Bitcoin Whales Flood Exchanges: What’s Behind the Sudden Surge?

Big money moves fast—and right now, it's swimming toward crypto trading platforms at a staggering pace. Bitcoin whales are dumping stacks into exchanges, sparking speculation and sweaty palms across the market.

The pump before the dump? Whale activity often signals major price swings. Are these deep-pocketed traders prepping to cash out—or just rearranging deck chairs on the crypto Titanic?

Liquidity or leverage? Exchange inflows can mean two things: whales seeking quick exits, or traders juicing positions with borrowed cash. Either way, volatility’s back on the menu.

Wall Street’s ‘risk managers’ are probably still drawing crayon lines on charts to explain this. Meanwhile, the OGs know—when whales move, retail traders get the crumbs.

Large Holders Moving Bitcoin To Exchanges

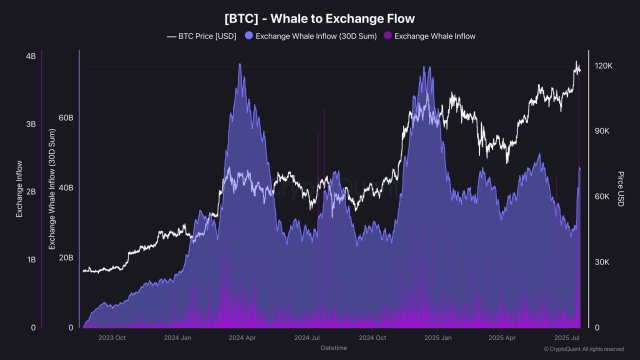

While Bitcoin has demonstrated a powerful rally, a worrying trend has been observed among whales or large holders. Darkfost, a market expert and verified author, shared a report on X that revealed that BTC whales are on the move once again, with a sharp uptick in large-scale inflows to crypto exchanges.

This rise in whale inflows to crypto exchanges signals renewed activity among major BTC holders. Such a development typically occurs before increased market volatility because large volumes of bitcoin being transferred to exchanges may indicate upcoming sell-offs or deliberate repositioning.

According to the market expert, over $75 billion in inflows occurred at the last two market peaks, signaling the start of a correction and consolidation phase. The development has raised concerns about the sustainability of the ongoing upward trend due to the risk of potential sell-offs.

Presently, the average monthly influx of whales has increased from $28 billion to $45 billion, a significant $17 billion increase. Data shared by Darkfost reveals that this sharp increase in inflows was recorded within 4 days, particularly from July 14 to 18.

Darkfost noted that this surge was likely triggered by the recent movement of 80,000 BTC to exchanges. Meanwhile, the whales seem to have taken advantage of Bitcoin’s rally to new ATH to lock in some profits. Historically, large inflows to crypto exchanges have shaped the next big MOVE for Bitcoin, bringing the ongoing trend to a critical junction.

In the daily inflows, the expert outlined a clear decline, which is something he believes should be carefully monitored, as whales have the ability to apply strong selling pressure, as demonstrated by the last two tops. Should this trend continue, Darkfost is confident the overall selling pressure may be lessened.

A Rising Profit-Taking Or Capital Rotation?

Glassnode, a leading on-chain data and financial platform, reported that transfers from Bitcoin whales to exchanges are accelerating on the 7-day Simple Moving Average (SMA). This rising transfer volumes points to a potential shift in market dynamics and sentiment among high-net-worth investors.

The report showed that the 7-day SMA is getting close to 12,000 BTC, which is one of the largest volumes this year and similar to the peak in early November 2024. Even though transfers from BTC whales to crypto exchanges have risen sharply, it is still below last year’s peak. However, it could be an indication of capital rotation or rising profit-taking among these big investors.