XRP Price Surges as Ultra-Rare Bullish Formation Sparks Market Frenzy

XRP just triggered a technical pattern so uncommon that traders are scrambling for position. The digital asset's charts are flashing signals not seen in years—maybe ever.

Technical Breakout Confirmed

Multiple indicators align simultaneously. Moving averages crossover, volume spikes triple the monthly average, and momentum oscillators blast through resistance levels. This isn't just green candles—it's a coordinated assault on bearish sentiment.

Market Psychology Shifts

Traders who dismissed XRP during its consolidation phase now face FOMO dynamics. The 'super rare' setup refers to historical precedents where similar patterns preceded triple-digit percentage gains. Of course, past performance doesn't guarantee future results—but try telling that to bulls watching order books fill.

Institutional Whispers Grow Louder

Behind the technicals, regulatory clarity acts as jet fuel. While traditional finance still debates blockchain utility, XRP's infrastructure partnerships demonstrate real-world adoption that bypasses bureaucratic hurdles.

Whether this marks the start of a sustained rally or another 'buy the rumor' moment remains uncertain. But for now, XRP's engine isn't just humming—it's roaring at redline. Just remember: on Wall Street, they call this 'price discovery.' In crypto, we call it Tuesday.

XRP Price Forms Rare Multi-Layered Bullish Setup

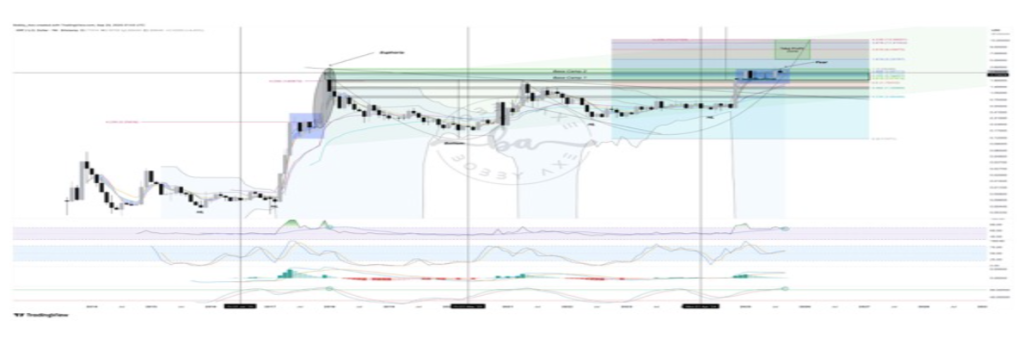

According to crypto market expert Bobby A, XRP is in a rare market position, consolidating above key historical levels while preparing for a move that could lead to new all-time highs. He noted that different indicators are aligning in support of a possible uptrend.

In a chart shared on X social media, Bobby explained that XRP’s market capitalization has been holding above its 2018 peak for more than 300 days, an uncommon show of strength amid the recent downturn. This long consolidation above a major resistance-turned support level suggests a massive build-up of energy before the next leg higher. He argues that this base formation signals a potentially explosive MOVE to the upside, with the next market cap targets identified at $173 billion and a peak around $727 billion.

On the price front, Bobby reveals that XRP has been forming a multi-month bullish flag pattern on its charts. He labels the critical support zones as “Base Camp 1” around $1.9 and “Base Camp 2” at $2.89—both of which have been successfully defended. He further highlighted that the monthly Relative Strength Index (RSI) is also positioning itself for one final push toward overbought territory, often a precursor to a sharp upward move. Based on his projections, XRP’s take profit zones sit between $5 and $13, levels that WOULD mark fresh all-time highs.

Bobby’s analysis highlights that XRP’s indicators are “firing on all cylinders,” with momentum across higher timeframes aligning for a potentially powerful surge. He further pointed out that Bitcoin Dominance (BTC.D), currently at 58.7%, is set to retrace toward the mid-to-low 40% zone soon. Such a move would enable altcoins like XRP to capture a larger market share, thereby reinforcing the likelihood of a bullish breakout. The analyst described this rare alignment as a generational setup that occurs only a few times in a decade.

Bearish Divergence Sparks Short-Term XRP Sell-Off

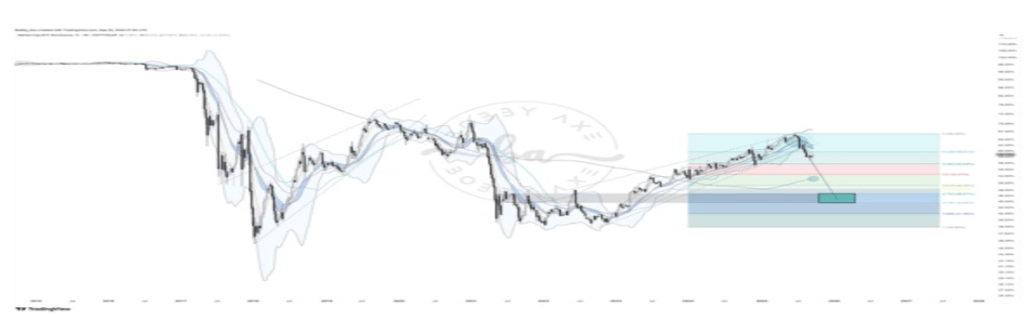

While XRP appears to be resisting the present market downturn, not all analysts share an immediate bullish sentiment. crypto expert JD has warned about a Bearish Divergence forming on XRP’s weekly chart—a signal that has now played out as expected.

As shown in the chart, while XRP’s price made higher highs, the RSI indicator printed lower highs, creating a textbook Bearish Divergence pattern. This divergence has already led to a sharp 27% correction from the $3.37 take profit level that JD had previously identified. According to him, many market participants are now questioning why XRP has been under pressure despite broader optimism.

JD argues that the Bearish Divergence was the clearest warning signal, and those who ignored it are now witnessing its full effect. He cautions that while XRP may still avoid a deeper breakdown into the “grey box” supply zone, the short-term trajectory remains bearish until momentum resets.

Featured image from Unsplash, chart from TradingView