Bitcoin’s Unprecedented Bull Run Defies Expectations as Network Activity Dwindles

Bitcoin's latest bull market is rewriting the playbook—but not in the way anyone predicted. While prices soar, the network's heartbeat falters.

The ghost town blockchain paradox

Miners keep securing transactions, yet the streets feel emptier than a Wall Street bank on moral grounds. Where are the users? Where's the frenzy? This isn't your 2021 hype cycle.

Institutional silence speaks volumes

Whales accumulate quietly while retail investors—traditionally the bull market's cheerleaders—remain sidelined. Maybe they're all too busy arguing about shitcoins on CT.

When fundamentals and price action diverge this sharply, someone's bluffing. And in crypto, the house always wins... until it doesn't.

Unlike Past Bull Cycles, Bitcoin Network Activity Falters

After reclaiming beyond the $100,000 landmark, Bitcoin’s bull cycle looks like it is still on. However, the current Bitcoin bull cycle is deviating from historical norms because of an unanticipated dip in on-chain activity rather than price action.

Darkfost, a verified author on CryptoQuant and market expert, has underlined the disparity between this cycle and past cycles in a research shared on the X platform. “We’ve often heard that this cycle feels different, and when it comes to bitcoin network activity, it truly is,” the expert stated.

Unlike earlier bull cycles that were accompanied by a high number of transactions, skyrocketing address growth, and soaring network fees, this cycle is taking place on a rather quiet blockchain action.

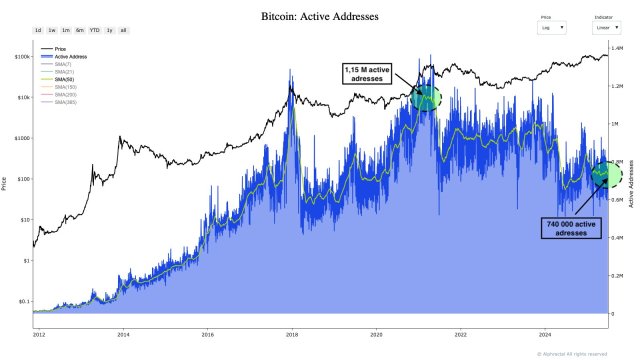

According to the on-chain expert, this is the first bull market cycle of Bitcoin where there is no increase in on-chain activity, reflecting a shift in the historical trend. The expert has delved into BTC’s active address count, revealing a persistent drop.

Data shows that the number of BTC active addresses has been steadily declining since its peak in 2021 during the bull cycle. Despite BTC’s notable upward performance this cycle, fewer wallets appear to be interacting with the network, which is an indication of fading on-chain participation.

In 2021, BTC’s active addresses reached a high of 1.5 million, but the figure has since fallen to 740,000 addresses. This steady decline in active addresses raises concerns about the sustainability of the current rally.

Spot BTC ETFs Influencing Investment In The Asset

Historically, activity on the Bitcoin network tends to resume its growth after a bear market phase. However, this has not been the case for the leading blockchain since 2023. During the inception of the Bitcoin Spot Exchange-Traded Funds (ETFs), a sharp drop in network activity was also observed.

Addressing the 2024 decline, Darkfost stated that many investors may be opting to obtain exposure through ETFs rather than directly holding BTC. By doing so, these investors might steer clear of the security dangers associated with self-custody and the complexity of managing transactions.

Considering this shift, it could be said that the introduction of spot Bitcoin ETFs may have had a significant impact on how investors invest in BTC, with obvious ramifications for on-chain measures. As the number of active addresses continues to decrease, speculations are whether the ongoing rally is relying more on speculative flows or institutional demand rather than broad user participation.