Ethereum Price Prediction 2025: Can ETH Surge to $5,000 as Institutional Demand Explodes?

- Ethereum Technical Analysis: Is This the Breakout We've Been Waiting For?

- Institutional Frenzy: How Big Money Is Reshaping ETH's Market Structure

- The $5,000 Question: What's Driving Price Targets Higher?

- Validator Exodus: A Hidden Catalyst for ETH's Next Move

- Ethereum vs. Bitcoin: The 2025 Performance Gap

- FAQ: Your Burning Ethereum Questions Answered

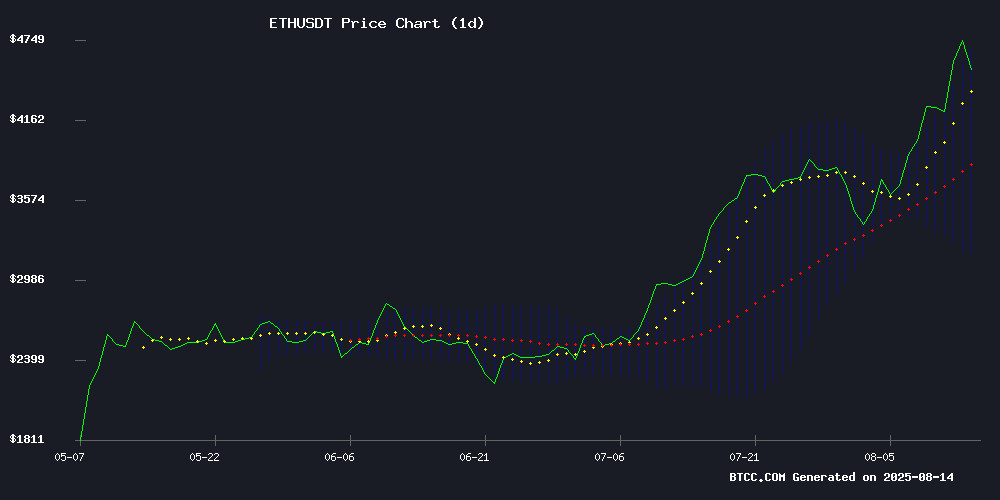

Ethereum is making headlines again as it flirts with all-time highs, currently trading around $4,537 with bullish momentum that has analysts buzzing. The real story here isn't just the price action - it's the unprecedented institutional frenzy driving ETH's ascent. From record ETF inflows to corporate treasuries hoarding ETH like digital gold, the supply squeeze is creating perfect conditions for a potential breakout to $5,000. Let's dive into the technicals, fundamentals, and market dynamics that could propel ethereum to new heights in coming weeks.

Ethereum Technical Analysis: Is This the Breakout We've Been Waiting For?

Looking at the charts, ETH is showing all the classic signs of a bullish continuation pattern. The price is currently sitting comfortably above its 20-day moving average ($3,932), which typically acts as strong support in uptrends. What's particularly interesting is the MACD indicator - while it's still showing a slight bearish divergence (-70.26), the gap is narrowing fast. This often precedes what traders call a "bullish crossover," where buying pressure overwhelms selling momentum.

The Bollinger Bands tell another compelling story. ETH is hugging the upper band at $4,680, which WOULD normally suggest overbought conditions. But in strong uptrends, assets can remain overbought for extended periods. "This isn't your typical overbought scenario," notes a BTCC market analyst. "When price sticks to the upper band like this, it often signals institutional accumulation rather than retail FOMO."

Institutional Frenzy: How Big Money Is Reshaping ETH's Market Structure

The institutional adoption narrative for Ethereum has shifted from "maybe someday" to "right now" in 2025. U.S. spot Ether ETFs just recorded their second-biggest inflow day ever at $729 million, with BlackRock's ETHA product alone pulling in $640 million. Cumulative inflows since launch have surpassed $10 billion - that's enough to buy up nearly 5% of ETH's circulating supply at current prices.

Corporate treasuries are getting in on the action too. BitMine Immersion shocked markets by disclosing holdings of 1.15 million ETH ($5 billion), while SharpLink Gaming - now chaired by Ethereum co-founder Joseph Lubin - is reportedly amassing hundreds of thousands of ETH. These aren't speculative plays; they're strategic allocations that could lock up supply for years.

The $5,000 Question: What's Driving Price Targets Higher?

Standard Chartered recently made waves with their upgraded ETH forecast: $7,500 by December 2025, $12,000 in 2026, and a staggering $25,000 longer-term. While those numbers might sound outrageous to some, they're based on concrete supply-demand dynamics. Consider this:

| Factor | Current Status | Implication |

|---|---|---|

| Price vs 20MA | 15.4% premium | Bullish momentum intact |

| MACD Trend | Converging | Bearish pressure fading |

| ETF Flows | $729M daily | Sustained institutional demand |

The supply shock is real. Between ETFs and corporate treasuries, about 8% of ETH's circulating supply is now effectively locked up. On peak days, ETF purchases have absorbed 3.2 times Ethereum's daily issuance. This creates a structural imbalance where demand vastly outstrips available supply - especially when you consider that many long-term holders refuse to sell at these prices.

Validator Exodus: A Hidden Catalyst for ETH's Next Move

Here's an interesting wrinkle in the ETH story that most retail investors are missing: the validator exit queue has ballooned to $3.2 billion worth of ETH waiting to be unstaked. At first glance, this might seem bearish - why are so many validators rushing for the exits?

The reality is more nuanced. Many of these validators originally staked when ETH was below $2,000 and are simply taking profits after the recent rally. But here's the kicker: much of this unstaked ETH isn't hitting exchanges. Instead, it's migrating to liquid staking protocols or being scooped up by institutional validators. This creates a fascinating dynamic where sell pressure gets absorbed almost instantly.

Ethereum vs. Bitcoin: The 2025 Performance Gap

While bitcoin gets most of the mainstream attention, ETH has quietly been outperforming BTC by 124% since April's market bottom. This isn't just a short-term fluke - it reflects Ethereum's growing utility beyond being a simple store of value. From DeFi to NFTs to enterprise blockchain solutions, ETH's use cases continue expanding while its supply becomes increasingly constrained post-Merge.

Fundstrat recently called Ethereum "the biggest macro trade for the next decade," forecasting $12,000 by year-end. Whether that prediction comes true remains to be seen, but the underlying thesis is sound: Ethereum isn't just digital gold, it's the foundation for an entire digital economy.

FAQ: Your Burning Ethereum Questions Answered

What's driving Ethereum's price surge in 2025?

The current rally stems from three main factors: 1) Record institutional inflows into ETH ETFs, 2) Corporate treasuries accumulating ETH as a strategic asset, and 3) Technical breakout above key resistance levels creating FOMO among traders.

How likely is ETH to hit $5,000 soon?

With current momentum and the supply squeeze from institutional demand, many analysts believe $5,000 is more a question of "when" than "if." The absence of major resistance until the all-time high at $4,865 suggests the path is clear for further upside.

Should I be worried about Ethereum being overbought?

While ETH is technically overbought on short-term indicators, strong uptrends can remain overbought for extended periods. The key difference this time is institutional participation, which tends to create more sustained moves than retail-driven rallies.

What's the biggest risk to Ethereum's rally?

The main risk would be a sudden drop in institutional demand or broader market downturn. However, with ETFs now providing a regulated on-ramp for traditional investors, the demand profile for ETH appears more stable than in previous cycles.