Solana Price Receives a Major Bullish Signal Based On Exchange Data

Solana just flashed its most bullish exchange signal in months—and traders are scrambling to position.

The Exchange Exodus

Supply is draining from major trading platforms faster than institutional FOMO can keep up. When coins move off exchanges, it typically signals one thing: holders aren't looking to sell.

Liquidity Lockdown

Fewer tokens on exchanges means thinner order books and potentially explosive moves when demand spikes. It's the crypto equivalent of hoarding ammunition before a battle.

The Bullish Backdrop

This supply squeeze comes amid renewed developer activity and NFT volume that's quietly outperforming Ethereum on some metrics—because nothing motivates crypto traders like the scent of a potential pump.

Of course, in traditional finance, moving assets off regulated platforms would be called 'risk management.' In crypto, we call it 'a bullish signal.' How quaint.

Solana Investors Pick Up Supply

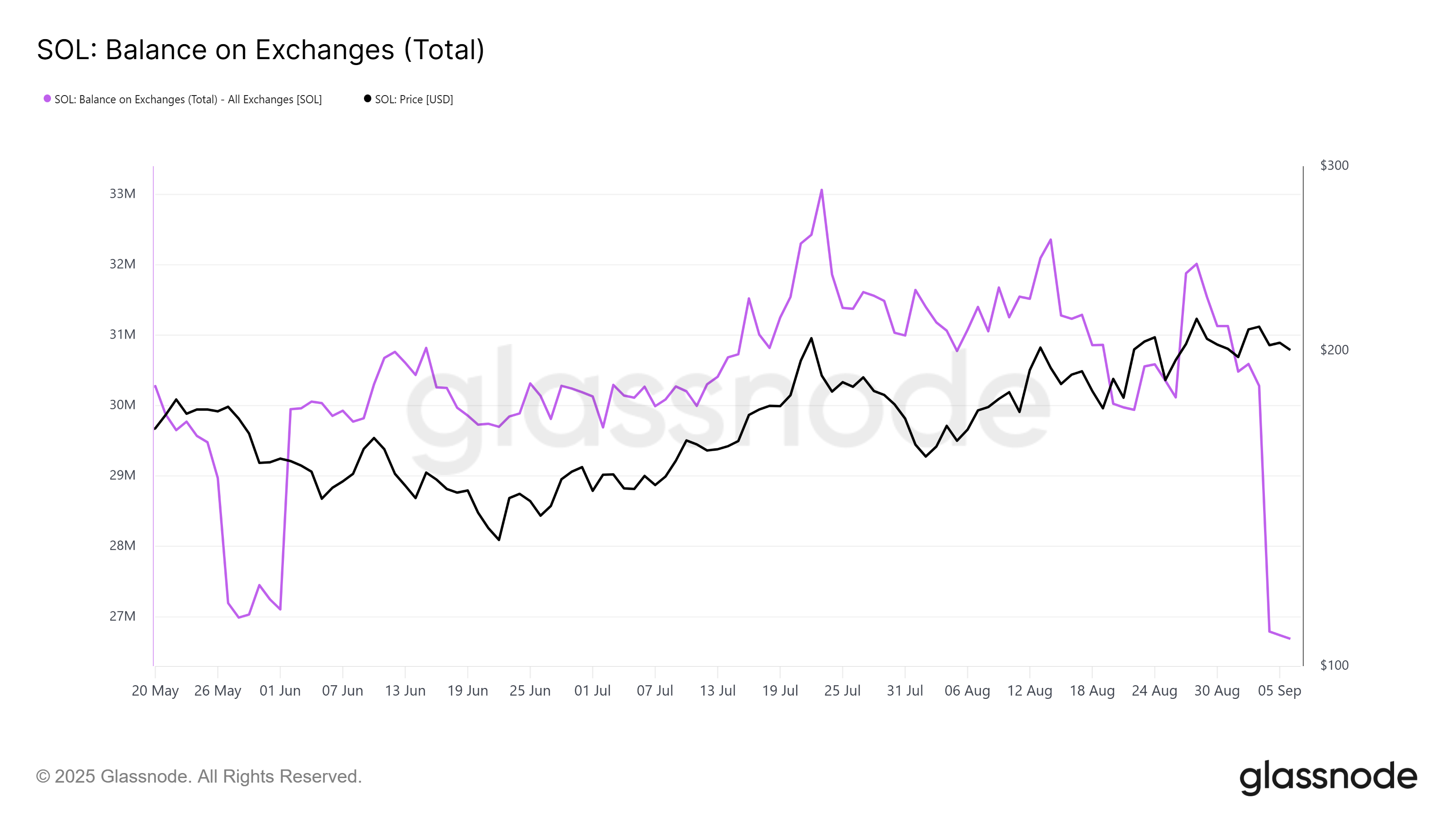

Data shows that balances on exchanges have dropped by 3.79 million SOL since the start of the month. This marks a clear shift in investor behavior as coins leave centralized platforms, a typical sign of accumulation and long-term holding.

In just a week, investors scooped up $770 million worth of SOL, highlighting a strong bullish stance. The expectation is that continued accumulation will strengthen support above $200, potentially enabling Solana’s price to break through higher resistance levels.

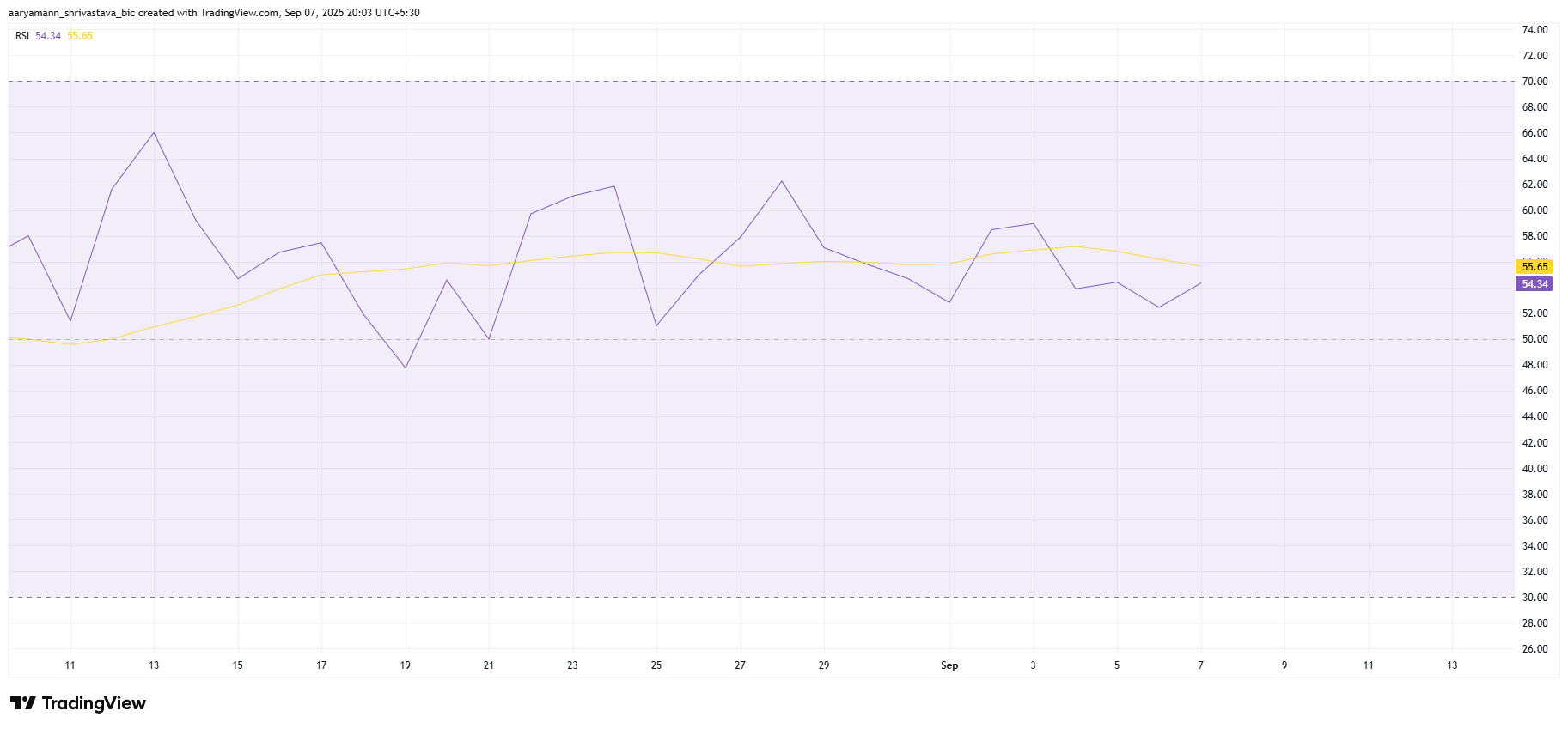

From a technical perspective, Solana’s Relative Strength Index (RSI) is holding comfortably above the neutral 50.0 mark. The indicator remains in positive territory, suggesting bullish momentum persists and that the altcoin still has room for upward movement.

This positioning also signals resilience against broader market pressures. With RSI not yet in the overbought zone, solana appears well-placed to continue its climb, provided investor inflows remain steady and no sharp selling undermines the trend.

SOL Price Awaits Breakout

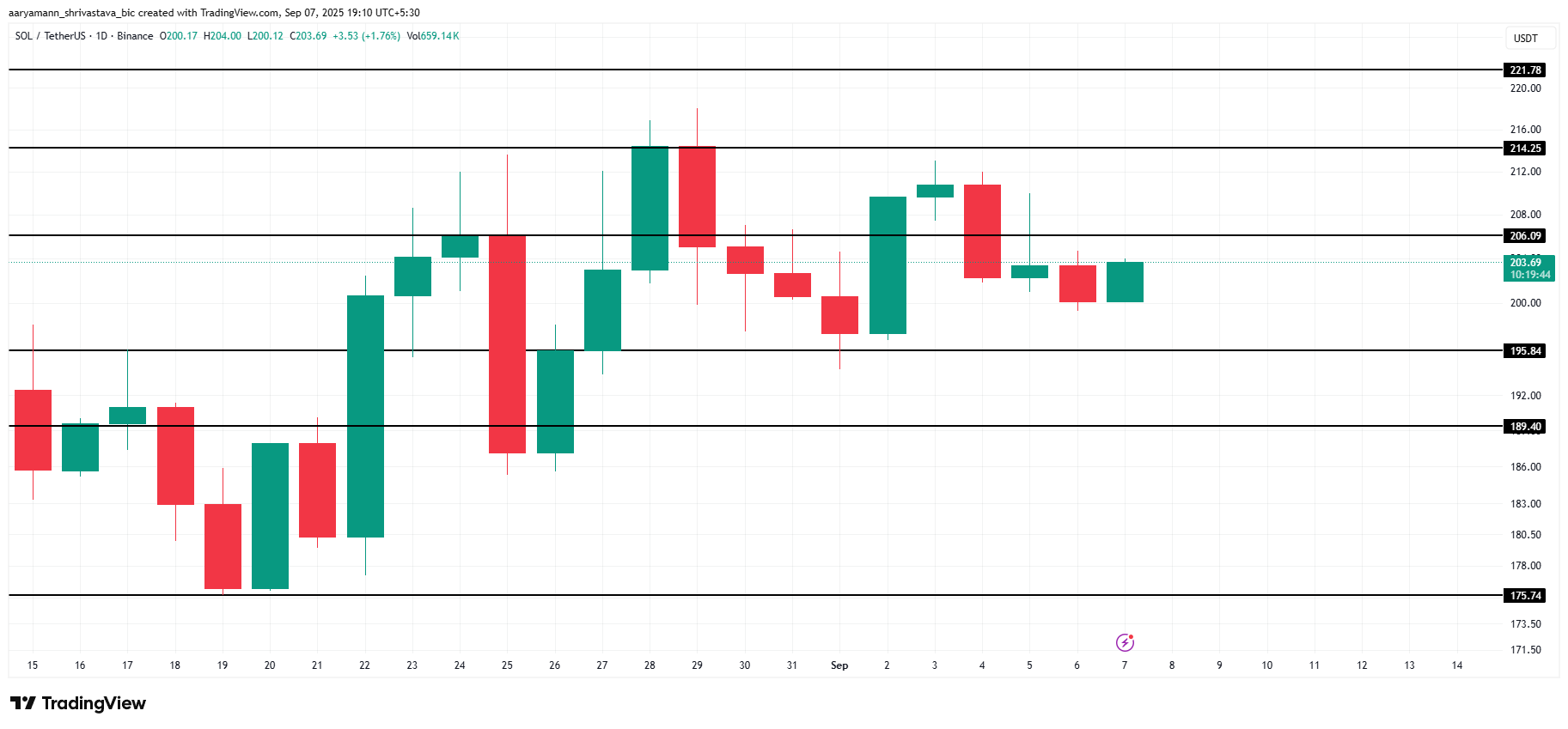

At the time of writing, Solana is priced at $203, just under the immediate resistance of $206. Holding above $200 remains key, as it provides the foundation for further gains in the near term.

Strong investor support could push SOL past $206 and toward $214 in the coming days. A successful breakout above that level WOULD open the door to $221, adding momentum to the bullish outlook.

However, if holders decide to lock in profits, Solana could face a pullback. Losing the $195 support would expose the price to a decline toward $189 or lower. This would effectively invalidate the bullish case and extending sideways action.