Half-Billion Dollar Bet: Bitcoin OG Scales Multi-Asset Long To $611 Million

A Bitcoin pioneer just doubled down—hard. Their massive long position now tops $611 million, spanning multiple crypto assets. That's not just conviction; that's a statement.

The Anatomy of a Mega-Bet

Forget dipping a toe. This is a full-scale deployment of capital. The position, which started as a half-billion-dollar wager, has been methodically scaled. The strategy isn't isolated to Bitcoin; it's a multi-asset play, leveraging the interconnected momentum across the crypto ecosystem. It's a classic move from a player who's seen cycles come and go.

Reading the Market's Tea Leaves

What drives someone to commit nine figures? It's a calculus of timing, technicals, and sheer nerve. While traditional finance hedges every potential downturn, this approach embraces volatility as the price of admission. It's a bet that the macro winds—institutional adoption, regulatory clarity, technological maturation—are all blowing in one direction. Sometimes, the smartest trade is the simplest: buy and believe.

The Contrarian's Calculus

In a world of algorithmic traders and robo-advisors, a position this size feels almost archaic. It’s a human decision, fueled by experience and a long-term vision that most quarterly-earnings-obsessed fund managers can't comprehend. It bypasses the noise, focusing on core infrastructure bets and foundational protocols. This isn't chasing memes; it's building a fortress.

A $611 Million Reality Check

Let's be cynical for a second: on Wall Street, this would fund a mid-sized marketing campaign for a new ETF. In crypto, it moves markets and signals sentiment to the entire sector. The scale is a reminder that while the suits are still debating risk exposure, the OGs are busy executing. The bet isn't just on price; it's on the entire thesis of decentralized finance displacing legacy systems—one stubborn, slow-moving institution at a time.

Whale Positioning and Strategic Bids Ahead

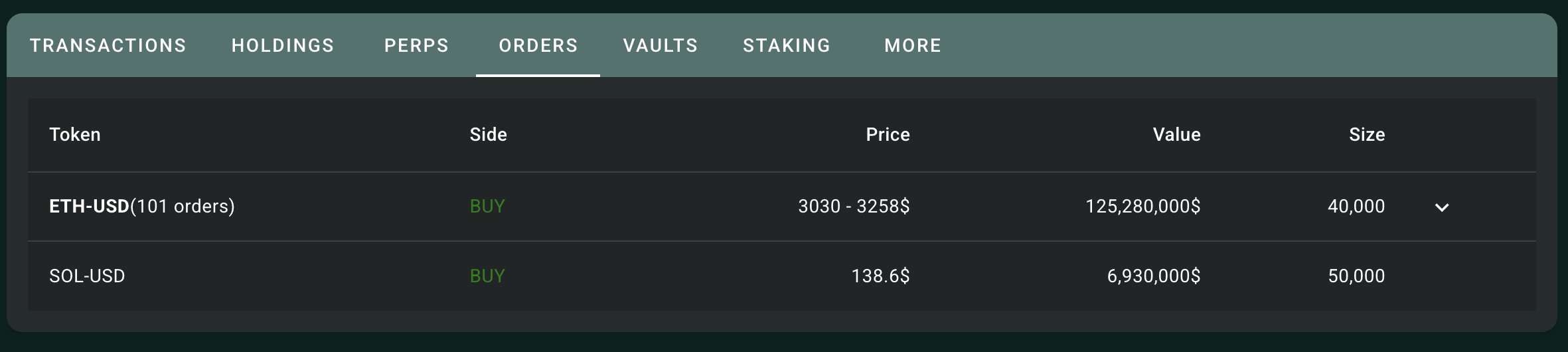

Lookonchain reports, citing Hypurrscan data, that this whale isn’t just holding an already massive multi-asset long position—he is strategically preparing to increase exposure even further. According to the data, he has placed limit orders to add an additional 40,000 ETH in the $3,030–$3,258 price range and 50,000 SOL at $138.6. These levels are positioned just below current market prices, suggesting he expects—or is at least prepared for—a deeper pullback before the next major move.

This behavior is notable because it reflects a deliberate accumulation strategy rather than impulsive buying. By setting large bids at key support zones, he aims to capture liquidity during periods of volatility, effectively using market weakness to scale into long-term positions. Such an approach is typical of sophisticated traders who rely on structured entries rather than reacting to short-term fluctuations.

The scale of these pending orders also indicates that his conviction extends beyond his already massive exposure. If filled, these additions would significantly increase his leverage in the broader crypto market, particularly in ethereum and Solana. For observers, this raises an important question: is this smart money positioning ahead of a potential macro-driven rebound, or is it a high-risk bet into an uncertain environment?

Bitcoin Price Analysis: Testing Support, Lacking Momentum

Bitcoin’s latest price action on the 3-day timeframe shows a market stuck between recovery attempts and lingering downside pressure. After the sharp November sell-off, BTC stabilized above the $90,000 zone, which is now acting as a short-term support area. Price briefly dipped below this level but was quickly bought back, suggesting that buyers are still defending the region. However, the rebound remains shallow, and the structure lacks the strong momentum typically seen during bullish reversals.

The chart shows BTC trading below the 50-day and 100-day moving averages, both of which have now turned downward. This alignment reflects a shift toward medium-term bearish conditions. The 200-day moving average currently sits below the price and has become the most important dynamic support; BTC is hovering directly above it. Historically, when Bitcoin holds the 200-day MA after a major correction, a consolidation phase often follows before a decisive move.

Volume also reinforces the uncertainty. Despite multiple attempts to push higher, buying volume remains muted compared to previous rallies, indicating limited conviction from bulls. Until BTC breaks convincingly above the 50-day MA region NEAR $100K, the market will likely remain in a cautious, range-bound state.

Featured image from ChatGPT, chart from TradingView.com