1.19 billion, with daily trading volume standing at around $146.7 million.

While these numbers reflect a degree of healthy liquidity, they also underscore the fact that the coin is still trading far below its recent highs, remaining outside of the stronger performers in the crypto market.

Source: BraveNewCoin

The asset has consistently struggled to reclaim the $0.75–$0.80 range, which has become a major overhead barrier for any sustained recovery attempts. Holding above the $0.64 support zone is seen as critical to avoid further losses, as a breakdown could quickly expose the memecoin to the historical low near $0.4570.

Technical Indicators Confirm Bearish Control

A deeper look at the daily chart from TradingView shows Optimism trading at $0.6713, which is well below the Bollinger Band basis line of $0.7541. This indicates that the asset is firmly in bearish territory, as price action continues to hover near the lower band at $0.6409.

Riding the lower edge of the bands often reflects sustained selling pressure with no immediate signs of reversal.

Source: TradingView

The Chaikin Money FLOW (CMF) is currently at -0.07, which points to moderate but persistent selling activity outweighing buying interest. This indicator has remained mostly negative throughout September, reflecting capital outflows and limited appetite from institutional or large-scale buyers. Without strong positive shifts in CMF, accumulation efforts remain weak and fragmented.

Key levels now define the next likely moves for the asset. On the downside, support rests at $0.6409, followed by the historical low near $0.4570, which could become a target if bearish pressure continues. On the upside, immediate resistance lies at the Bollinger band line of $0.7541, with stronger resistance at the upper band near $0.8672. A confirmed close above these levels, especially with volume support, WOULD be required to confirm any bullish reversal.