Crypto Whale’s $10M Bloodbath: From Market Prophet to Portfolio Pariah

He called the crash perfectly—now he's living it.

The Strategic Miscalculation

That same trader who nailed Bitcoin's last major correction just watched $10 million evaporate from leveraged long positions on BTC and ETH. The market giveth, and the market taketh away—usually right after you've finished bragging about your last win.

Leverage Liquidation Looms

Those perfect predictions from the previous downturn apparently didn't translate to timing the recovery. The whale's current positions sit deep underwater, proving once again that in crypto, yesterday's genius is today's bagholder.

Welcome to cryptocurrency—where even the oracles get their prophecies wrong about 50% of the time, but the commissions are always right on schedule.

Whale Doubles Down Despite Unrealized Loss

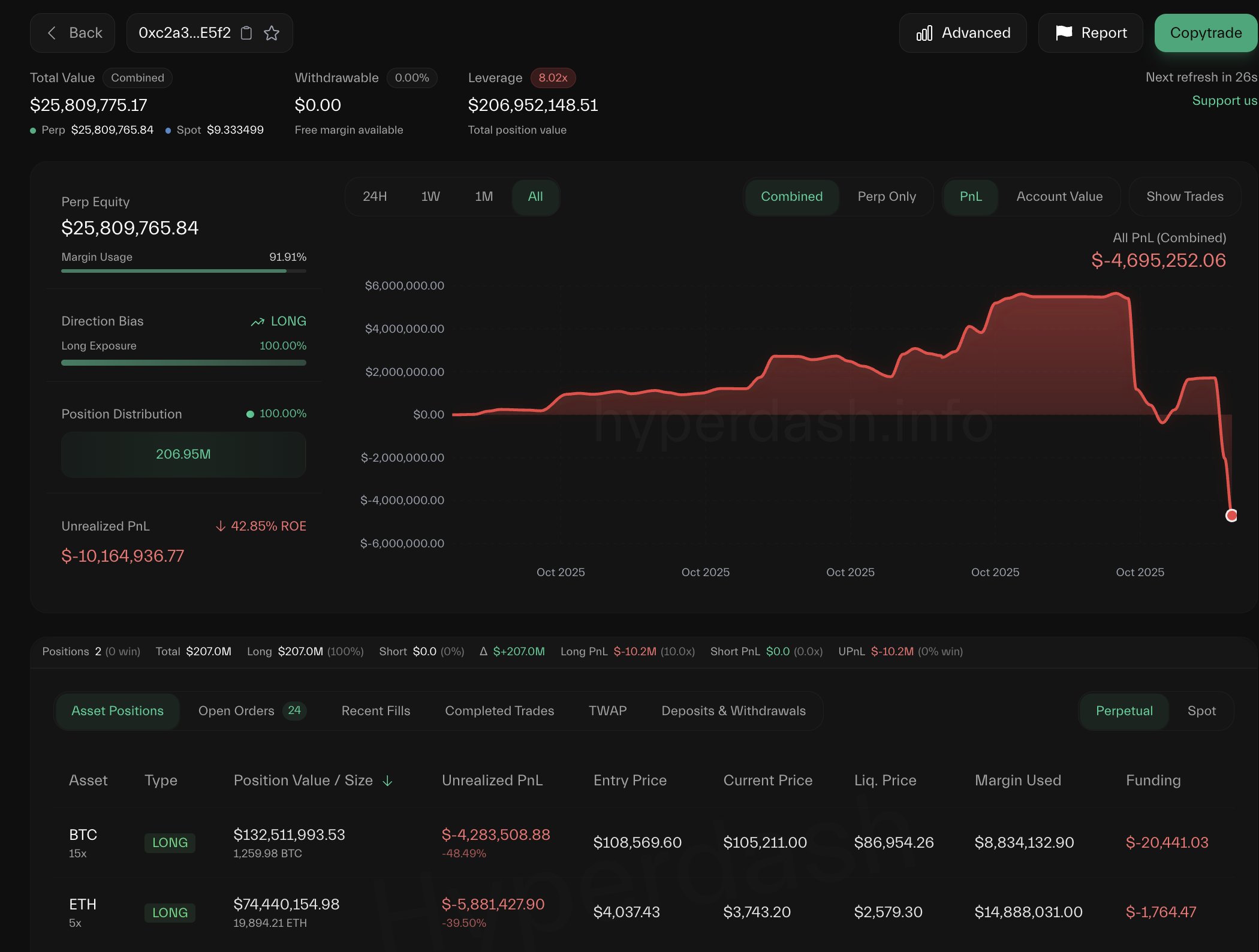

According to Lookonchain insights, the well-known whale (0xc2a3) is now facing a dramatic reversal of fortune. After flipping his strategy and opening massive long positions on both bitcoin and Ethereum, the trader has seen his previous $5.5 million profit completely erased, now sitting on a net loss of $4.69 million. Despite this, on-chain data shows he’s continuing to add to his BTC longs, signaling a high-conviction — or high-risk — bet on an imminent market rebound.

At present, the whale’s positions amount to 1,260 BTC (≈$132.5 million) and 19,894 ETH (≈$74.4 million). These are some of the largest open positions on Hyperliquid, drawing intense scrutiny from traders and analysts alike. Some speculate that his aggressive accumulation indicates insider confidence or a strategic long-term view, while others warn it may simply reflect overleveraged Optimism amid deteriorating market structure.

Meanwhile, Bitcoin’s price continues to drift toward range lows, hovering just above $105K, where short-term holder realized prices and major moving averages converge. The sustained selling pressure across exchanges and persistent bearish sentiment suggest that the market has yet to find a solid floor.

Still, the whale’s behavior has introduced renewed debate about whether smart money is positioning early ahead of a recovery or misjudging a still-fragile market. If his conviction proves right and BTC stabilizes, this could mark a key accumulation phase before the next leg up. But if not, the losses could deepen further — reaffirming just how volatile and unpredictable Bitcoin’s macro landscape remains.

Bitcoin Faces Weekly Breakdown As Volume Surges

Bitcoin’s weekly chart reveals a decisive shift in momentum, with price closing NEAR $105,800 after a steep -8% decline for the week. The correction has erased multiple weeks of gains, pushing BTC dangerously close to the 50-week moving average (MA50), currently around $101,700 — a level that has historically acted as a strong support during mid-cycle consolidations.

What stands out most in this chart is the sharp increase in trading volume, the highest since late 2023, confirming that the latest sell-off has been driven by significant market participation. The large red volume bar indicates broad capitulation among short-term holders, aligning with on-chain data showing increased realized losses and elevated selling pressure across exchanges.

If Bitcoin manages to hold above the $103K–$106K range and defend the MA50, the structure could remain within a broader bullish continuation pattern. However, a confirmed weekly close below this support WOULD likely trigger a deeper retracement toward $100K or even $97K, where the 100-week MA currently lies.

Featured image from ChatGPT, chart from TradingView.com