Bitcoin Long-Term Holders Gobble Up 1.15M BTC – Diamond Hands or Impending Sell-Off?

Bitcoin''s veteran HODLers just stacked another 1.15 million coins—enough to make Wall Street''s ''diversified'' portfolios blush. Are they doubling down or preparing to cash out?

The whale watch begins: With institutional FOMO at ATHs and retail traders still chasing memecoins, LTHs now control enough supply to trigger seismic price swings. Will they hodl through the next 50% correction or fold like a cheap suit?

Meanwhile, traditional finance bros insist ''this time it''s different'' while quietly updating their LinkedIn bios to ''Web3 enthusiast''. The irony writes itself.

Bitcoin Prepares To Move As LTH Signal Strength

Bitcoin is poised to enter a phase of price discovery, potentially signaling an explosive move that could reshape the entire cryptocurrency market. As of Tuesday, June 10, 2025, BTC is consolidating NEAR its all-time high (ATH) of $112,000, a critical juncture that could dictate its next direction. This week promises to be decisive, with the market teetering between an expansion into uncharted territory above $112,000 or a pullback to clear liquidity below $105,000.

Macroeconomic uncertainty continues to fuel volatility across financial markets, with the U.S. economy exhibiting increased systemic risks. Rising US Treasury yields are adding pressure, amplifying the stakes for BTC’s next move.

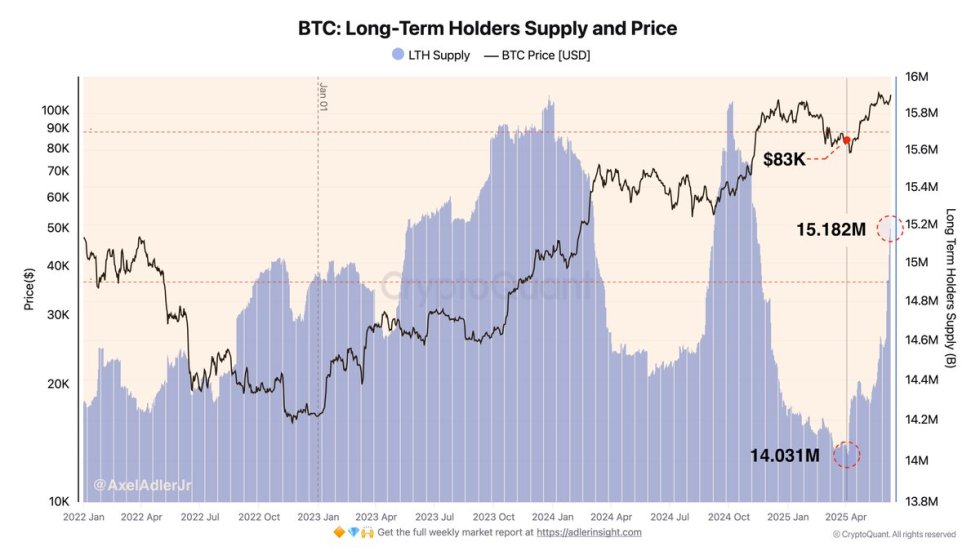

Top analyst Axel Adler recently provided valuable insights, highlighting the robust accumulation by Long-Term Holders (LTHs). Starting from the $83,000 level, the LTH cohort has grown from 14.031 million to 15.182 million BTC, an increase of 1.151 million BTC, currently valued at approximately $125.4 billion. These coins were amassed in the $61K–$83K range, with an average entry price of around $72,000.

The LTHs now enjoy an unrealized profit of about $42.5 billion, representing a 51% gain above their cost basis. This significant holding increase reflects strong confidence in Bitcoin’s long-term potential, potentially acting as a stabilizing force during this consolidation phase. Whether BTC breaks out to new highs or retreats to test lower support, the LTH accumulation suggests a solid foundation.

BTC Consolidates Below Price Discovery

Bitcoin is trading at $109,546 on the daily chart, consolidating just below the $112,000 all-time high after reclaiming the $109,300 resistance level. The price action shows a strong recovery from last week’s dip to the $103,600 support, a level that continues to act as a key pivot during periods of volatility. This clean bounce from support, followed by multiple higher lows, keeps the overall structure bullish.

The 50-day simple moving average (SMA) at $102,409 continues to rise, offering additional support just above the $100K psychological level. Meanwhile, the 100 and 200 SMAs at $93,237 and $95,419 remain well below the current price, highlighting Bitcoin’s dominant trend strength.

Volume has been steady, and the price is now pressing against the upper range, suggesting the market is coiling for a decisive move. A daily close above $112K WOULD signal breakout confirmation and likely trigger Bitcoin’s entrance into price discovery. However, if BTC fails to reclaim new highs, a sweep back toward $105K–$106K is possible, especially given current macroeconomic headwinds.

Featured image from Grok, chart from TradingView