HK-Listed IVD Medical Bets Big: ETH Treasury Strategy & HashKey Exchange Partnership Unveiled

Hong Kong's IVD Medical just made a power move—allocating treasury reserves to Ethereum and locking arms with crypto heavyweight HashKey Exchange. Here's why it matters.

From Pipettes to Private Keys

The diagnostics firm is swapping traditional assets for ETH, betting on crypto's long-term store-of-value thesis. No half-measures—this is a full-throated endorsement of decentralized finance.

HashKey's Institutional Play

The partnership suggests IVD isn't DIY-ing its crypto exposure. HashKey's compliant infrastructure lets them skirt regulatory landmines—because nothing says 'serious investor' like outsourcing custody to avoid an SEC-sized headache.

The Bottom Line

Another blue-chip dipping toes in crypto waters. Will competitors follow suit, or wait for the next 50% drawdown to call it a bubble? Only volatility knows.

Leading Hong Kong digital assets exchange HashKey has entered into a strategic partnership with IVD Medical Holdings Limited (1931.HK), a Hong Kong Stock Exchange-listed company.

According to an announcement shared with Blockhead, "the two parties will collaborate to advance enterprise-level digital asset adoption and explore new models for integrating blockchain with industrial capital."

IVD Medical, also known as Huajian Healthcare, kicked off its "Global Enhanced ethereum (ETH) Vault" strategy with a 5,190 ETH purchase via HashKey Exchange for HK$149 million (~$19M) on 9 August, aiming to become the leading public company in Hong Kong in terms of ETH reserves. The company will be increasing its "reserves through regular and quantitative purchases" using multiple funding sources, including its own funds, stable annual distributable profits, replacement of existing inefficient inventory assets, and continuous ATM (At-The-Market) financing.

IVD is a leading medical diagnostics provider in China with an established pharmaceutical commercialization network, comprising 351 direct customers (covering hospitals and medical institutions), 1,253 distributors and 1,674 Class III hospitals (accounting for approximately 70% of such hospitals in China)".

Class III hospitals in China are typically large, comprehensive facilities often affiliated with universities.

According to regulatory filings over the last month, IVD Medical is launching ivd.xyz – an exchange focused on trading tokenised real-world assets (RWAs) – alongside plans for a stablecoin called IVDDollar (IVDD).

ivd.xyz aims to solve numerous challenges associated with medical and pharmaceutical research such as low financing efficiency and asset liquidity due to poor distribution by leveraging its hospital network in China and its global asset acquisition capabilities.

Earlier, the company board had resolved to proceed with a primary listing on the NASDAQ through a proposed initial public offering of its American Depositary Shares (ADS).

A wholly-owned subsidiary in the U.S. has also been incorporated to oversee and implement ivd.xyz's strategy there and to initiate a stablecoin license application under the GENIUS Act.

IVD intends to apply for a stablecoin issuer license in Hong Kong, with future plans for relevant license applications in places like Singapore and Europe.

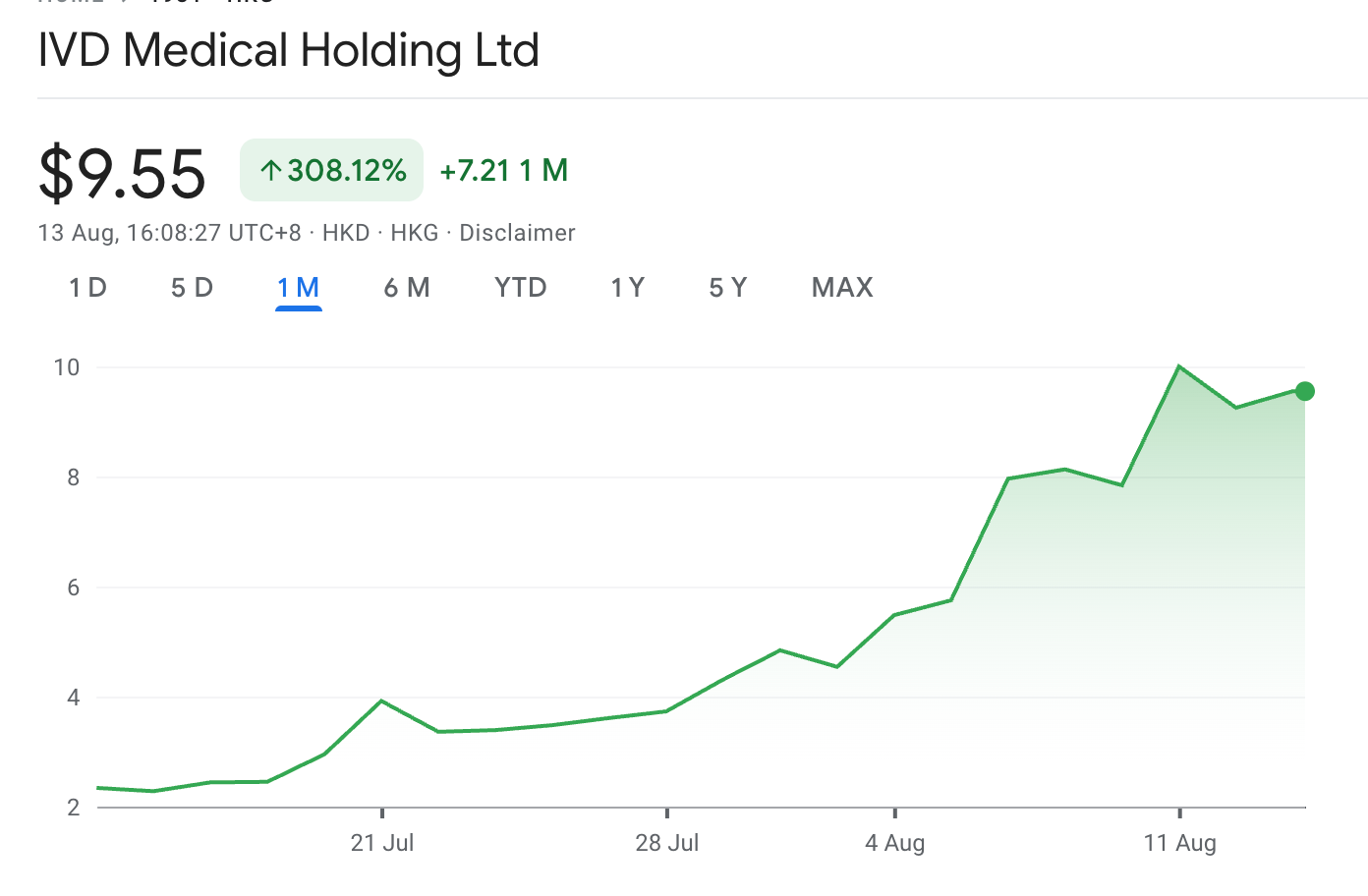

IVD's stock price has more than tripled since 14 July, when the company first announced their plans. If successful, IVD could be the poster company for mainland Chinese companies looking to experiment with Web3 technologies outside of China.

Stay ahead of the curve with the latest industry news on Blockhead’s Telegram channel!