BTCC Crypto Daily (7.21)|Anticipation Builds Ahead of Crypto Policy Report, Bitcoin Consolidates in Search of Breakout

1.Overview

- White House’s first crypto policy report to be released on July 22

- Lutnick: Powell keeps interest rates too high

- Cooper Research: Bitcoin surge to $150K in October is “inevitable”

2.Macro & Policy Outlook

Key Events Today

- Results of Japan’s 27th Upper House Election

- US June Conference Board Leading Economic Index (Previous: -0.1%)

- New Zealand Q2 CPI YoY (Previous: 2.5%, Current: 2.7%)

Global Macro Developments

1. US Treasury: Dollar to be “on-chained”; GENIUS Act reinforces reserve currency status

US Treasury Secretary Bessent posted on X that blockchain technology will power next-gen payments and that the dollar is set to go “on-chain.” He credited the Trump administration and Congress for advancing the GENIUS Act, which he said would reinforce the dollar’s role as the global reserve currency for generations. Deputy Treasury Secretary Michael Faulkender added that the act provides legal clarity for stablecoins and enhances the speed, affordability, and security of digital dollar transactions, furthering the U.S. commitment to becoming a global crypto-financial hub.

2. White House to release first crypto policy report on July 22

The White House Digital Asset Market Task Force will release its first crypto policy report on July 22, 2025. Led by David Sacks, a former PayPal executive and head of AI & crypto policy, the report was co-drafted with 11 federal agencies, including the Treasury, Commerce Department, SEC, and CFTC. It is expected to propose a federal stablecoin regulatory framework, a national Bitcoin strategic reserve, and guaranteed fair banking access for crypto firms — potentially aligning with the recently passed GENIUS Act.

3. JPMorgan to charge data aggregators

According to Reuters and Bloomberg, JPMorgan plans to charge data aggregators like Plaid and MX a fee each time users move funds to crypto wallets or third-party services like Robinhood. This fee aims to cover cybersecurity costs but may significantly raise operating costs for fintech and crypto platforms, possibly burdening consumers and triggering regulatory scrutiny.

4. Commerce Secretary Lutnick: Powell keeps rates too high; August 1 tariff deadline approaching

U.S. Commerce Secretary Howard Lutnick criticized Fed Chair Powell for keeping interest rates excessively high, warning of economic strain. He emphasized that August 1 marks the deadline for implementing a 10% baseline tariff on smaller economies. Lutnick also projected that Trump will renegotiate the USMCA and expressed confidence in reaching a trade deal with the EU.

5. LSE explores 24-hour trading model

The Financial Times reports that the London Stock Exchange Group (LSEG) is evaluating the launch of 24-hour equity trading to meet growing demand for round-the-clock global access. If adopted, LSEG would become the first major Western exchange to implement continuous trading — potentially prompting peers to follow suit.

Traditional Asset Correlation

- Nasdaq +0.22%, S&P 500 -0.35%, Dow -0.85%

- Spot Gold +0.25% at $3,352.19/oz

- WTI Crude (USOIL) +0.15% at $66.32/bbl

3.Crypto Market Snapshot

1. Spot Performance of Major Cryptocurrencies

(as of July 21, 14:00 HKT)

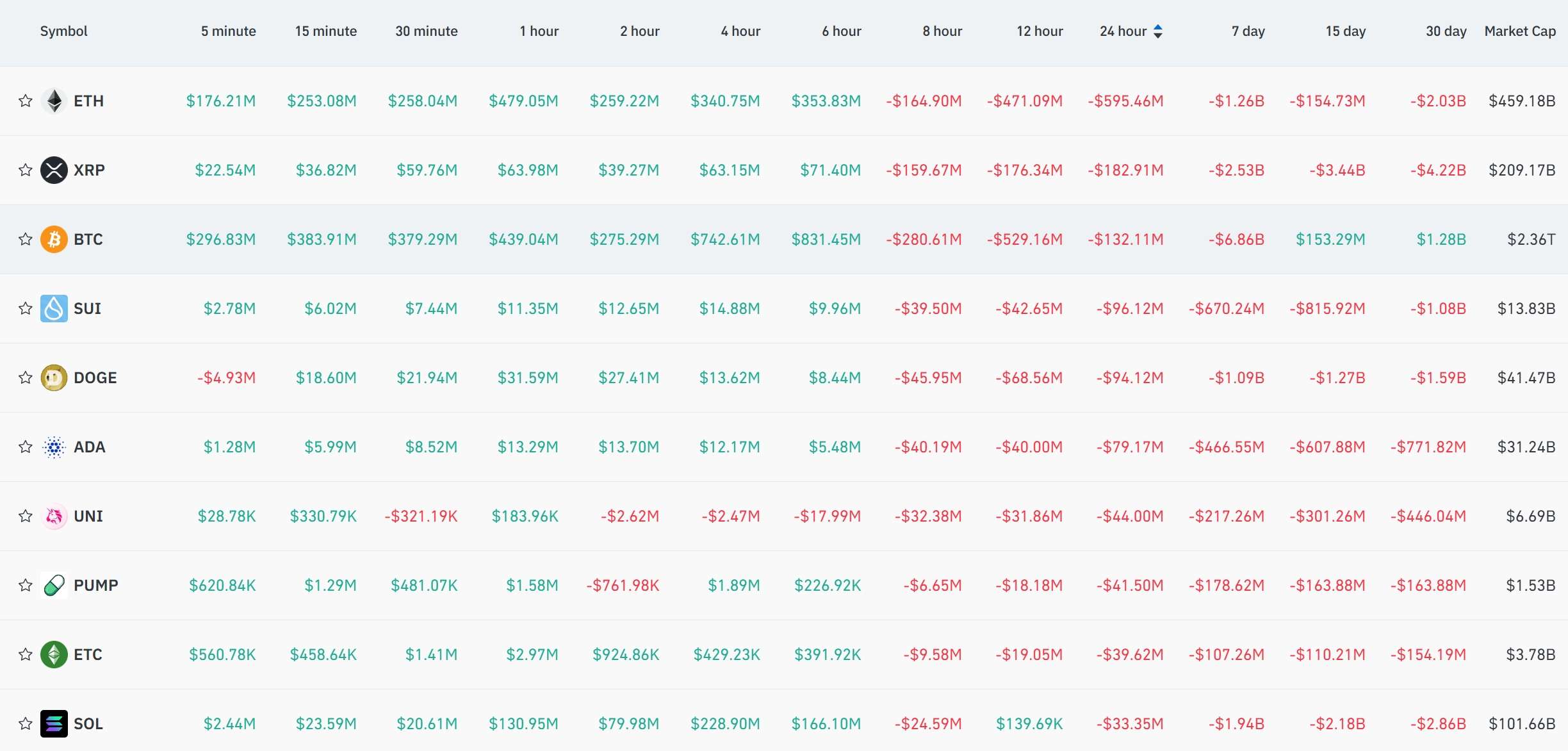

2.Futures Capital Flow Analysis

According to Coinglass (July 21), ETH, XRP, BTC, SUI, DOGE, and ADA recorded the largest net outflows from futures contracts in the past 24 hours, indicating possible trading opportunities.

3. Bitcoin Liquidation Map

As of July 21, with BTC trading around $118,605, Coinglass data shows that if BTC drops below $115,000, total long liquidations across major CEXs could reach $1.358 billion. Conversely, a breakout above $120,000 could trigger short liquidations of up to $1.494 billion. Traders are advised to manage leverage prudently to avoid mass liquidations during price swings.

4. Bitcoin Long/Short Ratio

As of 14:00 HKT on July 21, the BTC long/short ratio stands at 1.324, with longs at 56.97% and shorts at 43.03% (Coinglass).

5. On-Chain Monitoring

- According to Lookonchain, a whale address that accumulated ~1,500 BTC between 2023 and 2024 has transferred 400 BTC to an exchange, potentially for profit-taking or partial liquidation.

- Another whale address (0x4a20) reportedly holds $121M in long positions on Hyperliquid, including ETH (25x leverage), BTC (40x), HYPE (10x), and PEPE (10x). Unrealized profit stands at ~$1.14M.

4.Blockchain Headlines

- Bitcoin dominance drops below 2024 peak

- Total NFT market cap surpasses $6 billion

- Ethereum launches “The Torch” NFT to commemorate its 10th anniversary

- Block Inc. to join the S&P 500 on July 23

- Vitalik Buterin: ~50% support for raising Ethereum L1 gas limit to 45 million

- Bank lobbying group urges OCC to pause crypto bank charter approvals

- Rich Dad author: “Bubbles always burst — will buy more BTC if it drops”

- CoinDesk parent Bullish rumored to face financial headwinds amid IPO plans

- Minsheng Securities: Stablecoins may enable on-chain trading of traditional financial assets

- Bitcoin Core devs fix a 5-year-old disk-filling bug

- Analysis: Miner and whale selling during BTC rally may signal local top

- Analysis: RWA growth may cause regulatory challenges, short-term USD credit expansion

- Trump praises Coin Center executive for “best BTC explanation ever”

- Trump: “I understand the implications of firing Powell — no one needs to explain it to me”

- VanEck and others urge SEC to approve ETH staking ETFs using FIFO order

- Institutions: U.S.-Indonesia tariff deal may ease shocks, spur reforms

5.Institutional Insights · Daily Picks

- Cooper Research: Every 10,000 BTC added to ETF holdings raises BTC price by ~1.8%; October rally to $150K seen as “inevitable.”

- BofA Merrill Lynch: Stablecoins will disrupt bank deposits and payments over the next 2–3 years; banks face critical strategic choice.

- Presto Research: Institutional inflows are driving BTC and ETH rebound, but profit-taking from old wallets may trigger volatility; altcoin outlook remains uncertain.

6.BTCC Exclusive Market Analysis

Bitcoin is consolidating around the $118,000 mark. Early in the session, it rallied from short-term support to break out of its recent trading range, unleashing bullish momentum. However, it encountered selling pressure near the upper Bollinger Band, with weakening follow-through on the buy side. Price is now moving sideways near key resistance, with alternating candles signaling indecision, narrowing volatility, and a critical phase of capital distribution.

From a technical perspective, the Bollinger Bands are flattening amid price consolidation. BTC has repeatedly bounced off the mid-band but failed to hold above the upper band. MACD remains in a bullish crossover, but the histogram is shrinking, and the signal lines are converging — indicating fading bullish momentum without clear directional breakout confirmation.

The market is now awaiting the upcoming White House crypto policy report, which is expected to outline federal stablecoin regulations, a national Bitcoin reserve strategy, and more. Current price consolidation reflects cautious sentiment as investors await potential policy cues.

Short-term traders may consider range-based strategies: short near upper resistance, long near lower support, and adopt quick in/out execution to avoid whipsaws. Mid-term traders are advised to wait for Bollinger Band expansion or a MACD volume breakout aligned with price action before entering trend-following positions.

Risk Warning: The content above is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and be aware of the high risks associated with cryptocurrency trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]