BlackRock Rakes in $260 Million From Bitcoin and Ethereum ETFs in Under 2 Years

BlackRock's crypto cash grab hits $260 million—proving even traditional giants can't resist the digital gold rush.

The Fee Machine

While Wall Street skeptics dismissed crypto as a passing fad, BlackRock quietly built an ETF revenue engine that's minting millions. Their Bitcoin and Ethereum products have become fee-generating powerhouses, pulling in institutional money at staggering scale.

Mainstream Adoption Accelerates

Traditional finance's embrace of digital assets isn't slowing down—it's accelerating. BlackRock's success demonstrates that when you wrap crypto in familiar packaging, even the most conservative investors will bite. The old guard might still talk about blockchain's potential, but they're clearly more interested in its profits.

Just another reminder: in finance, principles are flexible when the fees are this good.

How BlackRock Quietly Built One of Its Most Profitable Businesses Through Crypto ETFs

According to Dragonfly partner Omar Kanji’s data, BlackRock’s iShares Bitcoin Trust (IBIT) generated about $218 million in fees at a 0.25% commission rate during its first year. Its Ethereum fund, ETHA, added another $42 million under the same fee structure.

Kanji emphasized that the milestone is striking not only because of the size of the revenue. He noted that achieving it within a year of launch underscores how quickly BlackRock has entrenched itself in crypto finance.

BlackRock now makes over a quarter billion dollars a year from crypto and they did it in — Omar (@TheOneandOmsy) September 19, 2025

The success of these funds reflects a broader trend: investors are paying significantly more to access crypto products compared with traditional ETFs.

While IBIT and ETHA charge 0.25% in annual fees, most of BlackRock’s established ETFs—including its flagship IVV fund—charge between 0.03% and 0.1%.

This disparity highlights how institutional demand for Bitcoin and Ethereum exposure has translated into premium pricing power for the asset manager.

Meanwhile, that strategy has coincided with investor enthusiasm for the market class.

Launched in January 2024, IBIT has grown into the largest crypto ETF globally and now ranks as the 22nd largest ETF overall by assets, according to VettaFi.

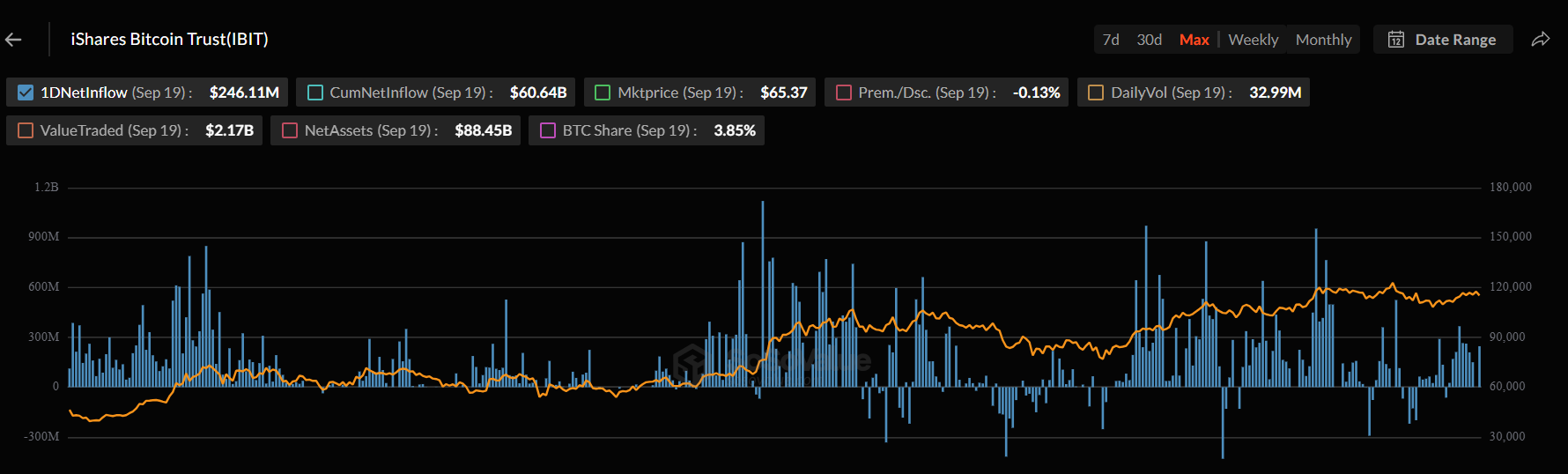

Additionally, SoSo Value data shows IBIT has attracted $60.6 billion in net inflows, representing nearly three-quarters of all US bitcoin ETF flows. Today, it manages more than $88 billion in assets, cementing its role as the industry’s flagship product.

On the other hand, BlackRock’s Ethereum product, ETHA, has also become a force in its category.

Since its July 2024 debut, ETHA has drawn $13.4 billion in net inflows, giving it a commanding 72.5% share of all US ETH ETF flows.