Bullish Rockets 83% Post-IPO—$1.1B Debut Defies Crypto Skeptics

Wall Street meets blockchain in a firework display of demand.

The numbers don't lie—but VCs might

An 83% first-day pop makes this the hottest crypto listing since Coinbase. The $1.1B raise? Just enough to buy three Jeff Bezos yachts—or fund real decentralization.

Institutional FOMO hits escape velocity

TradFi desks piled in like it was 1999. Meanwhile, Bitcoin maxis muttered 'told you so' through gritted teeth.

The cynical take

Another nine-figure liquidity party for pre-IPO insiders. But hey—at least the retail bagholders get fresh memes this time.

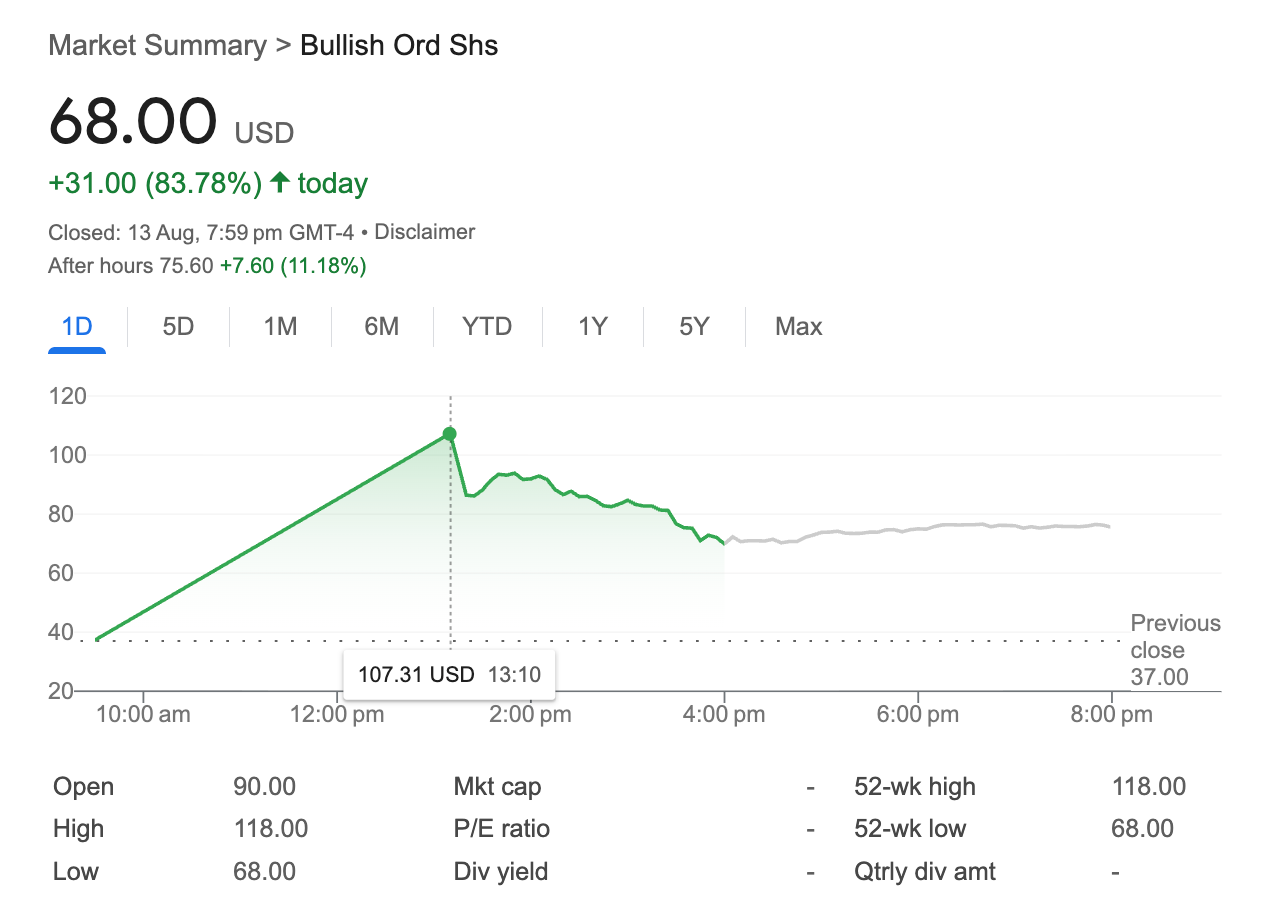

Bullish (BLSH) made a strong public market debut Wednesday, with shares surging 83% to close at $68 on the New York Stock Exchange following the cryptocurrency exchange's $1.1 billion initial public offering.

The stock opened at $90 before settling at $68 by market close, giving the Peter Thiel-backed company a market valuation of $9.9 billion. Trading continued strong in after-hours sessions, with shares climbing above $75 as of publication time.

The performance exceeded expectations after Bullish priced its expanded offering at $37 per share Tuesday evening, raising more than the originally targeted $990 million. The company sold 30 million shares, up from an initial plan of 20.3 million shares.

The debut caps a successful return to public markets for crypto companies, following Circle's strong performance earlier this year. Bullish's first-day performance reflects continued investor enthusiasm for digital asset platforms despite market volatility in the sector.

Led by former NYSE president Tom Farley, Bullish operates a cryptocurrency trading platform and owns CoinDesk, the crypto news site it acquired in 2023. The company reported handling $250 billion in digital asset trades in 2024 and projects net income of $106-109 million for the second quarter.

JP Morgan, Jefferies and Citigroup led the underwriting syndicate for the offering. BlackRock and ARK Investment Management had indicated interest in purchasing up to $200 million worth of shares at the IPO price.

The strong debut validates Bullish's positioning as institutional interest in cryptocurrency trading continues to grow, with traditional financial firms increasingly offering digital asset services to clients.

Stay ahead of the curve with the latest industry news on Blockhead’s Telegram channel!