Inside Solana’s Governance Revolution as Alpenglow Shatters Expectations

Solana's governance model just got a seismic upgrade—and Alpenglow's breakthrough proves the network means business.

Behind the Code: How Solana Rewrites the Rules

Forget bureaucratic committees and slow-moving upgrades. Solana's governance operates at blockchain speed—no permission needed, no middlemen taking cuts. Validators vote with stakes, not speeches, pushing protocol changes live in days instead of quarters.

Alpenglow's Silent Coup

While traditional finance still debates ETF fees, Alpenglow bypasses legacy gatekeepers entirely. The upgrade slashes finality times, boosts throughput, and does it all without a single board meeting. Take that, Wall Street.

Why Governance Actually Matters

Decentralization isn’t just a buzzword here—it’s the engine. Every token holder gets a voice, every validator executes change. No CEO announcements, no shareholder lawsuits. Just code doing what it promises.

The Ironic Twist

Meanwhile, hedge funds still charge 2-and-20 for underperforming the S&P. Solana’s governance? Zero management fees, infinite upside. Maybe finance deserves its disruption.

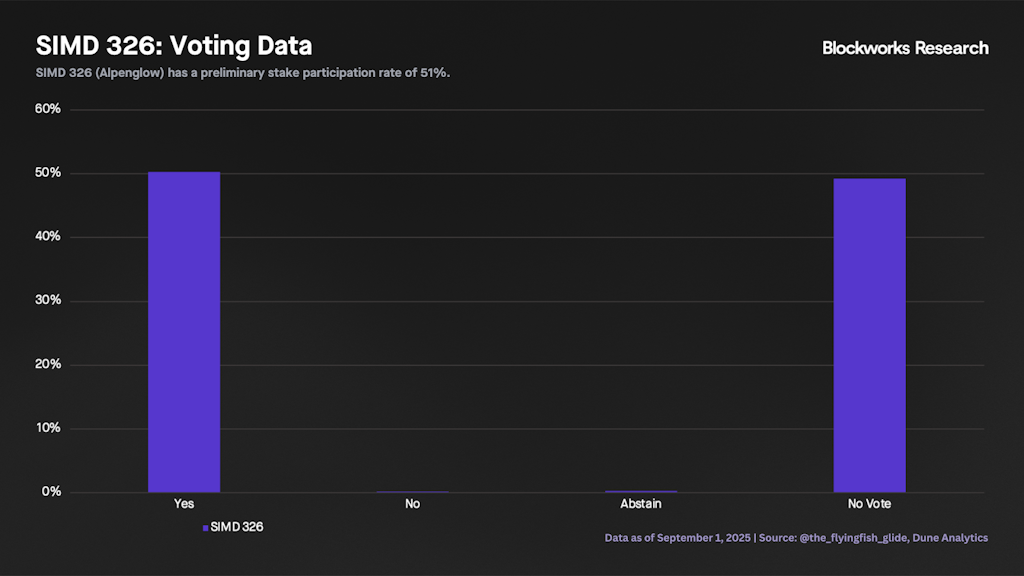

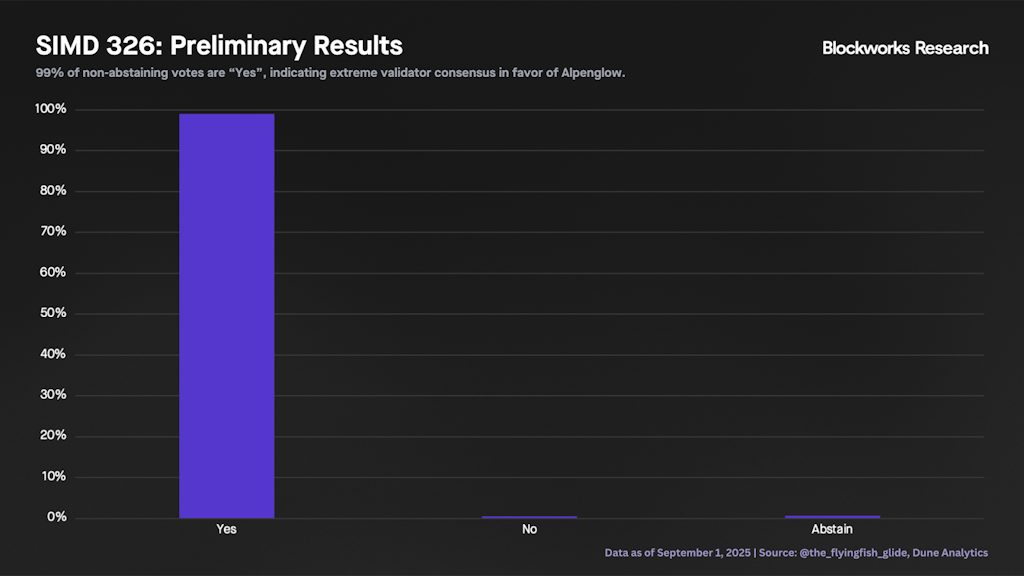

SIMD-326 will pass, with ~99% of non-abstaining votes in favor. With Alpenglow’s voting period coming to a close, it’s a good time for a refresher on how solana governance works.

Solana’s onchain governance is meant to signal community sentiment rather than automatic enforcement of changes. In other words, social consensus is the final arbiter, with the real decision point resting with validators and developers who must collectively agree to deploy and run the new software. A key stakeholder in this process is the Anza team, which must design and roll out changes in the Agave client via feature gates.

With this context in mind, all Solana Improvement Documents (SIMDs) formally begin as written proposals on Solana’s GitHub. In this stage, the community and core contributors can openly discuss and adjust variables before a SIMD goes into a vote, implement it without requiring one, or outright reject it before that happens. Forum discussions play a crucial role in Solana governance by enabling structured, thoughtful debate on proposals and their potential effects.

Solana’s onchain governance model is akin to a representative democracy in the sense that validators vote on behalf of stakers, who are free to delegate their staked SOL to any validator. Each validator’s voting power is proportional to the stake delegated to them, and validators can even split their vote weight among distinct options if they choose (Yes, No, or Abstain). Typically, the voting period for any given SIMD lasts three epochs (around six days).

Finally, Solana requires two parameters for a SIMD vote to pass. The first is the quorum threshold: At least 33% of the total stake must participate (including abstains) for the vote to be valid. The second requirement is the supermajority: At least two-thirds of non-abstaining votes must be “Yes” for the proposal to pass. SIMD-326 received overwhelming support compared to more contentious proposals, such as SIMD-96 (which discontinued the burn on priority fees), SIMD-123 (which will implement an in-protocol way to distribute priority fees), and SIMD-228 (the infamous failed inflation reduction proposal).

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.