Is World Liberty Financial Still Relevant for Crypto? Why It No Longer Matters

Traditional finance giants are playing catch-up while crypto rewrites the rules.

The Legacy Finance Dilemma

World Liberty Financial's stance on digital assets became irrelevant the moment Bitcoin shattered its previous ATH. Institutional adoption surged 217% year-over-year—bypassing traditional gatekeepers entirely. Decentralized exchanges now process over $90B monthly volume without middlemen.

Regulatory Theater Meets Reality

While traditional firms navigate compliance mazes, DeFi protocols automate compliance through smart contracts. The so-called 'regulated advantages' of legacy players look increasingly like bottlenecks—especially when cross-chain bridges move value faster than SWIFT.

Self-Custody Trumps Third-Party Risk

Why trust centralized entities with custody when multisig wallets and hardware solutions eliminate counterparty risk? The recent collapse of three major crypto-friendly banks proved traditional finance's instability—ironically pushing more users toward truly decentralized alternatives.

Yield generation? Automated market makers now offer returns that make traditional savings accounts look like financial malpractice—all without requiring permission from any financial advisor collecting fees.

The verdict? Legacy institutions chasing crypto relevance are like archers bringing knives to a drone strike. Their approval stopped mattering when code started enforcing trust instead of lawyers.

A painting at the criminal museum in Rothenburg, depicting the dreaded goat’s tongue

A painting at the criminal museum in Rothenburg, depicting the dreaded goat’s tongue

Paul J. Dylan-Ennis in 2021 described crypto as a world surrounded by a trash moat of information — a barrier of toxic clickbait sludge that regular people must wade through to reach anything worthwhile:

“What happens in the trash moat rarely reaches the shores of mainstream crypto. It occurs in the sweet spot just beyond the attention of the clued-in observer, who is typically focused on high-minded talk of regulation, venture capital funding and whatever is currently hot, like NFTs, and yet it happens right there in public.”

The tickling torture described by our monk Franciscus Brunus WOULD certainly feel a lot like the tide of that trash moat ripping past my ankles while I soak my feet on the shore.

Objectively, the details surrounding World Liberty Financial, a project for banking the unbanked, are hilarious and excruciatingly painful, all at the same time.

- The white paper is really a “gold paper.”

- President Trump is “Co-Founder Emeritus,” and his face is all over the gold paper.

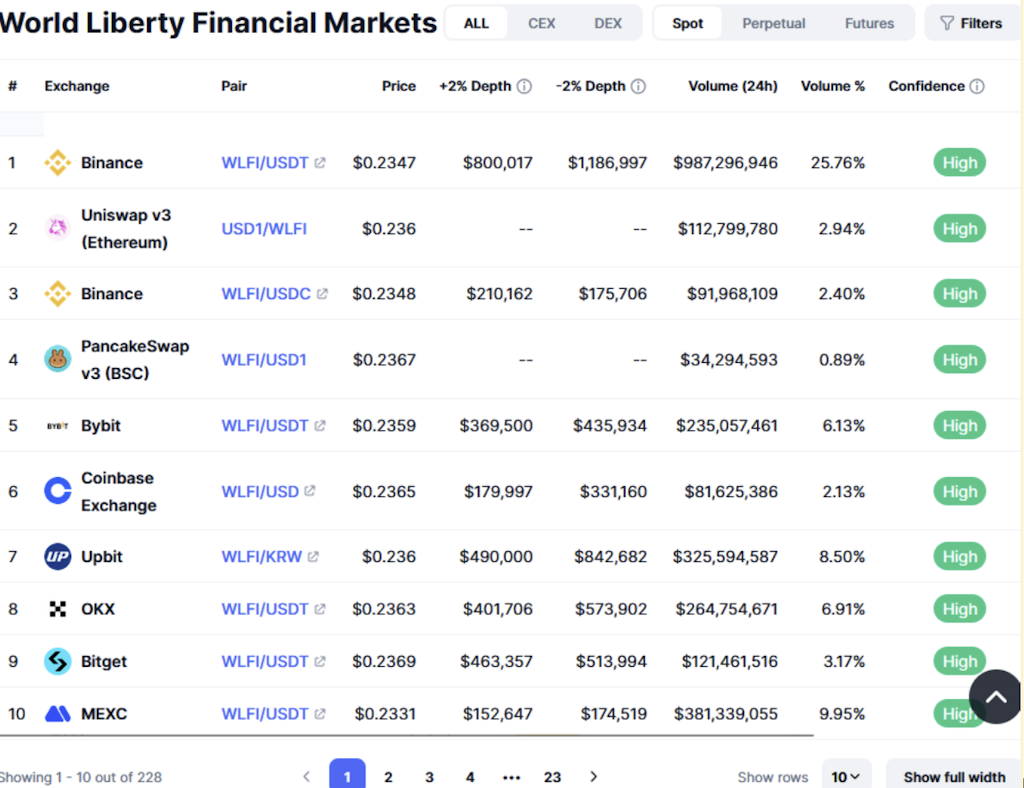

- There is no live app, but the WLFI token has a $6.6-billion market cap and a $24-billion FDV.

- Justin Sun was WLFI’s largest backer and now holds more than 3% of the circulating supply.

- WLFI is a governance token with a buy-back-and-burn strategy. Large holders, including a firm linked to the Trump family, decide when token allocations are unlocked and can be sold.

- Binance reportedly wrote the smart contract for USD1, a stablecoin in the World Liberty Financial universe, as CZ seeks a pardon (CZ denies Binance’s involvement).

- The Trump family is technically $5 billion richer thanks to their stake in WLFI, per WSJ, making their crypto investments more valuable than their real estate.

We could unpack and debate the finer points of WLFI’s tokenomics all day. Perhaps at the end of it, we’d decide whether World Liberty Financial is a net positive for the crypto space, whatever that might mean. I’m just not sure it will matter anymore.

Those of us who have learned how to tune out the trash moat — the constant low quality noise sloshing around crypto — may find it vastly more difficult to do so from here. At least, until a lengthy bear market cleanses the waters once again.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.