Crypto Whales Abandon Ethereum for Cardano: The Billion-Dollar Bet You Can’t Ignore

Crypto's elite are flipping the script—Ethereum's loss is Cardano's gain. Here's why the smart money's shifting.

Whale watching just got interesting. While retail traders chase memecoins, the big players are quietly executing a seismic portfolio shuffle. Ethereum, once the undisputed king of altcoins, is seeing outflows that'd make a centralized exchange blush. Meanwhile, Cardano's stacking up institutional interest like DeFi protocols stack yield.

The new math: ADA's tech stack beats ETH's gas fees. Cardano's proof-of-stake mechanism isn't just greener—it's becoming the playground for whales tired of Ethereum's 'work in progress' vibe. Ouroboros consensus? More like ouro-boring for competitors.

Behind the move: Cardano's hitting milestones while Ethereum's roadmap reads like a blockchain version of 'The NeverEnding Story.' Smart contracts? Check. Scalability? Getting there. Meanwhile, ETH 2.0's become the crypto equivalent of airport construction—always 6 months away.

The kicker? This isn't diversification—it's a calculated bet that the third-generation blockchain learned from Ethereum's mistakes. Because nothing warms a whale's heart like watching their bags appreciate while others pay $200 transaction fees. Just don't tell the 'ETH maxis'—they're still waiting for their gas refunds.

Diverging Paths — ETH Whales Slowly Exit, While ADA Giants Enter

In a recent post on X, the social media platform, Alphractal CEO & founder Joao Wedson shared on-chain insights into a growing divergence in the activities of ethereum and Cardano’s whales.

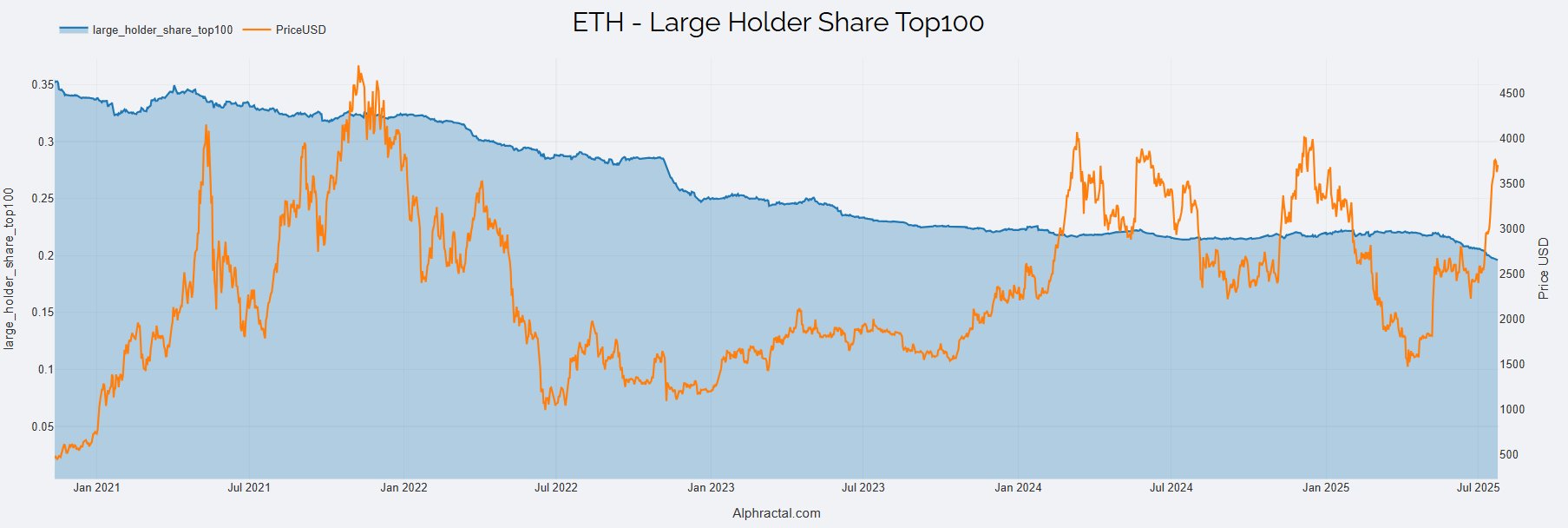

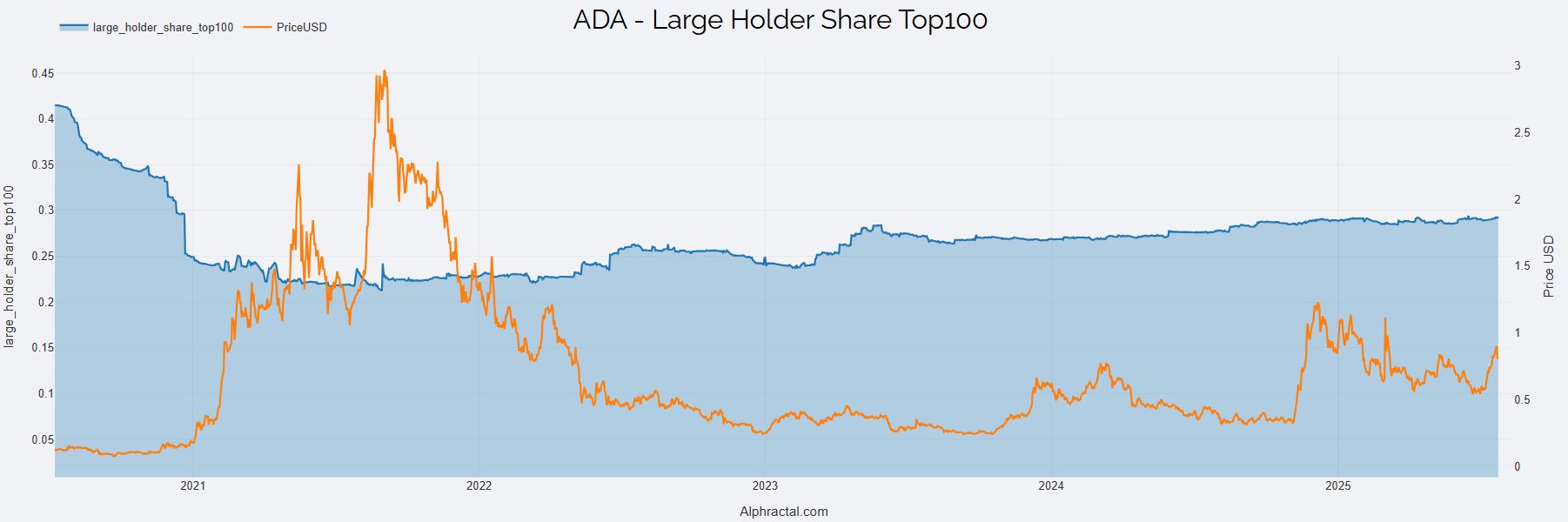

The relevant indicators here are the ETH and ADA Large Holder Share Top100 metrics, which track the percentage of Ethereum’s and Cardano’s total supplies held by the top largest wallets. This metric is particularly useful in figuring out if the major holders are accumulating or distributing their coins.

In the post on X, Wedson pointed out that the top 100 holders of Ether tokens have been consistently reducing their holdings. The analyst explained that, since May, their share of the Ethereum supply has dropped from 22% to about 19.6%. This means that the holdings of the large investors have decreased by 2.9 million ETH in that period.

On the other hand, Wedson highlighted that the top 100 holders of ADA have been “steadily accumulating day by day.” He explained that this signals confidence in the token and could be a sign that strategic positionings are occurring in anticipation of future bullish rallies.

What Could This Mean?

The crypto pundit went on to point out that these large addresses are associated with exchanges, but it does not take away the fact that Cardano seems more attractive at the moment. “From this perspective, Cardano currently looks more attractive based on large player behavior,” Wedson said.

In what seemed like salient advice, Wedson rehashed the importance of closely following the smart moves these crypto whales make, as they may reveal where the market is headed.

At press time, Ethereum, the “king of altcoins”, is valued at about $3,766, reflecting a 0.6% price increase in the past 24 hours. According to CoinGecko data, the price of ETH has had a slightly impressive performance of over 3% in the past week.

Cardano, on the other hand, is worth $0.8297, reflecting a mere 0.6% price jump in the past 24 hours. ADA’s 7-day action was also barely impressive, ending the week with about a 1.5% loss of its value.