Ethereum’s Potential Surge: What If Bitcoin Rockets to $120K Again?

When Bitcoin sneezes, the crypto market catches a cold—but Ethereum might just sprint ahead. With BTC eyeing a return to $120K, ETH's price trajectory could defy expectations.

Here's the breakdown:

The Bitcoin Effect

BTC at $120K isn't just a number—it's a tidal wave of liquidity. Ethereum, as the de facto leader of altcoins, historically rides Bitcoin's coattails... but with smarter contracts.

Ethereum's Secret Sauce

While Bitcoin maxis nap on their private keys, ETH's ecosystem keeps evolving. DeFi, NFTs, and layer-2 solutions turn speculation into utility—or at least, the illusion of it.

The Cynic's Corner

Let's face it: crypto valuations are 10% tech and 90% hopium. But if the market's buying, who's selling logic?

One thing's certain—if BTC hits $120K again, Ethereum won't just follow. It'll rewrite the playbook.

Ethereum demonstrated a significant degree of correlation with Bitcoin’s price action over the last few weeks This was despite BTC dominance’s retreat while ETH dominance rose.

The correlation between the two major cryptos meant that ethereum will likely continue extending its upside if BTC does the same.

But Will a BTC rally back above $120,000 allow ETH to push above $4,000 and possibly higher?

One analyst pointed out that ETH will likely push above $4000 if Bitcoin soars back above $120,000. He also noted that the cryptocurrency’s latest correction was not as severe as expected.

That outcome was revealed that ETH holders were still optimistic about its upside potential despite the recent cooldown in bullish momentum.

ETH price experienced some sell pressure in the first half of the week with price dipping as low as $3507. It was back above $3,700 at the time of observation, courtesy of a demand resurgence since Thursday.

Is Smart Money Still in Favor of Ethereum?

Although Ethereum bulls seem to have taken a recess recently, market data still revealed that smart money remained active.

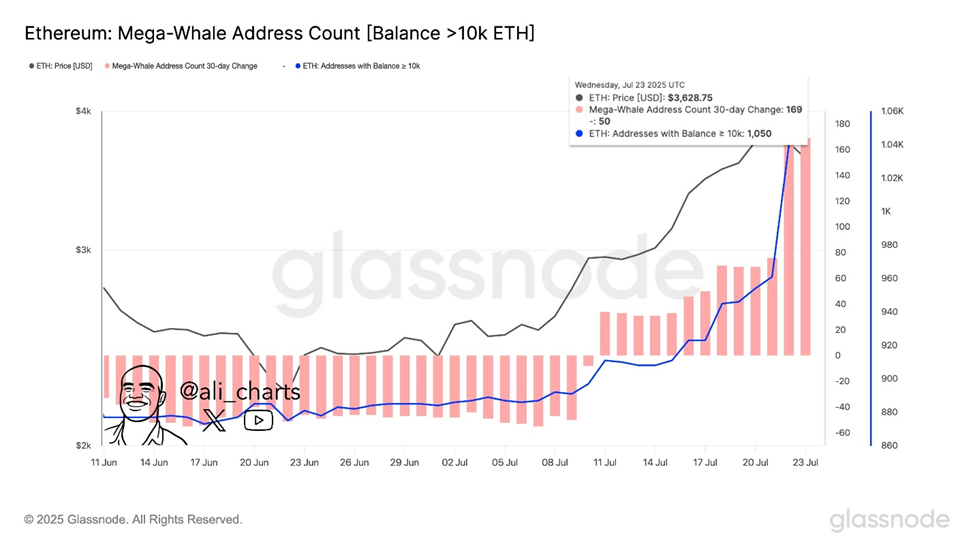

According to Glassnode, the number of whale addresses holding over 10,000 BTC ROSE drastically since the second week of July.

The number of addresses in the same category went up by 50 addresses in the last 30 days to about 1050 addresses at the time of observation.

The data revealed that the top 1% of ETH holders were busy accumulating more coins.

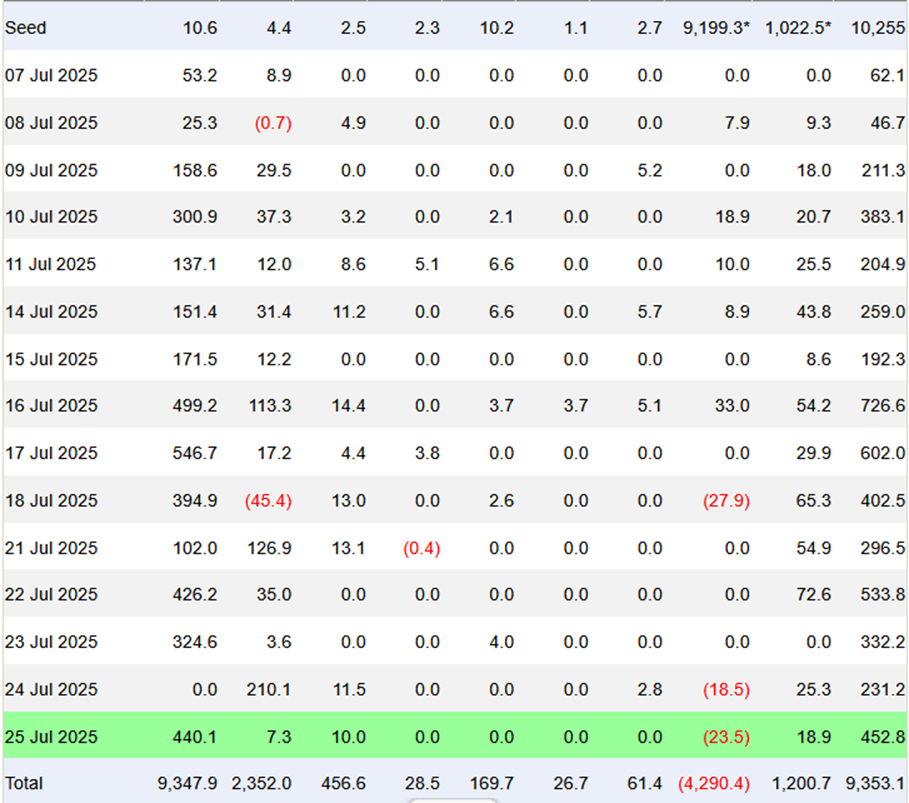

Institutional interest in Ethereum also remained robust despite the recent sideways price movement. Ethereum ETFs just concluded yet another week of sustained inflows.

Institutions injected over $1.8 billion worth of liquidity into Ethereum spot ETFs. The sustained inflows combined with healthy inflows from whales may explain why ETH managed to avoid more downside.

The sustained Ethereum ETF inflows also revealed that institutions maintained their conviction regarding ETH’s potential upside. In other words, ETH could easily push well above $4,000.

Analysts have particularly been keen on ETH price potential to push to new ATHs sometime soon. Some speculated that it could soon rally to $5,000.

$ETH about the make a massive run to $5k and the altcoin season doubters will be left speechless as altcoins go BANANAS!

— Dan Gambardello (@cryptorecruitr) July 24, 2025Will ETH Break Though its Long-term Wedge Pattern?

Zooming out on ETH price action revealed that ETH has been trading in a long term wedge or triangle pattern. It was underpinned by ascending support and descending resistance.

More importantly, ETH’s latest upside was coming up for another retest of the aforementioned support. The retest was on track to occur above the $3,900 price tag.

The observed surge in large Ethereum whale activity suggested a high probability that the cryptocurrency may go for a retest before end of July.

However, supply and demand characteristics in the coming week will determine whether price will break out from the wedge pattern or retrace in favor of more downside.

A breakout will confirm ETH’s momentum and potential to push to new highs. Such an outcome could potentially lead to a massive liquidation event for the bears.

However, it was worth noting that strong wave of sell pressure will pave the way for another retracement.

This is the main reason why ETH analysts were eager to see how demand and supply forces will play out in the last week of July.

The last time a tariff war broke out, ETH and other cryptocurrencies experience heavy outflows. Trump’s tariff war 2.0 is slated to kick off in the first week of August.

This could factor alone could potentially have an impact on crypto liquidity in the coming week.