SOL Price Prediction 2025: Can SOL Surge Past $200 With Bullish Indicators and Ecosystem Expansion?

- Why Is Solana Gaining Momentum in August 2025?

- Technical Analysis: Is SOL Primed for a Breakout?

- What's Driving Institutional Interest in Solana?

- Ecosystem Growth: More Than Just Price Action

- Potential Roadblocks to Watch

- Expert Take: BTCC's Perspective

- SOL Price Prediction FAQ

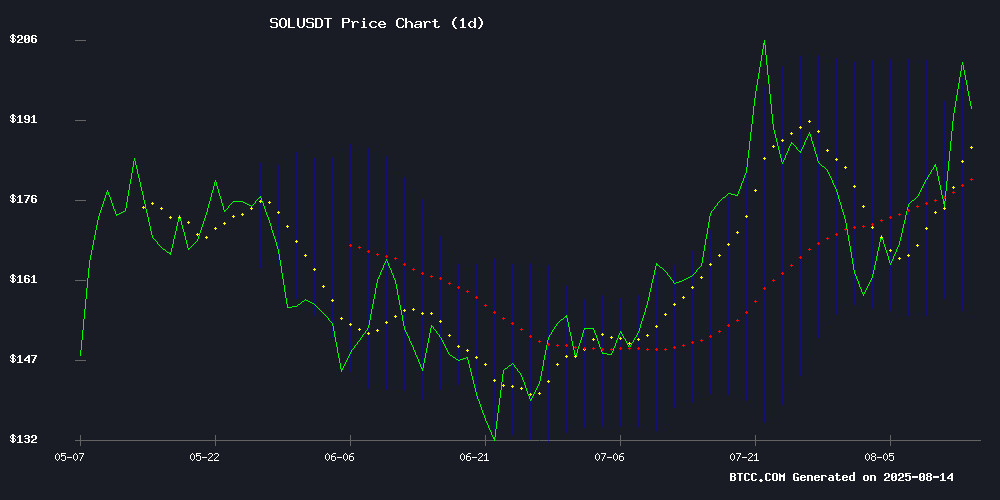

Solana (SOL) is making waves in the crypto market as it flirts with the $200 mark, backed by strong technical indicators and a rapidly growing ecosystem. Currently trading at $192.75, SOL has shown remarkable resilience above its 20-day moving average of $177.43. The MACD indicator hints at bullish momentum despite a negative histogram, while the upper Bollinger Band at $199.63 presents immediate resistance. With institutional interest growing through ETF filings and major partnerships like Coinbase-Squads, plus network activity hitting four-month highs, analysts are bullish about SOL's potential to break $200 and possibly reach $225. However, failure to hold $185 support could delay this upward trajectory.

Why Is Solana Gaining Momentum in August 2025?

The solana ecosystem is firing on all cylinders this August. Whale activity shows both profit-taking and new deposits (like $8.19M moved to Bybit), indicating confidence in SOL's fundamentals. Institutional players are jumping in too - Nasdaq-listed Upexi just appointed Arthur Hayes to lead their Solana strategy while holding over 2 million SOL in treasury. Meanwhile, the SEC's review of Invesco Galaxy's spot SOL ETF application adds legitimacy to the asset class. Network metrics tell the same story: stablecoin volume hit $1.2B (4-month high) and daily revenue peaked at $163,400. It's not just speculation driving this - real adoption is accelerating with projects like KeepSolid's new KS Coin loyalty program building on Solana.

Technical Analysis: Is SOL Primed for a Breakout?

Looking at the charts, SOL's technical setup looks promising. The price sits comfortably above all key moving averages - a classic bullish sign. While the MACD histogram shows -2.7051, both the MACD line (2.6912) and signal line (5.3963) remain positive. The RSI at 67 suggests strong momentum without being overbought. "SOL's approach toward the upper Bollinger Band at $199.63 shows serious buying pressure," notes Michael from BTCC's analysis team. "A clean break above $200 could open the path to $225, especially with OBV showing $607M in sustained demand." The 20-day MA at $177.43 should act as strong support if profit-taking emerges.

What's Driving Institutional Interest in Solana?

Institutions aren't just watching - they're placing big bets on Solana. Upexi's massive SOL holdings and Hayes' appointment signal long-term confidence. The ETF race is heating up too, with Invesco Galaxy's filing now under SEC review alongside applications from VanEck and Fidelity. These developments build on Solana's growing reputation as a serious blockchain contender, especially after the Coinbase-Squads partnership to boost USDC adoption. Solana now ranks fourth in stablecoin supply - not bad for a network that was written off after the FTX collapse. With CME-listed futures providing price discovery, institutions have the tools they need to engage with SOL seriously.

| Metric | Value | Significance |

|---|---|---|

| Price (Aug 15, 2025) | $192.75 | 4% below $200 target |

| 20-day MA | $177.43 | Strong support base |

| Upper Bollinger | $199.63 | Immediate resistance |

| RSI (Daily) | 67 | Bullish but not overbought |

Ecosystem Growth: More Than Just Price Action

Beyond the charts, Solana's fundamentals are strengthening. The KeepSolid KS Coin launch shows how builders are creating real utility - not just memecoins. Their loyalty program rewards users for engaging with privacy tools, blending crypto with practical applications. Network activity metrics confirm this isn't just hype - first-time SOL addresses jumped 51% since August 3 according to Glassnode. That's new money entering the ecosystem, not just existing holders reshuffling bags. With daily transactions climbing and revenue hitting $163k, Solana's proving it can generate real value beyond speculative trading.

Potential Roadblocks to Watch

It's not all sunshine though. That whale moving $8.19M to Bybit took $2.93M in profits - smart money knows when to take chips off the table. The SEC's ETF review process remains unpredictable despite political tailwinds. And while the RSI isn't overbought yet, a push above 70 could trigger short-term pullbacks. Technically, losing the $185 support WOULD be concerning - it might signal that the $200 breakout needs more time to develop. As always in crypto, volatility works both ways.

Expert Take: BTCC's Perspective

"The combination of technical strength and fundamental catalysts creates perfect conditions for SOL to challenge $200," says Michael from BTCC. "The Coinbase-Squads partnership and new KS Coin rewards add real ecosystem depth beyond just price speculation." He notes that while profit-taking may cause volatility NEAR psychological resistance levels, the overall trajectory favors upside. The key watchpoint remains whether SOL can hold above $185 on any pullbacks.

SOL Price Prediction FAQ

What is SOL's price prediction for August 2025?

Based on current technicals and ecosystem growth, SOL has strong potential to test $200 in August 2025. A clean break could open the path toward $225, though failure to hold $185 support might delay this move.

Is Solana a good investment in 2025?

Solana shows promising fundamentals with growing institutional adoption and real ecosystem development. However, as with all crypto investments, volatility remains high. This article does not constitute investment advice.

What's driving SOL's price increase?

Key drivers include: bullish technical indicators, institutional ETF interest, major partnerships like Coinbase-Squads, and growing network activity with stablecoin volume hitting $1.2B.

How does Solana compare to Ethereum?

While ethereum remains the leader in DeFi, Solana offers faster transactions and lower fees. Its growing stablecoin presence and institutional interest make it a serious contender in the layer-1 space.

What are the risks to SOL's price growth?

Potential risks include: regulatory uncertainty around ETFs, profit-taking by large holders, technical rejection at $200 resistance, and broader market downturns affecting crypto sentiment.