SEC Chair Champions Crypto-Driven Revolution: The Inevitable Shift to On-Chain Finance

The top U.S. securities regulator just gave a nod to the future—and it's built on a blockchain.

### From Regulator to Reluctant Prophet

In a move that sent shockwaves through both Wall Street and Crypto Twitter, the SEC's chair pivoted from watchdog to visionary. The message was clear: the archaic plumbing of traditional finance is facing its Kodak moment. On-chain systems aren't a fringe experiment anymore; they're the blueprint for a faster, cheaper, and transparent financial infrastructure. The old guard's resistance is starting to look less like prudent caution and more like a losing battle against innovation itself.

### Cutting Out the Middleman (and Their Fees)

This isn't just about new technology—it's a direct assault on legacy business models. On-chain finance bypasses layers of custodians, clearinghouses, and settlement agents. It automates compliance and executes deals in minutes, not days. Imagine a world where asset ownership is indisputable, recorded on a public ledger, and transferable globally without a battalion of intermediaries taking their cut. That's the efficiency play that keeps traditional bankers up at night.

### The Ironic Endorsement

The real story here is the source. For years, the SEC has been crypto's primary antagonist, launching enforcement actions and decrying the "wild west." Now, its leader is effectively outlining the industry's core value proposition. It's a staggering validation that even the most skeptical gatekeepers can't ignore the tectonic shift. The subtext? Adapt or be relegated to irrelevance. After all, what's a regulator without a market to regulate?

The genie isn't just out of the bottle—it's rewriting the rules of the vault. The shift to on-chain finance is no longer a question of 'if,' but 'how soon.' And for an industry built on disrupting rent-seeking middlemen, the ultimate irony would be watching traditional finance finally admit that the crypto crowd had a point all along—probably right before they try to launch their own token.

Crypto Will Put The Future Of Finance On-Chain

Atkins didn’t leave it at vibes. Earlier in the day, Atkins pointed to a staff no-action letter out of the SEC’s Division of Trading and Markets tied to the Depository Trust Company’s (DTC) voluntary tokenization effort — a pilot that effectively gives the plumbing of US securities settlement a carve-out to experiment without immediately tripping over parts of the Exchange Act rulebook.

“Today, the Division of Trading and Markets issued a no-action letter to the Depository Trust Company (DTC) regarding DTC’s voluntary securities tokenization pilot program. DTC’s initiative marks an important step towards on-chain capital markets,” Atkins shared via X.

The letter dated Dec. 11 describes a “pilot version” of what it calls DTCC Tokenization Services — a preliminary, time-limited program that lets DTC participants elect to have certain security entitlements recorded using distributed ledger tech instead of relying solely on DTC’s centralized ledger.

In plain English: eligible participants can tokenize positions, hold them in registered wallets on approved blockchains, and transfer those tokenized entitlements directly to another participant’s registered wallet — with DTC’s official records still serving as the system of record for what’s real.

Atkins added: “On-chain markets will bring greater predictability, transparency, and efficiency for investors. DTC’s participants will now be allowed to transfer tokenized securities directly to the registered wallets of other participants, which will be tracked by DTC’s official records.I’m excited to see the benefits of this program to our financial markets and will continue to encourage market participants to innovate as we move towards on-chain settlement.”

Notably, the no-action relief itself is narrowly scoped: it’s centered on how the pilot interacts with Reg SCI, Section 19(b)/Rule 19b-4, and certain clearing-agency standards — and it’s structured to sunset three years after launch of the preliminary version, with DTC required to notify staff when that launch happens. So this isn’t “tokenized stocks for everyone next week.” It’s closer to a supervised sandbox with reporting hooks.

Notably, Atkins is already pitching what comes next. “But this is just the beginning,” he wrote, saying he wants the SEC to consider an “innovation exemption” that WOULD let market participants begin transitioning on-chain “without being burdened by cumbersome regulatory requirements.”

That line is doing a lot of work, and it’s also where the fight (or at least the lobbying) is likely to concentrate. What qualifies as “innovation”? Who gets exempted, and from which obligations? And what’s the gating factor — investor protection, market integrity, operational resilience, or just politics?

Crypto watchers noticed the tone shift immediately. CryptoQuant CEO Ki Young Ju summed it up in one sentence: “SEC Chairman: The future of finance is on-chain.”

For now, the tangible takeaway is the DTC pilot: a regulated Core market utility experimenting with tokenized representations under staff comfort. The rest — the “on-chain future” language, and the exemption talk — is the part that could either become a framework or just another ambitious headline that runs into the realities of US market structure.

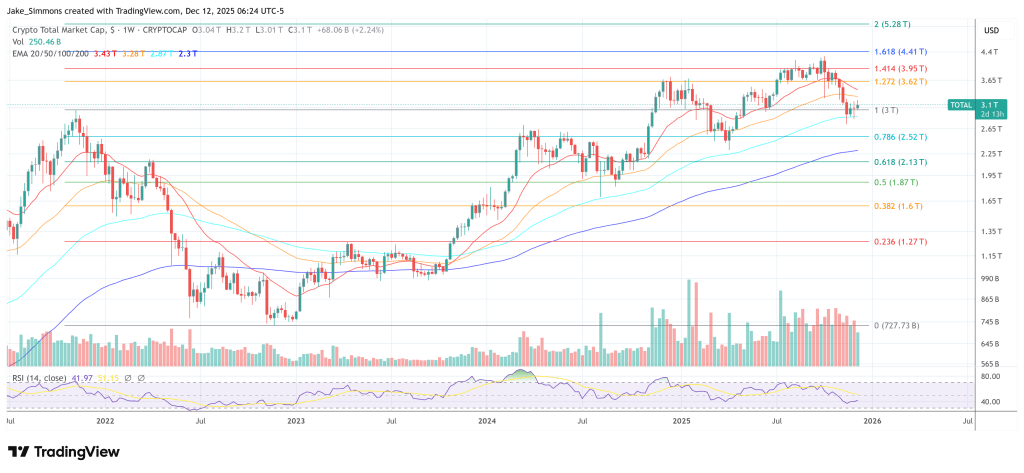

At press time, the total crypto market cap stood at $3.1 trillion.