Friday Charts: The Many, Many Architects of AI

Forget the lone genius in a garage. The AI revolution isn't being built by one visionary—it's being assembled by a sprawling, global network of architects.

From chip designers in Taiwan to data labelers in Nairobi, the supply chain of intelligence is more complex than any single company's org chart. Each layer adds a piece, a cost, and a point of potential failure.

The Hardware Hustle

It starts with silicon. The race for specialized AI chips isn't just about speed—it's about control over the entire stack. Foundries are the new oil fields, and the companies that own them hold the keys to the kingdom. Everyone else is just renting compute.

The Data Dilemma

Then comes the fuel: data. Massive, messy, and increasingly expensive to acquire and clean. The quiet war isn't for algorithms, but for datasets. Who owns the information that trains these models? The answer is rarely clear, and almost always contested.

The Labor Layers

Behind every 'autonomous' system are thousands of human hands. They tag images, transcribe audio, and filter toxic content—often for wages that would make a traditional financier blush. It's the ultimate irony: the pursuit of artificial intelligence relies on an immense amount of very real, very cheap human intelligence.

The result? A technological ecosystem where value is concentrated at the top, while risk and cost are distributed down the chain. It's a brilliant business model—for the firms at the summit. For everyone else, it looks a lot like building someone else's skyscraper, one precarious brick at a time. Just don't expect a cut of the property value when it's done.

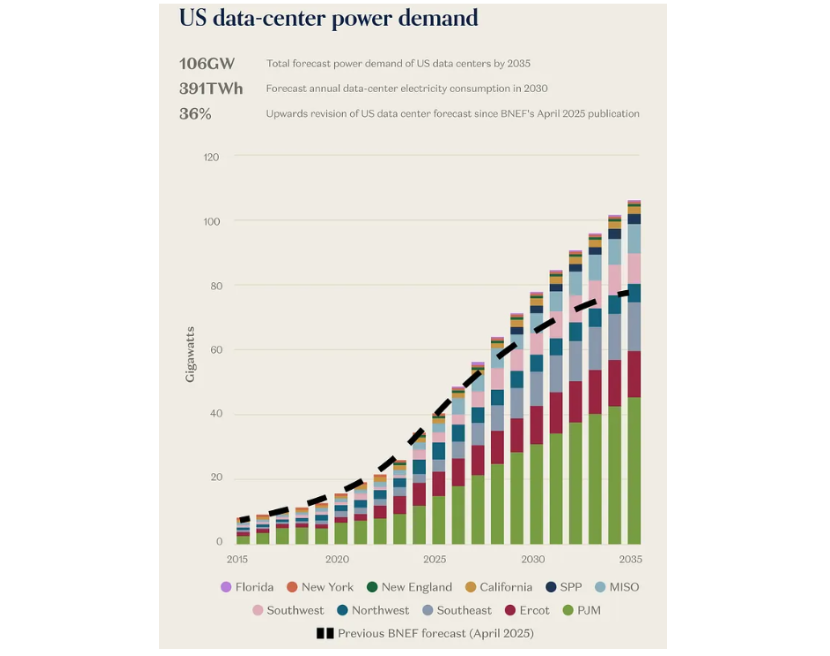

Per a16z, forecasts for data center power consumption have risen by 36% since just April. AI-related stocks were down today in part because they can’t get enough power to run all the data centers they need (or think they need).

Power to the people:

China’s big advantage in the race to AGI is that soon, it will be generating 3x as much power than the US is.

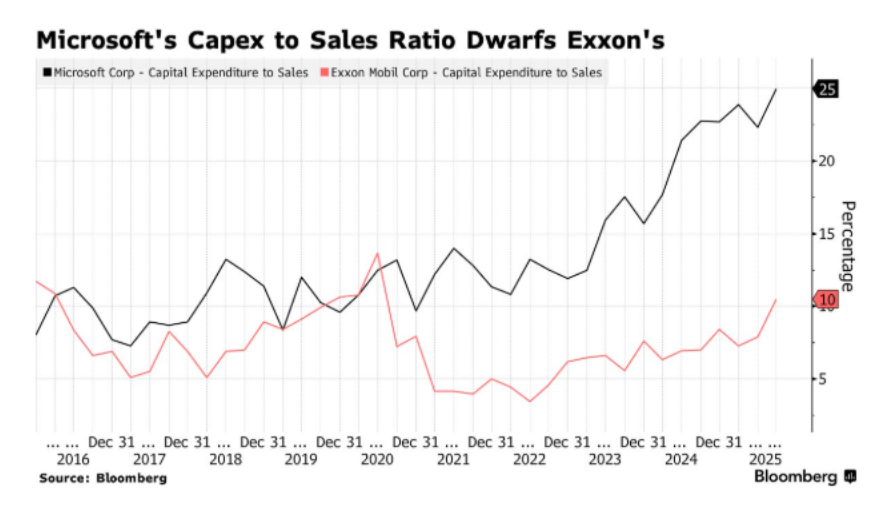

Investing role reversal:

Paul Kedrosky notes that as a percentage of sales, Microsoft (a traditionally asset-light business) is now spending more than double on capex compared to what Exxon (a traditionally asset-heavy business) does.

Not investing advice:

A Finra survey finds that 61% of investors under the age of 35 use YouTube for investing advice. To me, this suggests that Australia got it the wrong way around when it banned under-16s from social media this week. They should have banned over-30s instead.

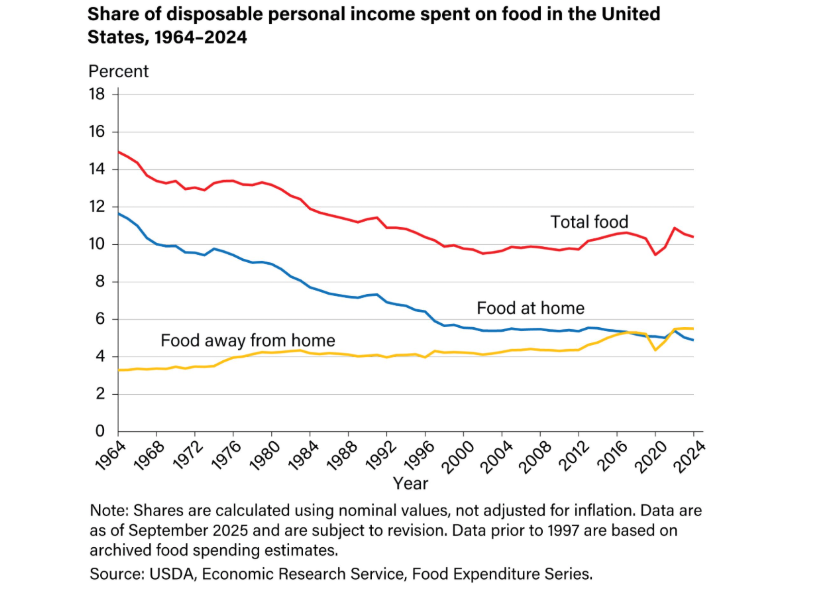

The non-crisis of grocery prices:

Contrary to what social media would have you believe, there is no crisis of grocery store prices: As a percentage of disposable income, food at home (in blue) has gotten cheaper. In total (red), our food budget has remained unchanged, but only because we’re getting lazier (yellow).

The stock market isn’t only about AI:

The equal-weight S&P 500 hit an all-time high this week.

A demographic time bomb:

Sam Bowman shares an incredible stat: “Every 100 South Koreans today will have only 6 great-grandchildren between them.” Not six each — six in total. Thankfully, AI should be doing most of the jobs by then.

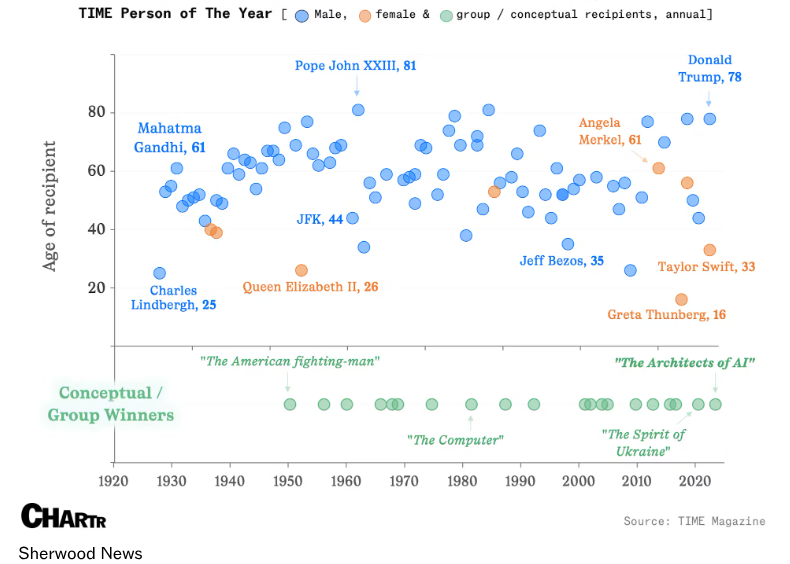

All the persons of the year:

Note that The Computer was Time Magazine’s “person” of the year in 1982. Not labelled in the above is the 2006 winner: you. The 2006 award recognized the individual content creators populating the world wide web with YouTube videos, blog posts, Instagram photos and Reddit comments.

This year, “you” should rightfully have joined nine US presidents as a repeat winner, because if we hadn’t populated the web with our content, the “architects of AI” would’ve had nothing to work with.

Your training session is now complete. Please proceed outdoors.

Have a great weekend, readers of the year.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.