Bitcoin Mining Difficulty Shatters Records While Miner Revenues Plummet

Bitcoin's mining difficulty just blasted through another all-time high—right as miner revenues hit their lowest point in months.

The squeeze is on

Network difficulty spiked again, forcing miners to burn more energy for fewer coins. Electricity costs chew through profits while Bitcoin's price stagnates—classic crypto efficiency.

Revenue reality check

Daily earnings nosedived as transaction fees dried up and block rewards failed to offset operational overhead. Some operations now flirt with unprofitability unless they're plugged into Venezuelan-level power subsidies.

Miners adapt or die

Efficiency upgrades become non-negotiable. Outdated rigs get retired faster than Wall Street analysts backtrack on bad predictions. Survival hinges on cutting costs—or praying for a miraculous price pump.

Meanwhile, traditional finance guys still think 'proof-of-work' refers to their weekend golf handicap.

Bitcoin Miners Face Tight Margins With Record Difficulty And Weakening Income

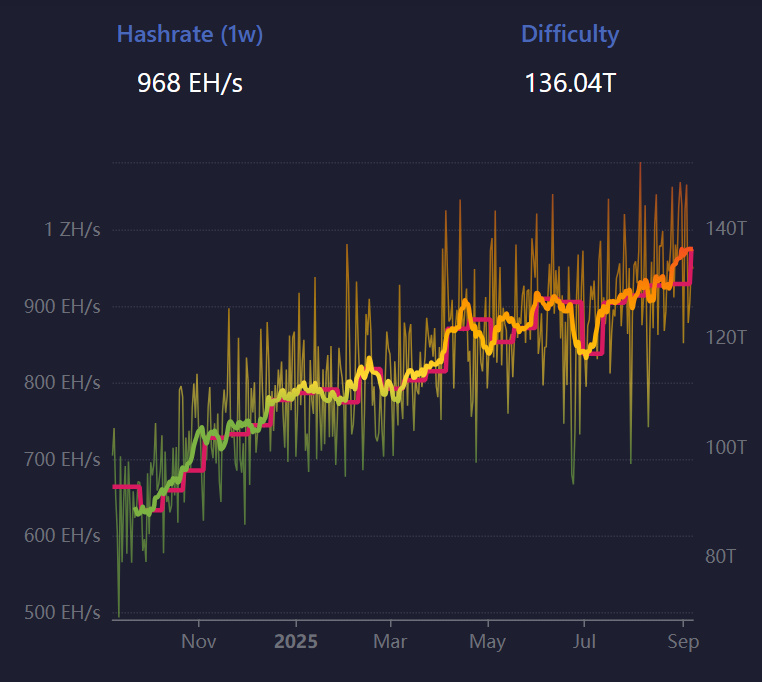

This mechanism is central to Bitcoin’s design. Difficulty levels are recalibrated every 2,016 blocks—roughly once every two weeks—to keep block production close to the ten-minute target.

A rise signals that more computing power has joined the network, while a drop reflects miner exits. In both cases, the adjustment ensures stability in the pace of new block creation.

Meanwhile, the rising threshold comes at a challenging time for Bitcoin miners.

Data from Hashrate Index shows that hashprice—the benchmark for miner revenue per unit of computing power—has slipped to around $51.

That level is the weakest since June, underscoring how revenue pressure is building even as competition intensifies.

According to Hashrate Index, August’s numbers highlighted this squeeze. During the month, Bitcoin’s hashprice average across the period settled at $56.44, about 5% lower than July.

At the same time, the firm noted that BTC’s transaction fees offered little to no support during the period.

Hashrate Index pointed out that BTC miners collected just 0.025 BTC per block on average—a 19.6% slide from July and the weakest performance since late 2011. In dollar terms, that translated to $2,904 in average daily fee income, down nearly 20% month-on-month and the lowest since early 2013.

Considering the above, bitcoin miners are in a bind as the combination of record difficulty levels and weaker revenue streams leaves their operations on tight margins.

This means miners may face mounting pressure to maintain profitability through the remainder of the year unless Bitcoin’s price climbs meaningfully or on-chain activity generates higher fees.